Swiss Gold Exports to China & India Doubled

Bloomberg – Exports of Swiss-refined gold to China and India doubled in March to 46.4 metric tons and 72.5 tons respectively. This is the highest monthly data since January 2014, according to the Swiss Federal Customs Administration. Much of the gold is coming from the United Kingdom, which increased its Swiss exports sixfold last month. This is a continuation of a trend that started in 2013, when China and India began buying the gold sold by gold-backed funds that had attracted Western investors. These funds sold the largest amount of the metal in March since 2013, totaling 55.7 tons.

Read Full Article>>

Following the Federal Reserve’s monthly meeting, the financial media has been making the rounds to get everyone’s opinion of the economy. Jim Grant agrees with Peter Schiff: it looks like radical monetary policy “is pretty much here to stay.” As usual, Grant shares his contrarian views with CNBC in his dry, witty, and disarmingly honest style.

Peter Schiff shares his thoughts on the Federal Reserve’s meeting that concluded yesterday. He also takes a look at the official first quarter GDP figure, explaining the misleading data behind it.

Michael Lombardi, Founder of Profit Confidential, lays out the fundamental argument for the gold price moving higher this year and into the future. It basically comes down to supply and demand factors. Less and less gold is being mined each year, while demand for the yellow metal from major economies like China and India continues to grow. Meanwhile, central banks are also increasing their gold purchases at rates we haven’t seen in 50 years.

John Whitefoot, an Analyst with Lombardi, shares his 2015 silver forecast. Unlike many investors, Whitefoot expects silver prices to rally, catching markets by surprise. He points to three important factors:

- The S&P 500 is overvalued by 65%, indicating the stock market is in a bubble that will pop soon.

- Silver has industrial demand that allows it to thrive during periods of economic growth.

- Supply problems paired with huge demand will drive prices higher.

Perhaps the only point our Chairman Peter Schiff would disagree with is that the US economy is going to continue to improve in the coming years. Nevertheless, the case for silver prices rising significantly this year and into the future remains. Many of Whitefoot’s arguments are also explained in detail in our free special report – The Powerful Case for Silver. Download it here.

The Federal Reserve has a two-day meeting this week. CNBC World asked Peter Schiff what he expects the results of the meeting will be. Peter argued that the Fed will continue to bluff about raising interest rates. He believes a fourth round of quantitative easing is more likely in the next year.

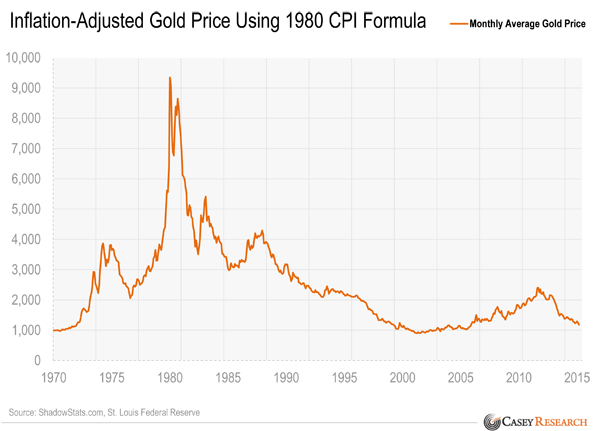

Peter Schiff has argued for years that government inflation data in the United States is bogus. The Federal Reserve and financial media focus on a broader measurement of inflation that overlooks the significant increases in the cost of living for most Americans. What’s more, the way this inflation is measured has changed dramatically over the years, further divorcing it from reality.

John Williams’ Shadow Stats is one of the best places to find a more realistic picture of US inflation. He uses a more accurate method from 1980 of calculating inflation in the Consumer Price Index.

Casey Research worked with Shadow Stats to chart the price of gold in inflation-adjusted dollars based upon 1980 calculations. The results are striking:

In the second part of his interview with the Daily Bell, Peter Schiff discusses the economic dilemmas of Greece and the eurozone. He warns that the United States faces the same moral hazard of massive public debts that will be impossible to repay. Peter believes the Federal Reserve and American government will resort to currency inflation to deal with these debts.

Daily Bell asks Peter for the best strategy to protect one’s savings and investments from a US dollar currency crisis. Peter recommends physical precious metals and careful investments abroad. Read the first part of the interview here.

Jim Cramer raised a great point on Mad Money this week. You wouldn’t own a house or a car without the proper insurance. So why would you have a portfolio of investments without insurance? Gold is that insurance – the only asset that is guaranteed to minimize the downside risks when there is economic or geopolitical uncertainty. When all other assets are crashing, the price of gold generally rises.

The only area where Cramer is a bit off-base is in dismissing physical gold. He recommends owning GLD, the largest gold exchange-traded fund, which generally moves closely in-line with the price of gold. The problem with GLD is that while it is supposedly “physically backed,” investors cannot redeem their holdings of GLD for actual physical gold. On top of that, the gold held by the GLD Trust doesn’t have to be insured.

GLD allows investors to cheaply invest in the price of gold, but to truly insure your portfolio, you want to own physical bullion.

News broke this week that China may soon announce a major increase in its gold reserves in order to convince the IMF that the yuan should be included in the Special Drawing Right basket of currencies.

Jim Rickards, an expert on geoeconomics, believes the yuan’s inclusion in the SDR is inevitable and will go into effect at the beginning of 2016. In an interview on CNBC, Rickards explains the politics behind this move, and why the United States is being pressured to allow it. It comes down to the US wanting to maintain the dollar-yuan currency peg, which Peter Schiff discussed the importance of back in January.