The Silver Institute has released its October issue of Silver News. This edition spotlights the continuing demand for silver bullion coins, highlighting the fact that the US Mint, the Royal Canadian Mint, Australia’s Perth Mint, the Austrian Mint, and the British Royal Mint recently all put their silver bullion coins on allocation at the same time.

Although individual mints, especially the US Mint, have gone to allocations in past years, most recently when American Eagle Silver Bullion Coins sold out in July of this year, restriction from multiple mints at the same time is unprecedented and illustrates considerable tightness in the current global silver coin business.”

After a year of anticipating a Federal Reserve interest rate hike, all eyes are on the Fed’s December meeting. There are two obvious outcomes: the Fed does raise interest rates or it does not. In his November Gold Videocast, Peter Schiff explains why both scenarios are bullish for gold. Peter points to the behavior of gold under both Alan Greenspan and Paul Volcker as proof that a rising interest rate environment isn’t automatically bearish for the yellow metal. On the other hand, if the Fed continues to delay raising interest rates, investors will begin to realize their expectations were ill-founded and reconsider their positions in gold and silver.

Either way, investors who have been waiting to buy should thank the Fed for extending the opportunity to buy gold for less than $1,100 an ounce.

Rob McEwen provided Kitco with an insider’s view on the mining industry and physical gold investment. McEwen was the founder and former CEO of Goldcorp, the world’s fourth largest mining company, so his insights into precious metals should not be taken lightly.

McEwen had 3 very important observations for investors:

1. If prices remain this low, there’s a possibility of gold and silver supply shortages as miners produce less.

While the government and mainstream media keep telling us, “The economy is improving, the economy is improving!” we keep getting news like this from the New York Times:

With a hint at what may be in store for shoppers this holiday season, Macy’s cut its profit outlook and CEO Terry Lundgren said markdowns are likely as a convergence of factors lead to a high inventory of goods for retailers. Macy’s third-quarter sales fell 3.6% at established locations.”

Macy’s Q3 revenue dropped to $5.87 billion, falling short of the $6.15 billion forecast by Wall Street analysts. The company dropped its full-year earnings forecast a full 50 cents, from $4.70 to $4.80 per share down to $4.20 to $4.30 per share.

Peter Schiff has been saying that it’s only a matter of time before the student loan bubble pops.

Now you can watch the clock tick thanks to the new National Student Loan Debt Clock developed for MarketWatch by StartClass, an education data site.

According to MarketWatch calculations, student loan debt increases in America by an estimated $2,726.27 every single second:

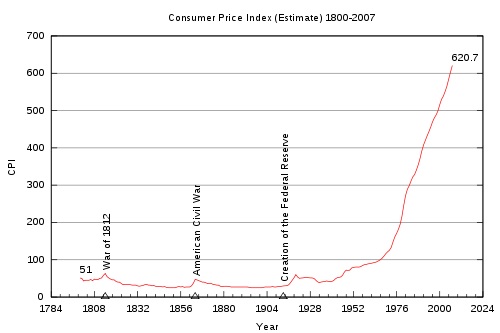

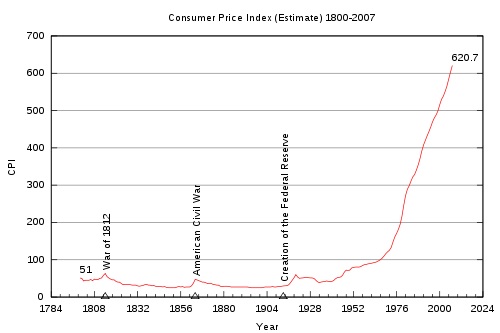

In a new podcast, Tom Woods tears apart an article from the liberal website Think Progress in which an amateur economist attacks the gold standard. Joseph Salerno (Academic Vice President of the Mises Institute) and Jeffrey Herbener (Associate Editor of the Quarterly Journal of Austrian Economics) joined Woods to counter the mainstream misconceptions of the gold standard.

Think Progress went so far as to claim that the gold standard is responsible for increased consumer price volatility. This is clearly wrong, which Woods proves with a single chart. Notice when consumer prices really start to skyrocket – right around 1971 when Nixon closed the “gold window.”

China announced it will start direct trading with the Swiss franc. This is another step in China’s relentless march toward becoming a major player on the world financial stage and away from dependence on the US dollar.

According to a Bloomberg report, the link between the currencies will begin Tuesday. The move by the China Foreign Exchange Trade System makes the Swiss franc the seventh major currency that can bypass conversion into the US dollar and be directly exchanged for yuan.

The People’s Bank of China said it welcomed the move in a statement on its website:

In his latest appearance on Alex Jones’ InfoWars, Peter Schiff began by discussing the tyrannical imprisonment of his father Irwin Schiff. They went on to discuss the economic predicaments of both the United States government and the average American citizen. In a country crippled by debt and an unhealthy sense of entitlement, Alex and Peter ask the essential question – how can intelligent investors prepare themselves for what comes next? One answer: buy hard assets like physical gold and silver.

While Janet Yellen keeps hinting at a “possible” US interest rate hike – something Peter Schiff has argued for months is highly unlikely – it appears the European Central Bank (ECB) will soon take rates deeper into negative territory. Americans should take note of what is happening across the pond, because it may eventually happen here.

According to a Reuters report, a consensus is forming at the ECB to drop the interest rate it charges banks in December:

In his latest video blog post, Peter Schiff challenges the mainstream notion that the October jobs numbers released yesterday are good enough to justify the a Federal Reserve rate hike in December.

Just because a rate hike is a possibility doesn’t mean it’s going to happen. It’s been a possibility all year. People thought it was possible they were going to raise rates in March. They didn’t. They thought it was possible they’d do it in June, September. Some people thought they might have raise rates last month. That was possible, but it didn’t happen… Yellen didn’t say that if we get all the improvements we want, we’re going to raise rates. She said if we get all the improvements we want, we might raise rates. She didn’t even use the word probable… Probable would imply the possibility was greater than 50/50…”