This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

The Wall Street Journal recently reported on a fascinating phenomenon unfolding in Venezuela. As many are aware, the nation is beset by a multitude of economic problems as its government has vainly attempted to produce a socialist paradise – with, of course, devastating results.

Things are apparently going to the next level. Recent air cargo shipments to Venezuela have not only included the usual fare of goods and supplies. Rather, 36 Boeing 747 jumbo jets recently arrived filled to the brim with, of all things, millions and millions of bolivars – Venezuelan paper currency

Yes – this is a mind-boggling amount of physical cash!

Sadly, Venezuela has actually had to outsource most of the printing of its currency due to shortages in supplies as well as a need for anti-counterfeit technology.

No doubt, all of these printed notes will end up sloshing around the Venezuelan economy driving up prices massively. Venezuela, according to sources, is effectively doubling the physical currency supply in circulation which will only worsen the country’s hyperinflation problem. It is projected to reach an inflation rate of 720% in 2016. And the currency is already nearly worthless. Last summer, a photo uploaded to Reddit of a man using a 2 bolivar note as a napkin went viral.

Jim Grant didn’t hesitate when asked. He sees the price of gold is going up.

Grant made the rounds Wednesday, appearing first on CNBC, saying he thinks the US is already in a recession, and we can expect even crazier monetary policy in the future. Then he did an interview with The Street and made an emphatic prediction about the price of gold:

I think gold is going to be coming into its own in reaction to the wrong-headed notions of our central bankers.”

Jim Grant appeared on CNBC’s Closing Bell and unhesitatingly said he thinks the US economy has already gone into recession:

I think we are in one…I think there’s a defensible case to be made that a recession began late last year.”

Grant echoed what Peter Schiff has been saying. In his Gold Videocast last week, Peter also said he thinks the recession started last year:

I believe eventually the government will acknowledge that this greater recession began in the fourth quarter of 2015, the very quarter that the Fed chose to raise interest rates.”

All of a sudden, everybody has gone bullish on gold, even Wall Street.

Within the last couple of days Jim Cramer, the CNBC Nightly Business Report, and Van Eck Global all sang gold’s praises. Cramer said, “There is a bull market in Gold,” and CNBC Nightly Business Report opened the show Monday proclaiming, “Hard assets – stocks slump, gold shines.”

CNBC even devoted a blog post to technical analysis on the gold bull market, saying “the rally in gold has the potential to develop into a breakout from the consolidation base and become a new uptrend.”

Wall Street has apparently caught on to what Peter Schiff was saying a month ago – 2016 looks like a big year for gold. This video compilation tells the story.

Mainstream analysts have started seriously talking about the possibility of negative US interest rates in the near future.

On the heels of the Bank of Japan dropping a key interest rate to negative 0.1% late last month and indicating it is willing to go deeper into negative territory, Bloomberg reports that American analysts see an increasing likelihood that the Federal Reserve is willing to follow suit:

If the world’s biggest economy weakens enough that traditional policy measures don’t help, the Fed may consider pushing rates below zero, according to Bank of America Corp. and JPMorgan Chase & Co. That step would broaden the Fed’s toolkit beyond what was available during the financial crisis, when it slashed its overnight benchmark near zero and bought bonds to stimulate the economy.”

In his inaugural Gold Videocast for SchiffGold a few weeks ago, Albert K Lu interviewed Adrian Day, CEO of Adrian Day Asset Management. Day said he believes the gold market is “consolidating, bottoming, and turning around.”

The last couple of weeks seem to confirm Day’s insight. Since hitting its low the day after the Federal Reserve raised interest rates, the price of gold has risen more than 10%.

A lot was made of the Fed’s rate hike in the mainstream media, but Adrian agrees with Peter – he doesn’t see a series of interest rate increases in 2016 because it’s an election year and the economy simply won’t support it. He called a rate-hike pause the new interest rate cut. He went on to say gold is set up for a strong rally. Once it gets going a lot of people will scamper at signs of positive news and jump in.

