Two 17-year-old high school students allegedly raked in nearly $60,000 selling fake gold bars on Craigslist, underscoring the importance of buying gold and silver from a reputable dealer.

President Donald Trump put a damper on the dollar earlier this week when he claimed, in a Wall Street Journal interview, it was “getting too strong.”

“I think our dollar is getting too strong, and partially that’s my fault because people have confidence in me. But that’s hurting — that will hurt ultimately … It’s very, very hard to compete when you have a strong dollar and other countries are devaluing their currency.”

After his comments, the dollar index dropped 0.7%.

During an interview on CNBC’s Future’s Now, Peter Schiff said Trump’s comments on the dollar were correct but insisted the president doesn’t understand the reasons behind it or its actual impact on the economy.

Peter Schiff once again went toe-to-toe with one of his favorite foes on CNBC’s Futures Now. After Peter explained why the Fed won’t be able to shrink its balance sheet, Scott Nations challenged him, citing GDP growth, unemployment numbers, and low inflation as reasons we should view the economy as strong.

When Peter pointed out that the jobs numbers were not good, Nations suddenly reversed course proclaiming, “That has nothing to do with whether or not we’re in a recession!” Then Nations went after Peter on gold. That’s when Peter really let him have it. Check out the video.

This week, Trump made military moves on two fronts, positioning ships off the coast of North Korea, and firing missiles into a key target in Syria. These quick, emotional moves sent ripples throughout the world markets. Uncertainty in the economy has been further amplified by an ever-extending timeline for tax reform.

President Donald Trump is making America confused again. Within one week, Trump has spun complete 180s on policies that were central to his campaign. CNN dubbed it “extraordinary political shape-shifting.” It appears America may be entering an unprecedented era of regime uncertainty. That doesn’t bode well for the economy, but it could be a boon for gold and other safe-haven assets.

Russia and China have gotten much cozier over the last several months, and the two countries are reportedly working to develop a joint organization of trade in gold. This could have a significant impact on both the dollar and the price of gold.

The Chinese began laying the foundation two years ago.

Is the so-called Trump Trade about to unravel? Economic analyst Jim Rickards thinks so. The Trump Trade rests on the idea that the president’s proposed policies of lower taxes, infrastructure spending, Obamacare repeal, and decreasing government regulations will juice the economy. As a result, corporate earnings will increase and the stock market will rise with them.

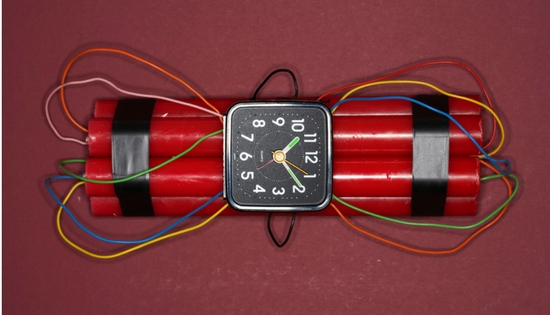

Will the US federal government shut down this month? It could if Congress doesn’t act before April 28. Federal government funding will run out on that date, and without a new spending bill, a partial shutdown will commence the following day. The last time this happened was 2013.

Tick … tick … tick … That sound you hear is a ticking debt bomb. According to the most recent data released by the Federal Reserve, outstanding credit card debt eclipsed the $1 trillion mark in February, increasing 6.2% from a year ago. Credit card debt now stands at the highest level since the 2008 crash, according to Fortune.

A collector of military tanks from the United Kingdom got a pretty good return on his $37,000 investment when he found gold bars worth more than $2 million dollars inside its fuel tank. Nick Mead is the owner of Tanks-A-Lot, a company that provides tanks and other armored vehicles for driving classes, private events, and movies.