Demand for physical gold and silver has surged over the past two months, with mints around the world reporting robust sales in the midst of the Greek crisis and warning signs in other economies.

According to US Mint figures, the sale of 1-ounce American Gold Eagles more than quadrupled, jumping from just 13,500 coins sold in May to 62,500 in June. The pace has only accelerated in July, with the US Mint reporting 69,000 Gold Eagles sold to date. This is the highest level of sales all year.

Last week, US Sliver Eagles completely sold out.

The People’s Bank of China (PBOC) announced today that it’s gold holdings have grown by 57% to about 1,658 metric tons. This is the first official update to China’s gold reserves since 2009.

China’s gold reserves are now the fifth largest of any country in the world and sixth when you include the holdings of the International Monetary Fund (IMF). Only the United States, Germany, Italy, and France hold more gold than China.

However, many believed China would announce even larger holdings than this. Ross Norman, CEO of bullion broker Sharps Pixley, told the Wall Street Journal, “The figure published by the PBOC is roughly half the market consensus on what we had thought they had accumulated…”

Peter Schiff got into a heated debate on CNBC this afternoon when he explained why he thinks now is a good time to buy gold. The floor traders couldn’t wrap their heads around Peter’s suggestion that the Federal Reserve might launch a new round of quantitative easing in the next year. Instead, they insisted that the futures market is accurately predicting a Fed Funds rate hike. Peter countered that the markets have been wrong before.

While visiting Athens, SchiffGold President Mike Freedman spoke with two Greeks about their country’s economic crisis. One had voted “yes” in the July 5th referendum, while the other had voted “no.” His conversations were eye opening and hold important lessons for America. Find Mike’s personal thoughts on the matter below.

Could America go the way of Greece?

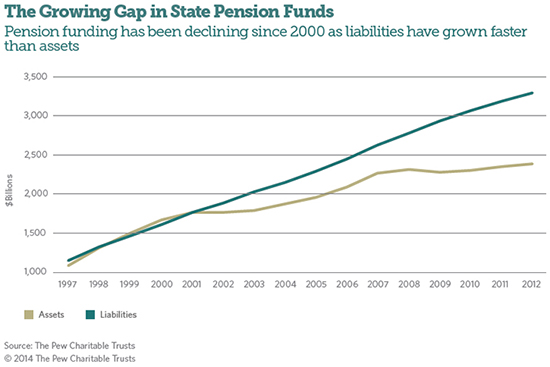

Most people don’t seem to think so. In fact, proposing that US policy could lead to a Greek-like meltdown will still elicit incredulous eye-rolls in most circles. But some of the structural problems that led Greece down her road to ruin already exist in the United States, especially when we look at state pension systems.

Greece has actually improved its pension system. It now ranks as the eighth worst in the world. That’s up from dead last. According to Eurostat, Greece spends 17.5% as a proportion of GDP on pensions, the most in the European Union.

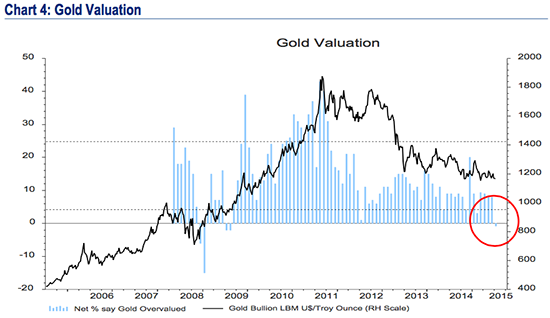

Fund managers are starting to view gold as a bargain.

According to Business Insider, in its latest survey of fund managers, Bank of America Merrill Lynch found the majority view gold as “undervalued.” In fact, this is the first time since 2009 that fund managers have marked gold as a good buy.

By Bank of America’s measure, gold is currently undervalued by about 1%. The current price sits some 40% below its all-time high in 2011.

I like chocolate. In fact, I like it a lot.

That said, I sure wouldn’t pay $150 for a chocolate bar.

But apparently a lot of Americans value chocolate about that much, or they simply don’t understand the value of precious metals.

A few weeks ago, Mark Dice tried – and failed – to sell a 10-ounce bar of silver bullion worth more than $150 at today’s price, for 10 bucks.

Since nobody wanted to buy silver at such a deep discount, Dice tried to simply give the silver away. Last week, Dice recorded people facing the choice between a free, 10-ounce silver bar or a chocolate Hershey Bar. Every person took the chocolate.

Peter Schiff shares his thoughts Greece’s capitulation and acceptance of a third bailout deal from Europe. He reviews some of the other options Greece might have had if it wasn’t run by a socialist government.

Supporters of a $15 per hour minimum wage continue to insist that it won’t impact employment. But the economic problems underlying the Puerto Rican debt crisis tell a different story and provide a possible glimpse into America’s future if the country continues down that path.

Last month, Puerto Rico Governor Alejandro García Padilla announced that the island cannot possibly pay its roughly $72 billion in debts. With more municipal bond debt per capita than any US state, a Puerto Rico default would have a much greater impact on Americans than the situation in Greece. As Peter Schiff recently noted, “Most Americans don’t own any Greek government bonds. But they probably own some Puerto Rican government bonds. Whether they know it or not, they’re in their muni bond portfolio.”

Many policies combined to drive Puerto Rico into this situation, but a recent report reveals labor and wage policies were a big part of the problem.

The financial media latched onto Janet Yellen’s latest statements as further proof that a rate hike will happen this year. Peter Schiff debunks this analysis in his latest podcast, pointing out that Yellen’s phrasing remains as ambiguous as ever. Peter also addresses the latest news out of Greece, where he expects the Greek government to reach a deal to stay in the eurozone. He wraps up with a quick summary of the drama in the Chinese markets.

In her talk, [Yellen] said that the labor market is continuing to improve. No it’s not. Didn’t she see the jobs report that came out on Friday? Didn’t she see all those downward revisions to prior months? Didn’t she see the plunge in the labor-force participation rate to 62.6 – a new low since 1977?”