Trump has pegged the next US Treasurer, Steven Mnuchin, who’s already begun making bold statements about tax cuts and revamping Fannie Mae and Freddie Mac. Italy may hold the keys to a European market crisis and Bernanke tells the Fed to keep their economic predictions to themselves. This much and more in this week’s Fed Up Friday.

Mnuchin – Reaching Sustained Growth Makes Tax Reform “Priority No. 1”

Steven Mnuchin will be the Treasury Secretary, and in his first televised interview following the announcement, he dug in on many of the statements Trump has said in the past; the main issue being tax reform. In addition to cutting corporate taxes by 20%, Trump also looks to give middle-class Americans an income tax cut. But plans to cut to government revenue are hardly a panacea if it’s missing one important ingredient. Peter Schiff explains:

“People are talking about these tax cuts and saying maybe the consumer is going to have some extra money. It’s not going to offset these higher costs that are weighing down the economy … The only way you can have middle-class tax cuts lead to economic growth is if you also reduce the cost of government.”

Donald Trump’s US Treasury nominee Steven Mnuchin sent mortgage markets into a frenzy when he said privatization of Fannie Mae and Freddie Mac should begin and that the incoming administration would “get it done reasonably fast.” Comments about the two mortgage finance titans shot their stocks up over 30% according to Bloomberg.

Both financial institutions have worked as clearing houses for mortgages, buying them from private lenders, packing them into securities, and stamping them with a US government’s guarantee. Privatization means increasing risk to some, but Mnuchin was quick to dispel any worries. “We will make sure that when they are restructured, they are absolutely safe and don’t get taken over again. But we’ve got to get them out of government control,” he stated.

A man from the French region of Normandy recently inherited a house from a deceased relative, only to discover his newly acquired home was actually a secret gold depository. Throughout the house, the man found a total of 220 lbs (3208.33 Troy oz.) of gold coins and bars totaling $3.7 million.

The man’s identity has yet to be released, but reports indicate he was in the process of preparing furniture for sale when he stumbled upon part of the horde.

Local auctioneer, Nicolas Fierfort, who had visited the home in order to appraise the furniture confirmed “5,000 gold pieces, two bars of 12 kilos and 37 ingots of 1 kilo” were found in total.

The southern African Republic of Zimbabwe knows all about currency crisis. In 2009, the country was forced to stop printing its own currency because inflation levels had grown to astronomical proportions. At its highest levels during 2008 and 2009, Zimbabwe’s inflation rate was estimated to have reached 79.6 billion percent. Eventually, the struggling republic was forced to abandon its own currency and cease the runaway hyperinflation. In turn, it adopted others like the South African rand, the euro, and the pound just to keep the economy functioning, according to Bloomberg.

Peter Schiff recently appeared on CNBC’s “Future’s Now” program to discuss what the Federal Reserve will likely do during a Donald Trump presidency. Peter said he sees a rate hike in December as too little too late given the ineffectual level of interest the economy has seen over the last several years, and because of the accelerated rate of inflation that’s taking place.

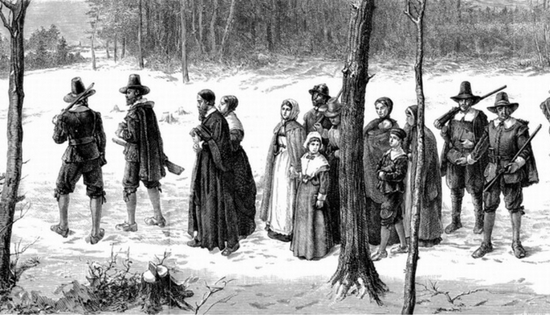

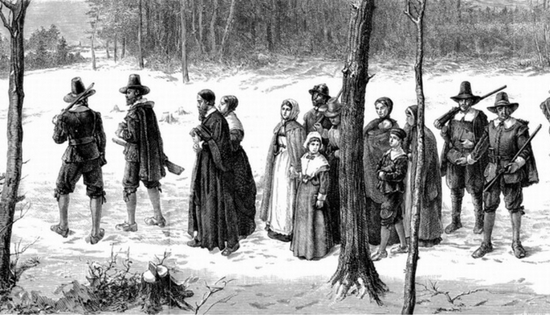

The majority of Americans know the basics behind the story of the pilgrims’ 1620 journey on the Mayflower, their eventual landing at Plymouth Harbor, and the physical and mental hardships they faced helping form the first permanent settlement of Europeans in New England.

Native American tribes like the Pokanoket were instrumental in helping the Pilgrims survive harsh winters, showing them how to plant corn, the best places to fish, and where to catch beaver. Thanksgiving is the day we celebrate the harvest feast the Pilgrims shared with the Pokanokets as an expression of thanks and good will.

Trade with other cultures, like the Pokanokets, was as essential for the Pilgrims’ survival just as it is for Americans today. Unlike our nation’s early European ancestors, however, today we use some pretty sophisticated ways to exchange goods and services. Credit cards, electronic transfers, bank wires, and cryptocurrencies make the Pilgrim’s form of currency seem like an alien technology, but that doesn’t mean it didn’t (and still doesn’t) work just as effectively today.

Last week, St. Louis Federal Reserve economist William Emmons presented a study showing American home ownership declining at a rate that’s projected to return levels to the 1950s. In a presentation entitled “Is Home Ownership Still the American Dream?” Emmons explains how the increase in home ownership of post-WWII was fueled by many factors, including New Deal government housing policies, which “laid the foundation for this huge increase in home ownership rates.”

Although the 2008 Housing Crisis was a strong factor, Emmons suggests the downward trend in home ownership began as early as 2005. The Fed economist also suggested the move on balance appeared secular and long-lasting, despite the fact that 90% of Americans younger than 45 have bought or expect to buy a home in the future. Aspirations to own homes are even higher among African-Americans and Hispanics than whites and Asians, yet rates for these groups are 20 – 30% lower.

Next to Donald Trump’s economic policies, one of the most spirited economic debates at the moment involves which direction the dollar will move in the coming months. While Goldman Sachs is predicting the dollar and euro will reach a value equivalency by Q4 of 2017, other analysts see the greenback trending downward next year.

The dollar has risen 4.4% against the euro and 2% against a basket of world currencies since Trump’s win on November 8, according to Fortune. Big moves within securities and bonds markets since Trump’s victory are creating a general sense of uncertainty, making predicting anything a difficult task.

But for market veterans like Jim Paulsen of Wells Capital Management and Peter Schiff of Euro Pacific Capital, the dollar’s demise is clear given inflationary anticipations mixed with short and long-term interest rate increases.

Peter Schiff recently appeared on Alternative Media Television (AMTV) to discuss the so-called “Trump effect” on the US economy. So far, the stock market has gone through some downs after the president-elect’s surprise win and now back up with the Dow Jones average nearing record highs.

There’s also been last week’s bond rout, which sent long-term yields soaring as bond prices dropped. The yield on the 10-Year Treasury saw its largest two-week increase since 2001, up 5.9 basis points to 2.337%. The selloff was driven by “rising inflation expectations and the market’s near-certainty that the Federal Reserve will raise interest rates in December,” according to MarketWatch.

As markets settle down following the week after the election, inflation continues to rise. Many continue to expect a December rate hike despite the potential volatility caused from state officials calling for Fed reform as early as Q1 2017.