The Fed appears to be skipping merrily toward an interest rate hike this afternoon, which is supposed to signal that the US economy has recovered. But as Peter Schiff has been pointing out relentlessly on his Facebook page, the actual economic data tells a completely different story. In fact, the economy isn’t nearly as good as advertised.

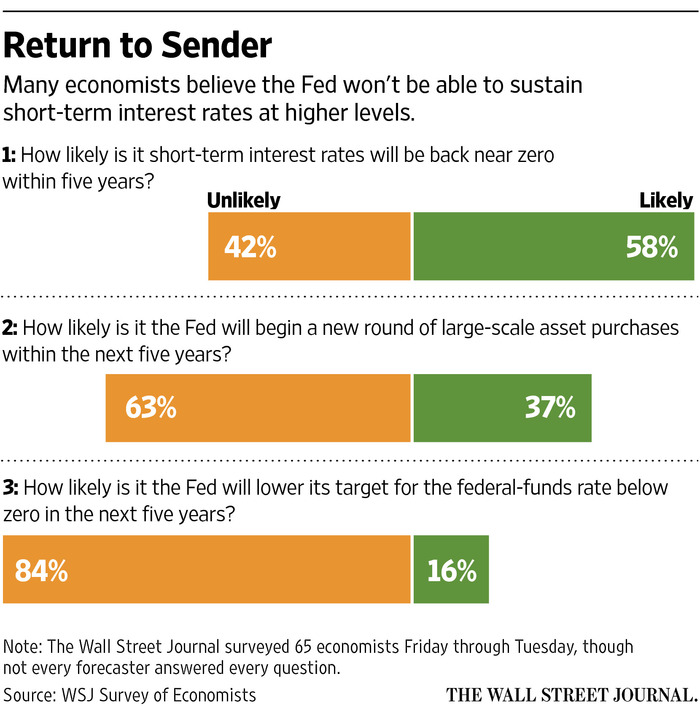

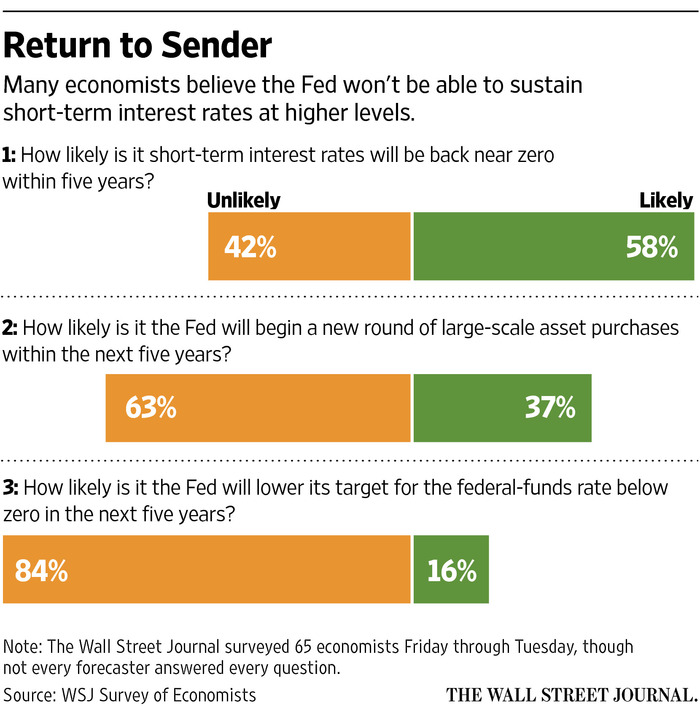

This is precisely why Peter and many other economists say they don’t think interest rates will stay above zero for very long, even if the Fed does indeed go forward with a hike.

Here are just a few of the warning signs over the last week or so.

Austria has started acting on its plan to repatriate a big chunk of its gold reserves.

Last week, the Austrian National Bank announced it brought 15 tons of gold back into the country. According to Reuters, a spokesman said the bank began repatriating the gold from London in October:

The Federal Reserve’s Federal Open Market Committee will kick off its December meeting Tuesday. Most pundits seem to think the Fed will raise the benchmark short-term interest rate from near zero to 0.25 on Wednesday. But many economists agree with Peter Schiff that even if the Fed ticks the rate up this week, it won’t stick.

We tend to think of economic crises as relatively rare, isolated events like the Great Depression or the 2008 meltdown. But in truth, they are pretty common. They’ve been happening for thousands of years, and few generations escape them.

This fascinating video by HowMuch graphically illustrates the history of economic crises.

If you want to be ridiculed by mainstream pundits, economists, and financial analysts, just bring up the gold standard.

Republican presidential candidate Ted Cruz got the full treatment after a recent GOP debate when he had the audacity to suggest, “I think the Fed should get out of the business of trying to juice our economy, and simply be focused on sound money and monetary stability, ideally tied to gold.”

Cruz’s passing references to the gold standard led to howls of protest. Based on the hue and cry, you’d think the Texas senator had suggested the earth was flat.

US Mint set a new record for American Silver Eagle bullion coins this year.

The mint sold over 44,850,000 ounces of American Silver Eagles, topping the previous record of 44,006,000 ounces set last year. Analysts expect the final sales total for 2015 to come in between 45 and 47 million ounces.

This article is written by Peter Schiff and originally published by Euro Pacific Capital. Find it here.

Over the past year, while the US economy has continually missed expectations, Federal Reserve Chairwoman Janet Yellen has assured all who could stay awake during her press conferences that it was strong enough to withstand tighter monetary policy. In delivering months of mildly tough talk (with nothing in the way of action), Yellen began stressing that WHEN the Fed would finally raise rates (for the first time in almost a decade) was not nearly as important as how fast and how high the increases would be once they started. Not only did this blunt the criticism of those who felt that the delays were unnecessary, and in fact dangerous, but it also began laying the groundwork for the Fed to do nothing over a much longer time period. To the delight of investors, the Fed has telegraphed that it will adopt a “low and slow” trajectory for the foreseeable future and move, in the words of Larry Kudlow, like “an injured snail.”

With the “positive” jobs report that came out last Friday, most analysts now think the Federal Reserve will raise interest rates this month.

Peter Schiff argues that the jobs report wasn’t really that positive considering the labor participation rate and the number of part-time workers. But he concedes that the rate hike may happen anyway, because Janet Yellen has changed the criteria she’s using to base her decision. On this edition of the Schiff report, Peter explains why the Fed has changed its tune, and why a hike, if it happens, isn’t the beginning of an upward trajectory.

The Fed chairman is trying to minimize the importance of liftoff…It’s not liftoff, It’s the flight path. It’s the trajectory. It’s how high do interest rates go and how quickly do they get there. And in fact, what the Fed chairman has really been saying is that, ‘Look, we’re going to raise interest rates, but don’t worry, because we may not raise them again any time soon.’ And in fact, from my perspective, if we actually get a rate hike next week, that’s the only rate hike we’re going to get from the Fed. It’s not going to be the beginning of the tightening cycle; it’s going to be the end of the tightening cycle.”

Peter Schiff got right to the point with Alex Jones last week: Obama is just trying to finish out his term without any major disasters. At this point, Peter thinks the Federal Reserve just might raise interest rates a hair this month, but then immediately lower them again when it becomes clear the economy is in a recession in 2016. Meanwhile, he believes the inclusion of the Chinese yuan in the IMF’s basket of reserve currencies signifies the end of an era for America on the global economic stage. Peter thinks buying gold and silver is a great way to profit from the coming crises, and he explained why he thinks silver may be an even better investment than gold.

While analysts and investors debate the latest jobs report, or obsess over the most recent Federal Reserve announcement, it’s easy to overlook the basic fundamentals of the gold market. With that in mind, consider this recent news: one of the world’s top gold producers says market dynamics may well lead to shrinking gold supplies in the future.

Randgold Resources Ltd. CEO Mark Bristow told Bloomberg that half the gold mined today is not viable at current prices. In other words, many mines aren’t even hitting their break-even point on half of the gold they dig out of the ground. That means new supplies of gold could begin to dry up in the near future.