While investors have primarily focused on gold’s bull run, silver has quietly outperformed the yellow metal.

Between Jan. 1 and July 11, the price of silver increased 44.7%, according to the Silver Institute. The price of gold increased 27.7% in that same time period.

The Silver Institute said the surge in the price of silver was “fueled by increased investor interest in silver as a safe haven asset and as leveraged exposure to gold’s price rally.”

Demand for silver has been robust in both paper and physical markets. Exchange traded holdings of the white metal increased by 44.3 million ounces through the first half of 2016, hitting a record high of 662.2 million ounces.

Silver coin sales set a record in 2015 and kept up the pace through the early months of 2016, according to the Silver Institute:

The Japanese economy is sliding into oblivion pulled along by central bank policy. In response, the Japanese people are buying gold.

Economic growth has languished in Japan for nearly two decades despite extraordinary monetary policy including negative interest rates and round after round of stimulus. The government even flirted with the idea of helicopter money, although that appears to be off the table, at least for the time being.

Factory output is down and stocks are slumping. The Japanese government just cut its GDP estimate from 1.7% to 0.4%, and Prime Minister Shinzo Abe urged more central bank intervention. He called for coordinated stimulus from the government and the central bank in yet another attempt to revive the ailing economy.

Meanwhile Japanese people are doing what people have done for centuries when faced with economic uncertainty. They are plunging into gold.

Over the last few months, a number of big-name, mainstream investors have said buy gold. Stanley Druckenmiller publicly advised investors to sell US stocks and buy gold. Legendary hedge fund manager Paul Singer said “it makes sense to own gold.”

With Brexit now a reality, and bond yields slipping lower and lower, the gold bulls continue to charge. This week, Joe Foster, gold strategist at VanEck, jumped on the bandwagon, saying he expects $1,400 gold this year, and he doesn’t believe it will end there:

Many are seeing the looming potential for another financial crisis and making a strategic allocation to bullion as a hedge against systemic risk.”

TD Securities also predicts $1,400 gold and said $1,500 is possible if the Federal Reserve further cools market expectations for an interest rate hike:

An old dog may not be able to learn new tricks, but he can apparently rediscover those that are long forgotten.

In a recent interview with Bloomberg, former Federal Reserve chairman Alan Greenspan warned of impending inflation.

His prescription?

A return to a gold standard.

Greenspan noted that growth in productivity has ground to a halt in the US. He described the current economic malaise as stagnation. Greenspan pointed out that the money supply measured by M2 is steadily increasing and has tilted up in the last several months. This is a leading indicator of inflation:

The thing that we should be worrying about now, which we have actually given no thought to whatsoever, is that this type of economic environment ends with inflation. Historically fiat money has always ended up that way.”

Peter Schiff recently appeared on Info Wars with Alex Jones and offered a dire warning:

The world sits atop a house of cards erected by central banks…unfortunately it’s not going to end well for most people.”

Peter said the aftermath of Brexit shows just how fragile the world financial system is, pointing out that in a healthy economy Brexit wouldn’t really matter. But we don’t have a healthy economy and the post-Brexit turmoil is a sign of things to come:

More and more people, mainstream people…now realize that this is the ninth inning of this thing – this whole experiment with Keynesianism and fiat money. It is very, very late in the game. Time is running out. The clock has been ticking and ticking and it’s going to stop. The day of reckoning is getting closer.”

So, what lies ahead? Peter reiterated a prediction he made on CNBC last month – the Fed will sacrifice the dollar on the altar of the stock market, we are rapidly heading toward a currency crisis, and we can expect more Federal Reserve intervention:

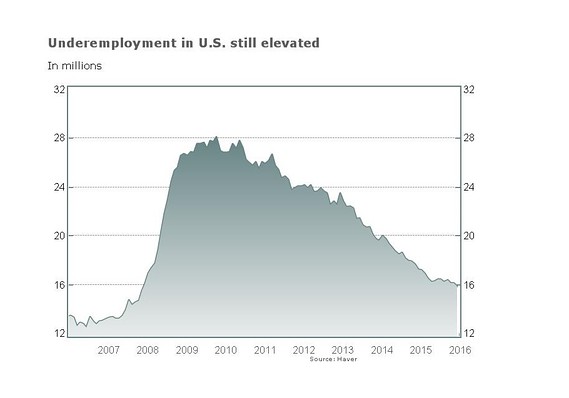

The June jobs report with its 287,000 new jobs lifted both spirits and markets drug down by the recent Brexit vote and other economic bad news. But the oft-reported numbers – jobs added and the unemployment rate – obscure the truth. In fact, the “real” unemployment rate remains above pre-recession levels.

