The Federal Reserve is in the midst of inflating its third big bubble. During an interview with Greg Hunter last month, Peter Schiff said the third time isn’t going to be the charm.

There is one thing Republicans and Democrats should agree about – buy gold.

But like everything else, the yellow metal has become politicized. If you believe the stereotype, only people on the right buy gold. A recent article by Martin Tiller at Nasdaq.com highlighted the phenomenon.

After a somewhat tepid October, gold inflows into ETFs picked up again in November, driven primarily by investors in Europe.

Global gold-backed ETFs increased their holdings by 9.1 tons last month, according to the latest data released by the World Gold Council. This continues a streak of monthly gains. In October, inflows came in at 3.3 tons, after surging in August and September.

Last week, Pres. Donald Trump nominated Marvin Goodfriend to fill a vacancy on the Federal Reserve Board of Governors. When we reported the news, we called him “another swamp creature” – a member of the Washington D.C./Wall Street clan Trump promised to drain away.

We’re not alone in our thinking. In an article on the Mises Wire, Tho Bishop called Goodfriend’s nomination “a dangerous act of outright betrayal to Trump’s core constituency of working-class voters.”

It’s true Goodfriend’s views on monetary policy don’t fit in with the current Fed status quo. But that’s not a good thing. Goodfriend isn’t a fan of the conventional radical policy of quantitative easing. He’s actually a proponent of an even more radical policy.

Following is Bishop’s analysis in its entirety.

We think of platinum and palladium as the “industrial metals,” but in 2016, there was more gold used in industrial applications than either of these two metals.

According to a report released by the World Gold Council, demand for gold in electronics has been growing since the fourth quarter of 2016. On top of that, other emerging technologies in the health and energy sectors are also driving up the industrial demand for gold. All of this could have a positive impact on overall gold demand in the future.

To date, gold is up nearly 10% in 2017, but as Ron Paul pointed out in his recent Market Update video, most people aren’t paying much attention.

Why not?

Because a lot of other things such as the stock market and cryptocurrencies are going up faster. Nevertheless, Paul thinks there are good reasons to believe what he calls the “third bull market” in gold has started.

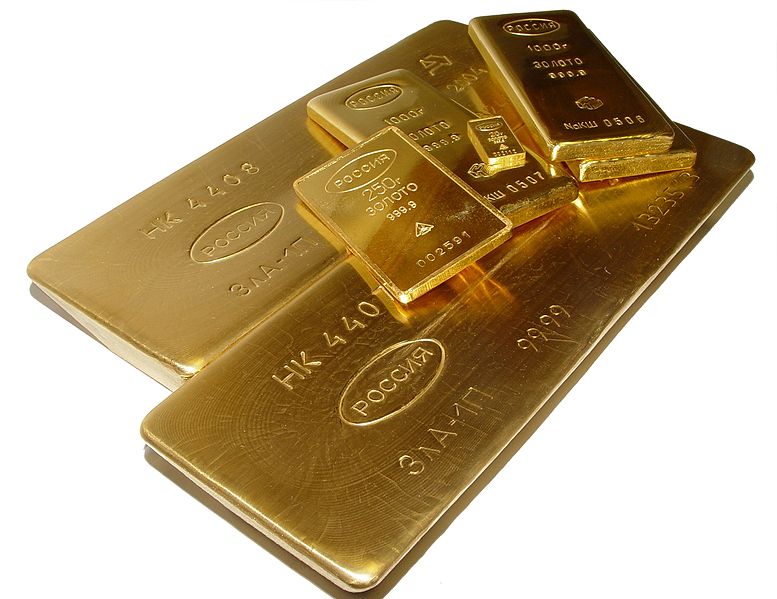

Russia’s gold holdings have topped 1,800 tons.

To put that into perspective, between 2000 and 2007, the Russian central bank held just 400 tons of gold. At that point, the country launched an aggressive gold acquisition program. In October of this year alone, the Bank of Russia bought 21.8 tons of gold. At 1,801 tons, the yellow metal now accounts for 17.3% of the country’s reserves. In the second quarter of 2017, Russia accounted for 38% of all gold purchased by central banks. Russia ranks sixth in the world in gold holdings behind the United States, Germany, Italy, France, and China.

Russia’s growing gold hoard is helping to establish economic and political stability and independence for the country.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Would you open up a box of cursed gold?

Some archeologists in Germany decided it would be a good idea.

Pres. Donald Trump has nominated another swamp creature to sit on the Federal Reserve board of governors.

Marvin Goodfriend does not come from the ranks of politicians. He’s an academic – an economics professor at Carnegie Mellon University. But he’s perfectly suited for the role of central planner. He fits right in with the other central bankers running what investment guru Jim Grant once called “the Ph.D. standard” monetary system, as opposed to the gold standard.