Ever since the financial crisis of 2008, many investors have bought gold and precious metals to withstand the storm of volatile markets and insolvent banks. Demand for gold storage services is so in-demand throughout the world, Switzerland vault owners are turning customers away. Many of these Swiss vaults reside in the Alps within old military bunkers converted to high-tech facilities catering to the wealthy.

In his latest podcast, Peter runs down the real threats of prosecuting and over-regulating financial institutions like Wells Fargo. Last week, Wells Fargo CEO John Stumpf was lambasted by members of the House Financial Services Committee over the unauthorized accounts scandal. Members called for Strumpf’s resignation and a breakup of the company.

Aside from the heated exchanges echoing the congressional chambers, the hypocrisy of the situation left a foul odor on the proceedings. For congress members to fault an executive for facilitating theft of customer deposits takes a lot of chutzpah. Peter explains:

The Fed wasn’t immune from the political spectacle that was the Presidential debate on Monday. After that, Yellen had to answer even more criticisms from the nation’s financial regulation.

“The Fed is being more political than Secretary Clinton”— Trump

In Monday’s much-awaited presidential debate between Hillary Clinton and Donald Trump, there were many contentious topics brought up to over 80 million viewers throughout the event. One topic, brought up by Mr. Trump, was the Federal Reserve, as well as Janet Yellen. As you might guess, he was not singing praises to the Fed Chair on the stage. Trump brought up that Yellen’s moves might be influenced by President Obama, and that the possibility of a stock market bubble was a near-certain disaster awaiting the economy.

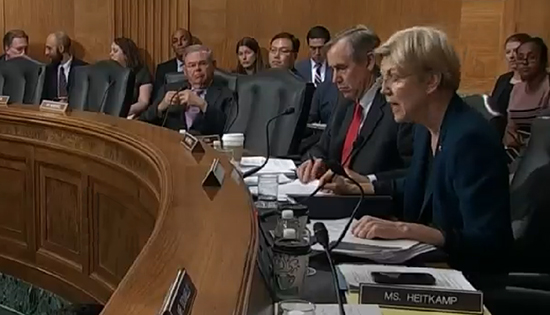

On Wednesday, Federal Reserve Chairwoman Janet Yellen testified before the House Financial Services Committee on financial regulation. The Fed Chair took criticism from both sides, with Democrats and Republicans criticizing the regulatory body for doing too much and for doing too little. Among the topics was the over-reach of Dodd-Frank, breaking up “too big to fail” firms, and the recent Wells Fargo phony account scandal. However, one important topic side stepped was the impact of low interest rates on any of the problems brought up at the hearing.

In his latest episode, Peter Schiff reacts to the first presidential debate and Donald Trump’s missed opportunities to put Hillary Clinton on the defensive about paid maternity leave, government mandates, profit sharing, and the Federal Reserve.

One of Trump’s biggest opportunities was going after independent voters by expanding the argument that Clinton’s policies were “just more of Obama” and included criticism of George W. Bush. “You’re looking for the undecideds,” Peter states. “You’re looking for the independents, and they will appreciate someone who’s critical of both parties.” Certainly, a cross-party strategy would have emphasized Trump’s “outside” position, a major theme of his campaign.

In the end, Trump failed to call Clinton out on her erroneous assumptions about the economy (i.e. Bush’s tax cuts caused the 2008 Financial Crisis). Trump had ample opportunity to show Clinton’s lack of business experience and idealistic detachment from economic realities.

In an epic meeting of economic intellects, Peter Schiff and Roy Sebag talk about Goldmoney’s recent acquisition of SchiffGold and the coming revolution in value transactions. Peter and Roy also discuss the special properties of gold that make it the best standard for backing currency, Goldmoney’s potential to change the way we buy, sell and save, and how crypto currencies and the internet are making banking systems irrelevant.

In light of the Fed rate hike news finally dropping this week, we can start looking ahead to the rest of the year. It’s a great time to be Fed Up with the election looming and global central banks making moves to preserve their economic health into next year.

Fed Holds Interest Rates “For the Time Being'”

In her press conference Wednesday afternoon, Janet Yellen said the Fed decided to keep rates at their current target but pushed that a hike before the end of the year was likely. The delay suggests Yellen and policy makers are continuing to keep up the illusion of economic health by maintaining an undercurrent of optimism despite the bad data continuing to come in.

“The case for an increase in the federal funds rate has strengthened,” she said, citing a need to “wait for further evidence of continued progress” in the economy. Despite the renewed optimism express by Yellen, most economists are still skeptical of a November hike, given that it’s just before the election.

Many investors wonder whether they can use their retirement funds for buying physical precious metals. It’s important for those who want to diversify their portfolios and reap the wealth-retention benefits of gold and silver. The answer depends mostly on what type of retirement fund you have.

India has traditionally been one of the largest gold markets on the planet, second only to China. However, the high price of the yellow metal is threatening India’s status as a leading importer of gold. Indian gold bazaars are the common places of exchange, and lately, their owners have seen a mass movement of people selling their gold jewelry. The market has transformed from whole sellers and brokers to everyday individuals looking to take advantage of the high price of gold, up 22% this year so far.

A Florida court recently found Robert Escobio and his companies, Southern Trust Metals and Loreley Overseas Corp guilty by the U.S. Commodity Futures Trading Commission (CFTC) of bilking customers in a precious metals scam. Escobio was accused of stealing $600,000 from 35 customers from July 2011 through May 2013. Over the time period, the defendant and his companies received more than $2.6 million from the plaintiffs, according to South Florida Business Journal.

Escobio, Southern Trust, and Loreley were banned from commodity trading and ordered to pay more than $2.1 million in penalties.