It’s no secret that 2017 was a down year for the precious metals market in the United States. Looking at US Mint sales figures tells the story. In 2016, the mint sold nearly 1 million ounces of American Gold Eagles. Sales figures in 2017 came in at just over 302,000 ounces.

Meanwhile, demand for gold surged in China last year. Imports of gold into India increased. So, what’s up with America?

In two words – Donald Trump.

Janet Yellen sang her swan song this week.

As expected, the Federal Reserve left interest rates unchanged during the Federal Open Market Committee meeting. The next hike will come after Jerome Powell takes the reins.

As Peter Schiff put it, Yellen got out of dodge.

Gold consumption in China grew 9.41% in 2017, according to information released by the China Gold Association. Gold jewelry demand, especially in poorer regions, helped drive overall demand higher.

The Chinese consumed 1,089 tons of the yellow metal last year. The South China Morning Post called the surge in demand “a big turnaround” after a 6.7% slump in 2016.

The price of Bitcoin fell below $10,000 this week. It rallied once again and pushed back above that key level, but turmoil continues to plague the world of cryptocurrencies.

We’ve been advising a diversified approach to crypto investing. Recently, Franco-Nevada president and CEO made a similar recommendation.

If you need to hedge your Bitcoin position, buy gold.”

The Dow Jones suffered its biggest one-day drop since August on Tuesday, falling 363 points. The Dow has lost 540 points in two days, the biggest decline since September 2016.

According to analysts quoted by CNN, fear of a tanking bond market is one of the main factors behind the stock market dip.

The bond market has been selling off lately. That’s raising fears that the era of extremely low bond rates — which has been very good to the stock market — could soon be over.”

Peter Schiff recently attended the Vancouver Resource Investment Conference. While he was there, he did an interview with Daniela Cambone of Kitco News.

Peter and Cambone talked gold, and Peter said he thinks the yellow metal is set to soar, despite the sentiment that Federal Reserve Rate hikes will hold gold down.

Gold has not really rallied. It’s been going up, right? But it’s been creeping higher. Now, everybody expected it to fall. Everybody believed that as soon as the Fed hiked rates, gold’s gonna tank. And it didn’t tank. It rallied.”

Jim Rickards has been talking $10,000 gold for a while. This seems like an absurd number, but Rickards insists the dynamic exist to push gold to that level – when the world financial system collapses under its own weight.

Rickards has been making the rounds again lately, saying gold is in the midst of its third bull run and has plenty of room to go.

In my view, we’re in the third bull market of my lifetime. The first one was 1971 to 1980. Gold went up over 2,000%. The second one was 1999 to 2011. Gold went up 655%. We’re in a new bull market that started in December 2015. Gold’s up 27% since then. Gold was up in 2016-2017. First back-to-back year of gold gains since 2011-2012. So, 2018 will be a breakout year … we’re actually in the third year of a bull market with a very long way to run.”

Everybody seems bullish on the economy. Nobody is worried about anything, even though there is everything to be worried about. Peter Schiff said he feels like he’s in Alice in Wonderland. In his most recent podcast, he referenced a Morgan Stanley analyst interviewed by CNBC.

She’s unquestioningly bullish on every front. Everything is bullish. There is nothing at all to worry about. In fact, the only thing she said that anybody is worried about is that there’s nothing to worry about. It’s that things are so good, they’re wondering what are we missing. Maybe we should be a little bit worried because nobody is worried because everything is good. I mean, there are so many things to worry about. That is the reality. But they’re not worried about any of them.”

Over the last two years, the Federal Reserve has been nudging interest rates higher and their efforts are starting to bear fruit in the marketplace. Bond yields are beginning to climb.

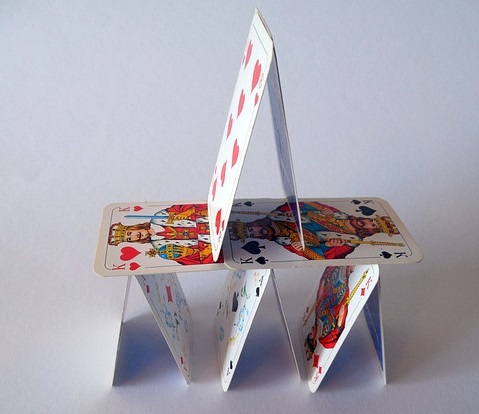

The question is how high can rates go before the house of cards the central bankers built comes tumbling down?

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.