When you have a decline over four years, it takes time to turn the corner and that’s what we’re seeing now. Gold is very undervalued right now.”

This is just the first of Albert K Lu’s exclusive interviews for SchiffGold. As creator and host of The Power & Market Report, Lu has years of experience analyzing the precious metals market and speaking with industry experts.

Debt is crushing the American economy.

Over the last month or so, the mainstream seems to have realized that the economy isn’t on nearly as solid ground as government officials and central planners were telling them throughout 2015, and all of a sudden, gold is in vogue. But as we pointed out last week, the signs of economic distress have been there all along.

One underlying fundamental that seems to get swept under the carpet is the staggering level of debt – both public and private.

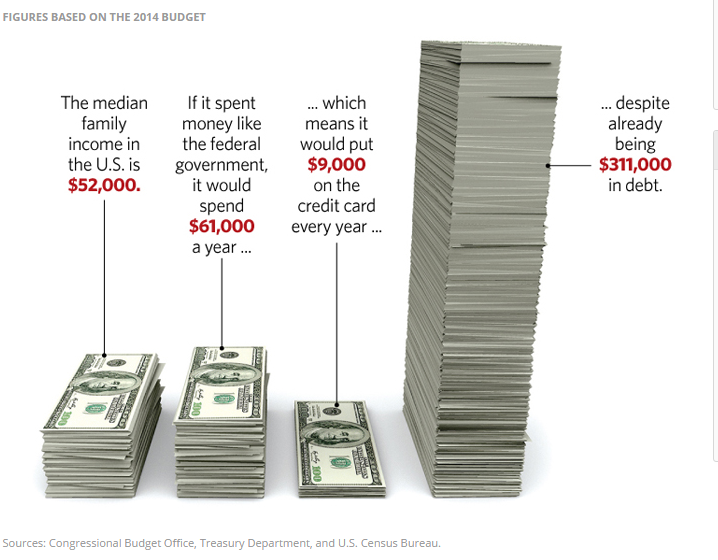

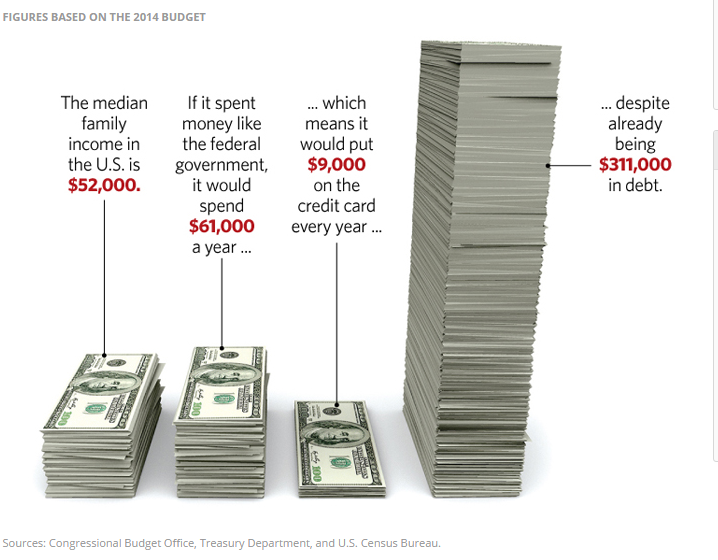

Last week, the US national debt crossed the $19 trillion threshold. Most of us can’t even grasp that number. The graphic above created by the Heritage Foundation puts it into vivid perspective, illustrating what this level of indebtedness and spending would mean to the average American household.

The mainstream world of economics and investment has the attention span of a 12-year-old hopped up on sugar.

A couple of months ago, it was all doom and gloom for gold. The Fed was talking interest rate hikes, government spokespersons were claiming victory over the recession, and mainstream analysts were hastily pounding nails in gold’s coffin.

