Yellen and Trump Speeches Highly Anticipated by Investors

Investors will have much to mull over this week as Donald Trump gives his first address to Congress, and Federal Reserve Chair Janet Yellen speaks Friday. After that, the FOMC goes into their blackout period in anticipation of their March 14-15 policy meeting.

Tuesday night, Donald Trump will give his first State of the Union address to Congress, which is expected to touch on immigration, tax cuts, regulation, Obamacare, trade agreements, defense, and homeland security. Investors are hoping Trump will lay out more specifics on his tax plan and trade policy.

Gold investors are waiting on more clarity from Trump as well, with prices holding steady Monday at a 3.5 month high, according to Reuters. “Since the beginning of the year, the gold price has always been on the rise,” said Jiang Shu, chief analyst at Shandong Gold Group. “This will draw more and more momentum traders into the market.”

Spot gold is expected to rise to $1,278 per ounce, “as it has more or less broken above resistance at $1,249,” according to Reuters technical analyst Wang Tao.

“The biggest driver of gold has been the relatively weak US dollar,” explained Shu. “People think that … Trump doesn’t want a strong dollar and the market thinks that perhaps there would not be a rate hike in the first half of the year.”

Investors are correct to think Trump is angling for a weak dollar given his comments during the 2016 campaign. Last month, Peter Schiff pointed out Trump’s unstated weak dollar policy:

“Donald Trump always talked about the overvalued dollar when he was a candidate. He didn’t always say, ‘the dollar is overvalued.’ He would say, ‘foreign currencies are undervalued,’ which is basically like saying the same thing only using different words … If he wants foreign currencies to appreciate, then by definition, he wants the dollar to depreciate.”

Yellen’s Friday talk will be a bellwether to investors of the Fed’s likelihood to raise rates in March. “It’s an opportunity to let markets know what she’s thinking and what the likely path of interest rates is going to be,” said PNC Deputy Chief Economist Gus Faucher.

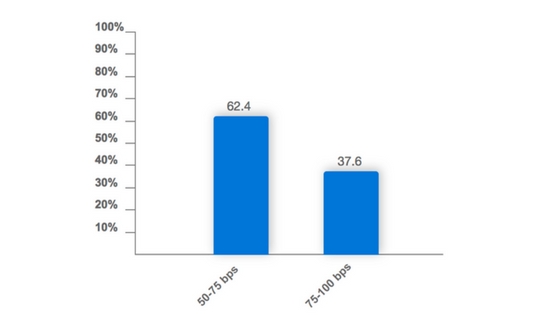

Investors are only pricing in a 22% chance of an interest-rate hike in March, according to Bloomberg quoting CME Group’s FedWatch tool. The Trump State of the Union will almost certainly be an unorthodox and insightful event which will likely factor into the FOMC’s decision next month.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]