The US national debt increased by $1.27 trillion in fiscal 2018. If you expected the pace of borrowing to slow in fiscal 2019, you’ll be disappointed. In just the first 11 business days of the new fiscal year, the US government added another $138 billion of debt to the total. That brings the total national debt to a staggering $21.654 trillion — or as Wolf Street put it “debt out the wazoo.”

Meanwhile, the two biggest buyers of US Treasuries are in a selling mood.

On Oct. 10, the IMF released its Global Financial Stability report, highlighting increased levels of risk revealed by a number of global metrics. Just after the report was released, stocks in the US, Europe and Asia lost 4%, 3% and 4% respectively over three days.

As a recent investment update released by the World Gold Council points out, although stocks rebounded and regained some of those losses, the IMF report and subsequent market pullback “underline the relevance of holding gold in the near and long term.”

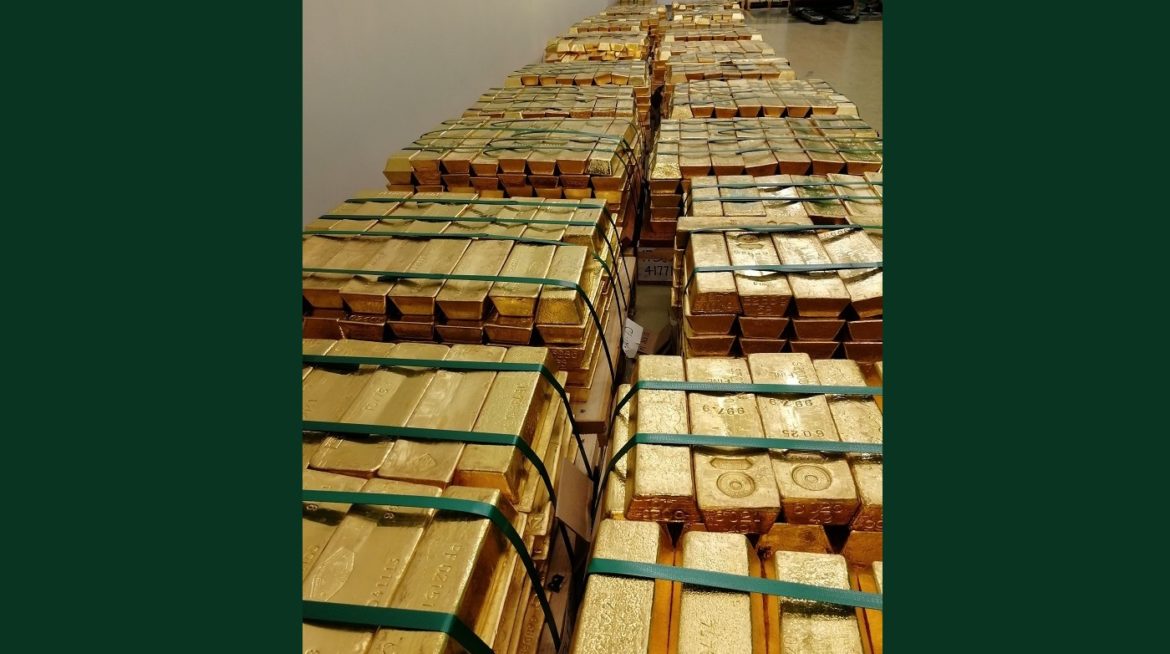

Yesterday, the Hungarian central bank announced it recently boosted its gold reserves 10-fold.

According to its website, the National Bank of Hungary (MNB) now owns 31.5 tons of gold, up from 3.1 tons. It was the first significant purchase of gold by Hungary since 1986.

A statement by the bank said the increase in gold stocks was intended to increase financial stability and strengthen market confidence.

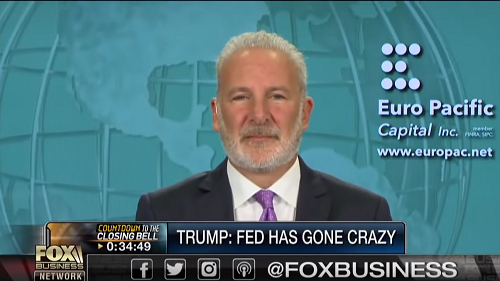

The stock market has been rocked over the last week but gold has rallied. In his most recent podcast, Peter called gold “the real standout in the market.”

The price of gold finally woke up — or traders work up and notice how cheap gold is.”

The federal debt spiral continues.

The 2018 fiscal year ended Sept. 30 and the US government closed out the year with its largest budget deficit since 2012. Uncle Sam ended 2018 $779 billion in the red, adding to the ballooning national debt.

Keynesian central planners suffer from what Peter Schmidt calls “fatal conceit.” Paul Krugman serves as the poster child for central planning arrogance. But it’s the Federal Reserve that gives the central planners power, as Schmidt highlighted in the first article in a series highlighting this fatal conceit. Schmidt built on this theme in the second article, telling the story of Benjamin Strong and his role in blowing up the 1920s stock market. In this third installment of the series, Schmidt tackles the question no one dares to ask.

In the wake of the stock market plunge last week, Pre. Donald Trump said the market drop wasn’t because of his trade war. Trump said, “That wasn’t it. The problem I have is with the Fed. The Fed is going wild. They’re raising interest rates and it’s ridiculous.” He also said the Fed is “going loco.” In a Thursday interview, the president doubled down, saying “I’m paying interest at a high rate because of our Fed. And I’d like our Fed not to be so aggressive because I think they’re making a big mistake.”

Peter Schiff appeared on Fox Business Countdown to the Closing Bell along with National Alliances head of fixed income Andy Brenner to talk rate hikes, the stock market and where things might go next.

Could we be heading toward $5,000 gold?

Last week, there was a big sell-off in the bond market. Yields on the 10-year Treasury soared 11 basis points in one day. Global stock markets sold off the following morning and US stock markets followed suit. This week, things really got really ugly on Wall Street. The Dow dropped over 1,300 points in two days. In a video for SchiffGold, Peter Schiff said stock market investors “finally took notice of the carnage that was going on in the bond market.”

On Thursday, the price of gold popped, rising nearly 3%. But despite all of the action this week, most people in the mainstream remain complacent. The narrative is that this is a normal bull market correction. Peter said nothing could be further from the truth.

The economy is even a bigger bubble than the stock market.”

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

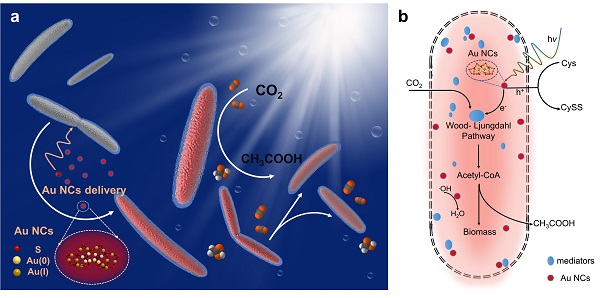

Will work for gold!

Who wouldn’t right? I don’t know about you, but I would work even harder for some gold than I would for dollars, knowing the Federal Reserve isn’t going to inflate the value of my gold away by 2% or more every year.

Well, apparently people aren’t the only organisms that know the value of gold. Scientists have discovered a bacterium that will work for us and actually help us create energy. But you have to pay it in gold.