Austria Repatriating Some Gold from Britain

Reuters – Austrian central bank officials say they plan to repatriate some of its gold reserves from Great Britain in response to criticism that it stores too much of its precious metal abroad. The Austrian National Bank administers the country’s 280 metric tons of gold reserves. Currently, about 80% is stored in Britain. Bank officials say they plan to decrease that to around 30%, with 50% of the reserves kept in Austria. The country also stores gold in Switzerland. This repatriation is part of a larger European trend beginning with Germany, which brought home 120 tons of gold from New York and Paris in 2014.

Read Full Article>>

Gold Smuggling in India at All-Time High

Times of India – Gold smuggling hit an all-time high in India this year, with police and revenue agencies seizing more than 3,500 kg of gold in 2014-15. In 2012-13, agents only seized 350 kg gold. It’s generally thought that seizures represent less than 10% of actual smuggling. Officials say in the two years since the duty on gold was upped to 10%, smuggling has increased by 900%. Seizures in Nepal also doubled with the Indian duty increase, as smugglers pushed gold from Dubai, Thailand and China into Nepal to be brought to India as authorities monitored more traditional routes.

Read Full Article>>

CNBC spoke with Peter Schiff last night about his expectations for today’s first quarter GDP announcement. They went on to discuss why no matter what the GDP is, the Federal Reserve will be unable to significantly raise interest rates this year. In a second segment, they spoke about the growth of China’s economy. Peter argues that long-term investors should be bailing on the US and buying into the budding Asian market.

Follow along with full transcripts of both videos below.

Just as Peter Schiff has been predicting, first-quarter GDP in the United States was revised dramatically lower today. The Commerce department previously estimated that US economic output rose 0.2% in the first quarter of 2015, but it is now reporting a seasonally adjusted rate of negative 0.7%.

Peter has anticipated this downward revision since the beginning of the second quarter.

The Federal Reserve and mainstream economists have recently put a lot of effort into discounting the first-quarter GDP figures. In his latest commentary from Euro Pacific Capital, Peter Schiff walks us through the supposed logic of seasonally-adjusted economic data and why the government feels the need to revise the way it looks at decades of past GDP statistics.

Why do we really need seasonal adjustments in the first place? Yes December is different from July, but those differences persist every year… I believe the truth is the system is getting more complex because we want it that way. We prefer the ability to manipulate figures rather than allowing the figures to tell us things that we don’t want to hear.”

Jay Taylor spoke with Axel Merk about the gold market and mismanagement of global economies by central banks. Merk believes that the United States, Europe, and Japan cannot afford to raise real interest rates. So even if the Federal Reserve delivers a nominal interest rate hike later this year, effective real rates will remain near zero. He expects this to stay the same for at least the next decade, which is very bullish for precious metals and gold.

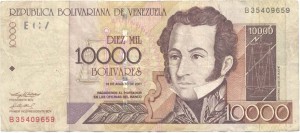

A lot of mainstream analysts will tell you that hyperinflation and currency collapse can’t happen today in an established economy, and they discount warnings about the dollar’s future by people like Peter Schiff.

But one only needs to look to the south to see that it not only could happen, it is.

Venezuela was once the premier South American economy and enjoyed the highest standard of living in Latin America. But mismanagement and socialist policies drove the once prospering economy into the ground. Today, Venezuelans face rampant inflation, with the bolivar now practically worthless.

The Associated Press called it “economic chaos.”

Deirdre Bolton of Fox Business’ Risk and Reward asked Peter Schiff about the alternative investments he recommends for protecting yourself from a crash in US stocks. They discussed foreign markets and gold investment, and Peter laid out his forecast for what the Federal Reserve will do next. She smiled and called his prediction of more quantitative easing and ongoing zero-percent interest rates leading to a collapse of stocks and the US dollar “way out there.”

Mises Weekends shared James Grant’s recent speech about his new book The Forgotten Depression. Mises Institute President Jeff Deist introduced Grant:

[His book] chronicles the so-called ‘forgotten depression’ of 1920 and 1921 under the then Warren G. Harding administration. The reason it’s called the forgotten depression is because it was mercifully short… The Federal government and the young-ish Federal Reserve did the opposite of what they did during the more recent 2008 crash, which is to say they applied real austerity. The Federal government cut spending, it balanced budgets, and the Fed allowed interest rates to rise. As a result, the depression of 1920 and 1921 is but a footnote in history…”

A recent report by Bloomberg highlights that if China were to adopt a gold standard, it would look nothing like the traditional systems used in the past. Ken Hoffmann, Bloomberg’s Global Head of Metals & Mining Research, doesn’t believe conventional western wisdom can predict the actions China might take. In fact, he cautions that China will be more than capable of thinking outside the box. And if the rising Eastern power does transition to a gold standard, it would send the price of the yellow metal through the roof.

China wants to establish the yuan as a global reserve currency. Backing it with gold would likely attract foreign investment. Here’s the catch — a gold-backed yuan would require either an exchange rate of about $64,000 an ounce, or three times more gold than currently exists in the world at current prices.

This article is by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

Metals have again found themselves very much range-bound this past month. Gold is trading between $1170 and $1230, and silver is bouncing back and forth between $15.75 and $17.50. We certainly seem to be in a kind of holding pattern until things shake out further. With geopolitical drama at a bit of a lull and everyone holding their breath until the next FOMC meeting in June, there hasn’t been too much to move the metals prices up or down. Clearly, something has to give.

The June Fed meeting could be a significant event at least. As this past Wednesday’s FOMC minutes suggest, the Fed will not raise rates next month. This dovish news could be the catalyst for metals to break out of their current rut.

As Peter has been reporting for over a year now, the US economy is not nearly as strong as the media would have you think. 2015 economic data has made it even harder for the recovery storyline to stick – especially with Q1 growth now confirmed to be lackluster. With the stock market very much dependent on easy money policies to keep chugging higher, Yellen has found herself caught between the proverbial rock and hard place.