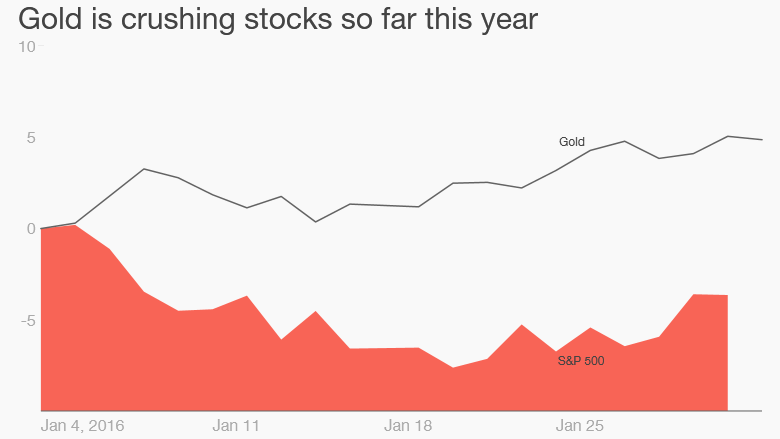

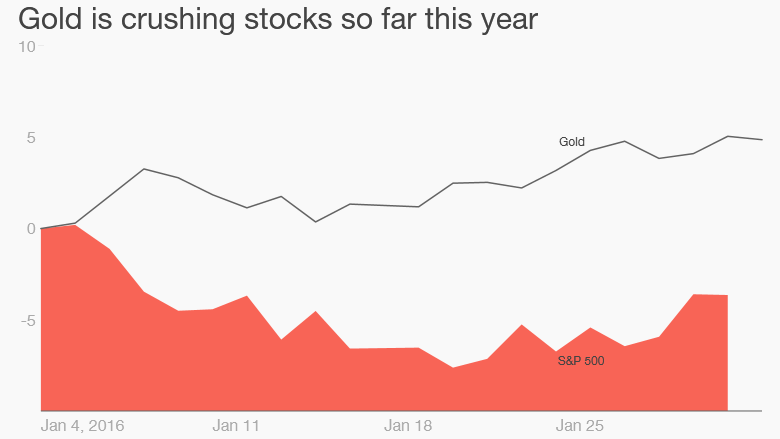

Cancel the wake, because today everybody has turned bullish on gold with the price up more than 9% since New Year’s Day.

A headline at CNN Money earlier this week boldly proclaimed, “Gold is 2016’s most beloved asset.” The story highlights the more than 10% gain in the price of gold since its low after the Fed hiked rates in mid-December, along with the dismal performance of stock markets, pointing out the Dow is down more than 1,000 points and the NASDAQ has lost 8% of its value:

Today, the President of the Federal Reserve Bank of New York admitted that tightening financial conditions could affect the Fed’s “monetary policy decision.” In his February Gold Videocast, Peter Schiff translates William Dudley’s statements: the Fed is not going to be able to keep its promise of raising interest rates four times throughout 2016.

In fact, Peter believes the US is heading into an official recession and that monetary policy will loosen – not tighten – this year. He argues the Fed will soon follow the lead of the Bank of Japan and the European Central Bank by lowering interest rates into negative territory. Meanwhile, gold has risen more than 6% in 2016 and is up about 8% since its dip following the Fed’s December rate hike.

We are always told to “be prepared” for a crisis. But what exactly does that mean?

We tend to think in terms of stockpiling supplies, or maybe having an evacuation plan. Of course, these are important steps. But there are other less obvious things we can do to prepare for upheavals, particularly when it comes to the prospect of an economic meltdown.

Brandon Smith founded the Alternative Market Project and he emphasizes the importance of developing local networks to facilitate barter. In the event of a systemic economic collapse, these networks will provide vital channels for the exchange of goods and services in the event traditional markets cease to function. The national network of barter markets he is facilitating are designed to insulate and protect local economies from what he calls the inevitable collapse of the current unsustainable fiat system.