Zimbabwe Introduces Digital Payment System Backed By Gold

The Reserve Bank of Zimbabwe (RBZ) has launched a digital payment system backed by physical gold.

The RBZ rolled out its digital gold-backed token in April after successfully implementing a program to produce physical gold coins in 2022. On Oct. 5, the central bank announced that these gold-backed digital tokens could be used as a method of payment for domestic transactions.

The digital tokens called Zimbabwe Gold (ZiG) can be stored in a digital e-gold wallet or on e-gold cards. Each token is backed by an equivalent amount of physical gold held in the RBZ’s reserves. The ZiG can be used in business transactions or shared peer-to-peer. In practice, this gold-backed digital currency makes it possible to do everyday business in gold.

According to a press release, the RBZ enlisted the service of external auditors “to validate the availability and adequacy of gold to back ZiG at any given time.”

RBZ Governor John Mangudya said the introduction of both gold coins and digital gold-backed tokens was intended to incentivize investors to put money into “national assets” instead of US dollars.

The issuance of the gold-backed digital tokens is meant to expand the value-preserving instruments available in the economy and enhance divisibility of the investment instruments and widen their access and usage by the public.”

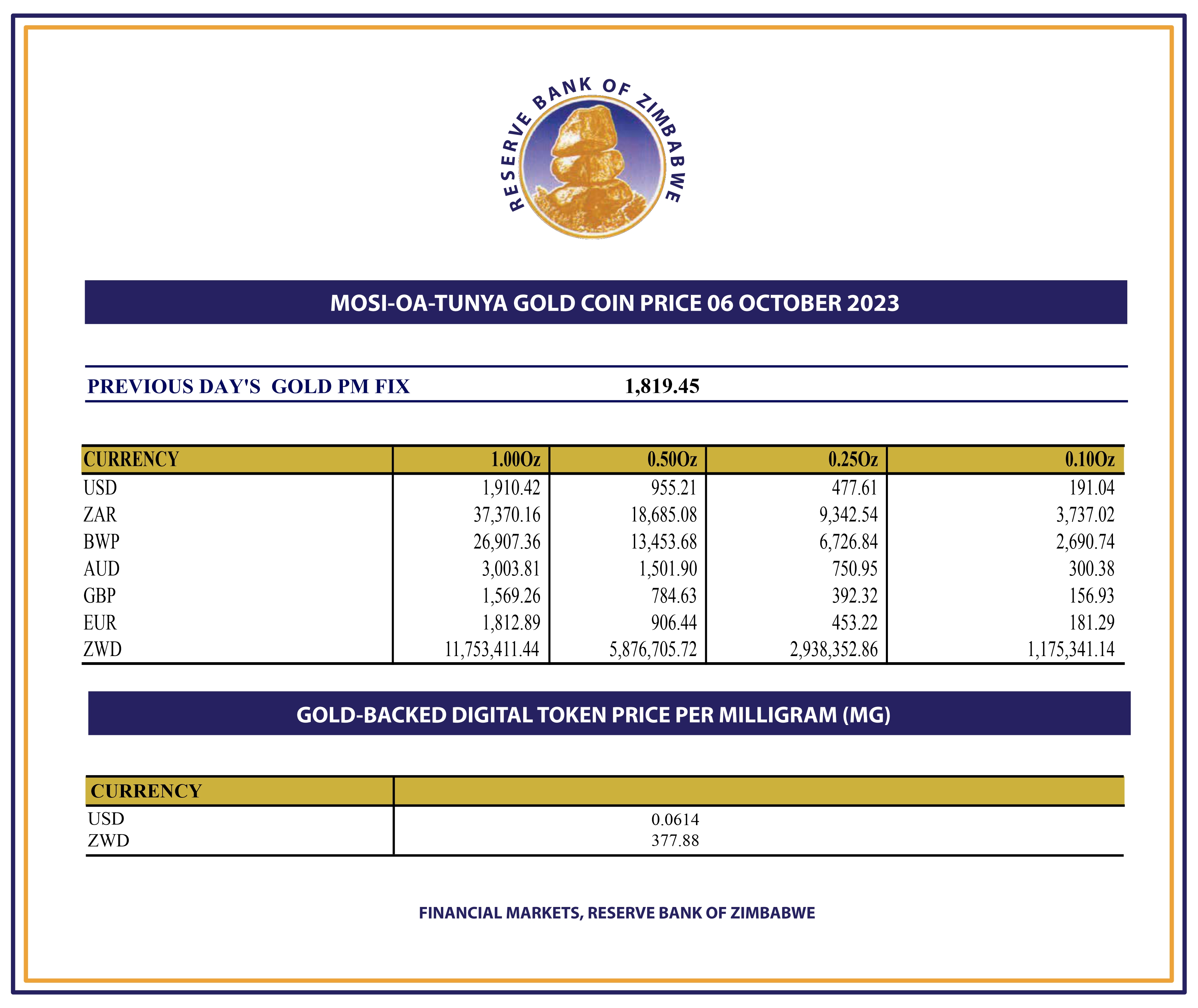

As of Oct. 6. people could buy ZiG for a little more than 6 cents USD or 377.88 ZWD per milligram. That amounts to 1 ounce of ZiG for $1,910 and 0.1 ounce for $191.

As you can see from the chart, Zimbabwe is once again dealing with rampant inflation. Over the summer, the inflation rate hit 175%. The RBZ initially issued gold coins “as an instrument that will enable investors to store value.” The ZiG is intended to “become one of the means of payment for domestic transactions, over and above its value-preservation purpose,” according to the press release.

When the Reserve Bank of Zimbabwe announced its plan to produce gold coins, Batanai Matsika, the head of a Zimbabwean brokerage firm, called it a “welcome development” in a market starved to hedge against inflation.

For a long time, the market did not have many investment options and this is a new asset class. The thinking was inspired by the need to come up with an instrument that addresses the inflation problems in the economy where purchasing power has been eroded. From what we are gathering, this is going to be a store value.”

Matsika went on to say the fundamentals of gold help it hedge against inflation and geopolitical risk, and that the gold coins would open the gold market to “ordinary investors.”

Ironically, the RBZ is trying to solve a problem it caused to begin with.

The country has labored under an inflationary monetary policy for decades. According to Al Jazeera, the central bank worsened the problem by printing even more new money, reversing gains made in the previous two years. Inflation decreased from a peak of 800% in 2020 to 60% in January 2022 before skyrocketing again later that year.

Zimbabwean investors have turned to the US dollar as a store of value. The dollar has its own inflationary problem, but as the world reserve currency, the greenback is the cleanest dirty shirt in the laundry. One US dollar can sell for as much as 650 Zimbabwean dollars on the Zimbabwean black market.

The availability of gold will likely ease pressure on the US dollar in the country. After all, gold is a better long-term store of value than another fiat currency. It has no counter-party risk and it cannot be created out of thin air by central banks.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]