The Daily Bell interviewed Peter Schiff last week and published the first half of their conversation yesterday. Peter explained why the United States economy isn’t recovering and why he blames the Federal Reserve.

Peter also answered a slew of other questions. Does Janet Yellen know that the Fed’s monetary policies have been destructive, or is she just very ignorant? Will the Federal Reserve raise interest rates soon, or will a dollar crisis force its hand? Why do US stocks continue to rise when American economic data remains so weak? Will the presidential race actually affect the economy and the Fed’s policies? Could Rand Paul make a difference as president?

Many global banks and precious metals analysts are now forecasting that gold has seen its bottom and will be moving higher in the coming years. The timeframe varies from institution to institution, but the consensus seems to be that the price of gold in dollars will rise significantly after 2015. Very few expect it to move dramatically lower this year.

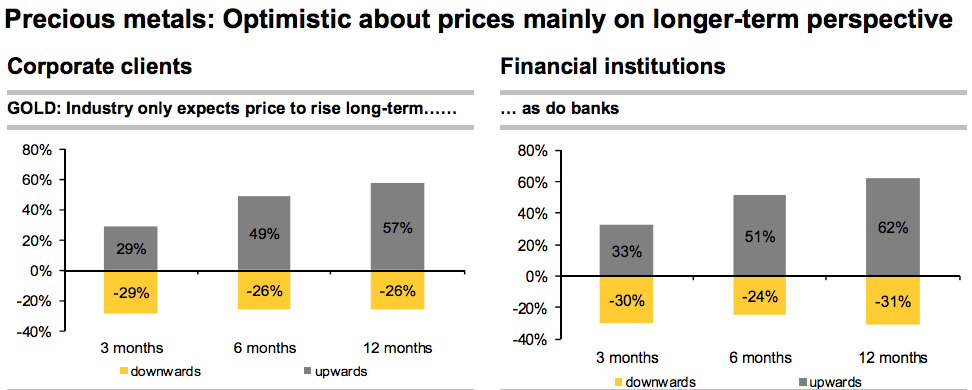

The German Commerzbank published the results of a commodity survey at the beginning of April, showing overwhelming bullishness for precious metals in the long-term. For investment bankers, “long-term” means next year. For investors interested in buying physical gold, that means they should make plans for investing in bullion very soon.

Peter Schiff spoke with Graham Ledger about why the United States economy will only truly recover when the Federal Reserve completely abandons quantitative easing and zero-percent interest rates. Unfortunately, Peter thinks this is highly unlikely due to the political ramifications. Raising interest rates to normal levels right now would likely pop the current stock market bubble. If that happens while Obama is still in office, it will be much easier for a Republican to get elected. That’s exactly why Obama will likely pressure Janet Yellen to keep suppressing interest rates until after the 2016 elections.

Why did we have QE3? Because QE2 didn’t work. Why did we have QE2? Because QE1 didn’t work. We’re going to have QE4 for the same reason, and it’s going to make the problem worse, which means we’re going to have QE5. It’s not going to end until we have a complete collapse of the dollar.”

Currency traders have been blaming the weak first quarter GDP on poor weather. Peter Schiff argues that they’re going to have to start looking for new excuses, because April data is starting to trickle in and it doesn’t look good at all.

China’s gold demand has exploded in the last few years as the Chinese government continued to liberalize its domestic gold market. Last year, foreign banks were given gold import licenses for the first time, and China opened a handful of new gold exchanges. However, China’s economic evolution stretches well beyond precious metals, as the West has seen in the recent boom in Chinese stock markets.

The financial media insists that Chinese stocks are in bubble territory and that Chinese economic growth of 7% is “disappointing.” In a new commentary from Euro Pacific Capital, Peter Schiff explains why the mainstream analysis is shortsighted when one looks at the history of the Hong Kong and Shanghai stock exchanges. Peter argues that with recent regulatory changes, Chinese markets have far stronger fundamentals than those in the West.

China Finally Stops Fighting the Stock Market

By Peter Schiff

Although China’s economy has been leading the world in annualized growth since the days that mobile phones had retractable antennas, there have always been some aspects of the country’s commercial and financial system that loudly broadcast the underlying illogic of a Communist Party’s firm control of burgeoning capitalism. China’s stock markets were one such venue where things just didn’t add up…literally.

In his keynote address to the Mines and Money Hong Kong conference, Doug Casey shared his predictions for the future of the world economy and the mining industry. Casey is a well-respected economist and seasoned, expert analyst of the precious metals industry. His economic viewpoint aligns with Peter Schiff’s, and he believes that the astronomical levels of global government debt and paper currency are going to lead to a “Greater Depression.” What will be the ultimate fallout of this depression? The world will return to precious metals as the most reliable money.

There’s a good reason why gold is money. It’s the only financial asset that’s not simultaneously somebody else’s liability. This is a critical thing in a world as unstable as we live in today. You don’t want to hold somebody else’s liability, certainly not the liability of a bankrupt government or an idiotic and bankrupt central bank. So what are you going to hold? People are going to go back to gold.”

Ron Paul appeared on CNBC to warn that a US dollar currency crisis is inevitable. The host tried to zero-in on a specific time frame for a crisis, but Dr. Paul emphasized that the catalyst for such an event will be an unpredictable change in investor psychology.

Most of the time these things [currency crises] are unforeseen, and most of the time there is a psychological element and a panic. If you have unsoundness and there’s no foundation, [and] it’s just held together by confidence, what happens when the confidence is gone?”

The host’s insistence on a specific time frame is a perfect example of the very problem Dr. Paul lays out. Since the markets can move quickly, both investors and central bankers get caught up in a short-term mindset. The stock market becomes the barometer of economic health, and long-term effects of monetary policy are largely ignored. When those effects finally emerge, investors react quickly and drastically, because they did little to prepare. Dr. Paul points out that this is exactly the problem the world faces today – psychological factors play a larger role than economic fundamentals.

One proposed solution to Greece’s European debt problem is for the Mediterranean country to abandon the euro and resurrect its old currency, the drachma. In his April Gold Videocast, Peter Schiff explains why a new drachma would be ideal for Greek politicians, but a disaster for Greek citizens and creditors. Peter also reveals why the United States faces the same debt dilemma as Greece. There’s just one major difference – the US already has a currency it can devalue.

On Friday, Peter Schiff looked back at a week of market rallies. While the US dollar strengthened, so did gold. In fact, gold approached a 2-year high in euros. Combined with the ongoing negative US economic data, this leads Peter to believe that there is a solid bottom in the gold market. At the end, Peter briefly notes that Ben Bernanke’s memoirs are due for release. Peter explains why he thinks the book should be shelved in the fiction section at your local bookstore.

We recently placed an anonymous call to one of the largest gold dealers in the country for some insight into how other precious metals companies operate. Since this company is very high-profile and has a huge customer base, you might expect them to offer amazing prices. After all, giant retailers like Wal-Mart can usually undercut the prices of their competitors thanks to the sheer scale of their business. Why wouldn’t gold companies do the same?

Unfortunately, our caller – let’s call him Mark – encountered not only ridiculously high mark-ups, but also a series of misleading sales tactics designed to railroad him into buying an illiquid and overpriced product.