Here’s another story for the “Peter Schiff was right” archive and another testament to just how clueless mainstream economists can be.

Three years ago, it was already becoming clear that ballooning student debt defaults were becoming a major problem. CNBC reported that the loan “industry underestimated defaults by a whopping $225 billion.” We wrote earlier this week about the latest White House data revealing just how much worse the defaults have become.

In the summer of 2012, Peter appeared on CNBC to debate why the federal government should get out of the student loan business. Diana Carew, an economist with the Progressive Policy Institute (PPI), appeared alongside Peter to defend the need for federal college funding.

You can watch the video below, in which Carew counters Peter’s economic arguments with straw men, suggesting that Peter wants to “get to decide who goes to college.” Carew used the same emotional rhetoric employed by politicians:

David Stockman, former Budget Director under President Reagan, appeared on Fox Business to warn that the United States faces a financial “time bomb” of $19 trillion of ballooning debt. This debt load will eventually become unsustainable when interest rates rise, which is an inevitability. Stockman points to the same historical data as Alan Greenspan – interest rates are traditionally 2-4% above the rate of inflation, and no amount of manipulation by the Federal Reserve can suppress them forever.

The 2% [inflation] is totally a made up target that conveniently allows them to shovel free money into Wall Street. It never does get to Main Street. The whole idea of zero interest rates is to get consumers and households all jiggy, and get them borrowing and spending. But that doesn’t work anymore, because we’re at peak debt. Households have $13 trillion of debt. “

Stockman’s warnings about debt are one of the key reasons investors should consider buying gold now.

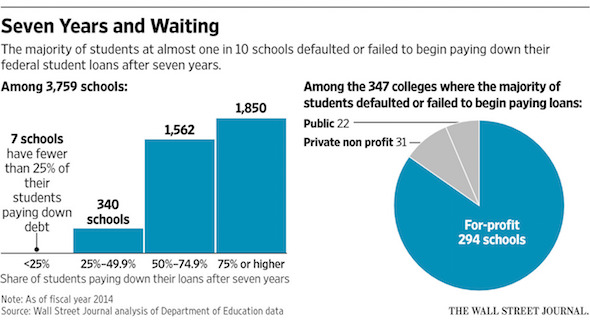

At the end of 2014, the New York Fed reported a surprisingly high delinquency rate for student loans – 11.3%. Now the latest data released by the White House reveals that number may in fact be dramatically higher. As the Wall Street Journal reports:

New figures covering more than 3,700 schools were released as part of the White House’s College Scorecard, which allows consumers to explore data about debt and degrees. The average repayment rate among almost 1,200 for-profit schools—meaning these students were actively paying off loans—was 61%, the lowest of any sector. The average repayment rate among all colleges was 73%.”

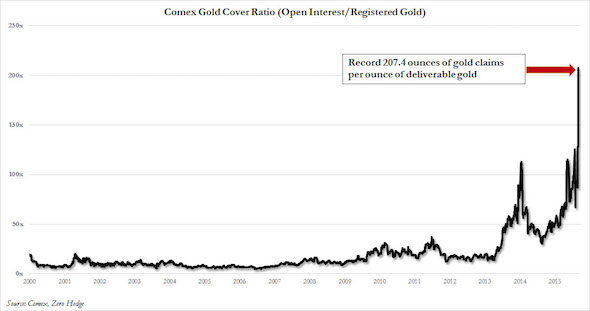

Bloomberg Business interviewed Peter Hambro, Chairman and Co-Founder of Petropavlovsk – one of the largest gold mining companies in Russia. Hambro presented physical gold to the Bloomberg anchors, who seemed genuinely dubious as to its value, insisting that gold is for “speculators.” Hambro clarified that “paper gold” is for speculators, and he believes the Comex futures market is going to come crashing down eventually – something we wrote about yesterday.

As an industry insider, Hambro shared invaluable insights into the physical gold market, especially when it comes to Asian demand:

In the Shanghai market, which is the only big physical market, recently introduced by the Chinese – year on year, they delivered 55 million ounces from August to August. That’s 65 billion dollars worth of physical gold. That is about half of the world’s mine supply.”

Hambro also shared Peter Schiff’s opinion that the Federal Reserve is not going to raise interest rates. Rather, all the Fed has to offer are economic bedtime stories to influence market perception. Click here to learn why you want to buy gold when perception becomes more important than reality.

Last weekend, Peter Schiff spoke with Free Talk Live, a nationally syndicated radio show. They discussed the growing student debt bubble, Peter’s imprisoned father Irwin, and the reasons why American businesses are moving to Puerto Rico. You can download the free report they discuss here: The Student Loan Bubble: Gambling with America’s Future.

The bubble in student loans is actually a small part of what is going on. The government has managed to reflate the housing bubble, the stock market bubble. We have a bond market bubble, a dollar bubble, a consumer loan bubble. The whole US economy is one gigantic bubble at this point. That’s all we got left…”

An apparent gold scam recently uncovered in Austin, Texas, serves as reminder for investors to use caution when dealing with small, unknown companies.

According to the Austin American-Statesman, the vaults belonging to an Austin company claiming to store millions of dollars in precious metals for its customers turned up virtually empty.

The latest update from CME Group shows a huge outflow of gold held for delivery by Comex. There are now less than 6 tons of registered physical gold available for delivery. For every 207 ounces of gold claimed by paper contracts on the Comex market, there is only one ounce of physical gold in Comex vaults. This is the lowest “coverage” ratio in the history of the Comex.

SilverDoctors.com interviewed Tom Power, the CEO of Sunshine Minting. Sunshine is one of the biggest suppliers of silver blanks to the United States Mint, which the Mint uses to strike the American Silver Eagle coins. Sunshine also also supplies gold and silver blanks to producers around the world, and has its own line of very popular privately minted products.

This interview provides an inside look into the precious metals industry, which is currently gridlocked with huge demand and supply shortages. Power explains the mechanics behind these shortages, and why Sunshine Minting is experiencing demand that far exceeds that of 2011.

We’re running 24/7, and we have been running 24/7 literally since 2009 to meet the demands of the market… The kind of growth we’ve seen is that in 2007, 2008, our total annual output of finished product was in the neighborhood of probably 25-30 million ounces a year. We thought 2011 was our best year ever at 55 million ounces. We’re on track to exceed 75-80 million ounces this year…”

When Alexis meets Scott Govinsky (“Everybody calls me Gov”), she’s ready to drop out of college and pursue a small business that has been making her money. Gov convinces Alexis to not only stay in school by taking out a loan, but to go into even more debt than necessary by traveling abroad in Italy.

Gov tries to brush reality under the rug when he says, “Don’t let information get in the way of learning.” What exactly is the information Gov ignores? The same information we share in our new white paper – The Student Loan Bubble: Gambling with America’s Future. Students aren’t the only ones who have to worry about college loans – the entire US economy is going to feel it when this bubble bursts.

Enjoy the video below, then click here to download SchiffGold’s free white paper.

A couple weeks ago, Peter Schiff joined Fox Business on the floor of the New York Stock Exchange to discuss the possibility of the Federal Reserve raising interest rates. He shared his candid opinion that investors should avoid US stocks and look to foreign markets and gold.

Remember, when the year started you had two camps. Those that thought the Fed would hike in March and those that thought they would hike in June. Both camps were wrong. I was saying they weren’t going to raise rates. Not because they shouldn’t, but because they can’t because they will prick this bubble economy they worked so hard to inflate…”