As Peter Schiff pointed out in his most recent podcast, the numbers buried in the numbers tell a different story – a jobs market still struggling mightily even though the mainstream is in celebratory mode:

Overall, a mixed picture, but the headline number, the 287 versus 180 consensus, that’s normally the number the market trades off and that is exactly what happened.”

In a recent episode of the Santilli Exchange, Pete Santilli talked with Hoover Institution Fellow Tim Kane about the June jobs report and the overall state of the US economy.

Despite all of the giddiness about the recent jump in the number of jobs created, Kane said this jobs report wasn’t as positive as advertised:

The thing that really shocked me was if we compare this year to last year, 850,000 people are not in the labor force. You have unemployed, you have employed, and you have people who are not in the labor force. That’s gone up. It’s not a good report.”

Kane went on to discuss the overall performance of the US economy in light of recent Hoover Institution research showing that the recovery after each subsequent recession is getting weaker and weaker. He pointed out that we should be in boom right now. But as Peter Schiff has put it, we are actually in a “phony recovery.”

SchiffGold is excited to announce that we will be merging with GoldMoney (formerly Bitgold), a rapidly growing financial technology company that offers a diverse variety of gold-based products. By combining forces, Peter Schiff will be joining the likes of well-known gold experts, James Turk and Eric Sprott.

This joint venture will enhance the services SchiffGold can offer our customers and the reach we will have on the global market. Our formula will stay the same – SchiffGold will continue providing personal service to our customers, expert 1-on-1 guidance, and among the lowest pricing for physical gold and silver in the industry.

The GoldMoney/SchiffGold team share a like-minded passion for gold and offering the highest quality services to our customers. With the help of our existing and future customers, we look forward to re-introducing gold into the modern-day-world.

In this video Peter Schiff explains the details of the merger and touches on the exciting enhancements of GoldMoney’s offerings. Peter Schiff speaks with GoldMoney’s co-founder and commodity king Josh Crumb. This fun and highly educational video is a must watch!

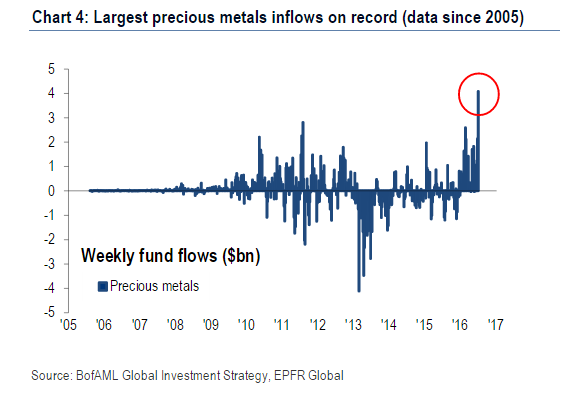

The week began with a surge in the price of silver, giving the white metal its biggest two-day gain since 2011. Now this morning, Bank of America Merrill Lynch reported the largest one-week inflow into precious metals funds on record – $4.1 billion in the week ending Wednesday.

The combination of the Brexit and the realization that the Federal Reserve isn’t going to continue raising interest rates has investors scrambling for safe havens. With gold and silver suddenly returning to the limelight, Bank of America Merrill Lynch is now forecasting the gold price to hit $1,500 by the end of the year.

Barry Dawes, Head of Resources for Paradigm Securities, told CNBC:

In the early 1830s, an eastern Kentucky man named Josiah Sprinkle started minting his own coins and circulating them around the area. Eventually, government officials got wind of Sprinkle’s operation and arrested him. But he was ultimately found not-guilty in court.

How did a man minting his own coins escape the long arm of the law? Because his coins were pure silver. They were equal in value to the silver dollars minted by the US government. In fact, they were worth slightly more.

This historical oddity reveals an important truth. When money was actually silver and gold, its value was intrinsic. The value came from the metal, not a promise by the issuing government. The government didn’t have to fiercely maintain its monopoly in order to protect the “value” of its fiat currency. If you had gold or silver – in whatever form – it was literally money. Josiah wasn’t doing anything wrong circulating his pure silver coins. He wasn’t ripping anybody off. His coins were worth what he promised.

A similar private coin was minted in Missouri, known as the Yocum Dollar: