World Gold Council Report Highlights Four Trends to Watch in 2018

The World Gold Council has released a report highlighting four market trends that will impact gold in the coming year. Although the WGC tends to embrace a pretty mainstream economic point of view, there is some good food for thought in the report, and some reason to be bullish on gold in 2018.

The WGC notes that gold performed remarkably well in 2017. Investors continued to add gold to their portfolios. It pointed to inflows of $8.2 billion worth of gold into gold-backed exchange- traded funds as one example of strong gold demand. In fact, gold outperformed many asset classes in 2018, despite a rising interest rate environment and surging stock markets.

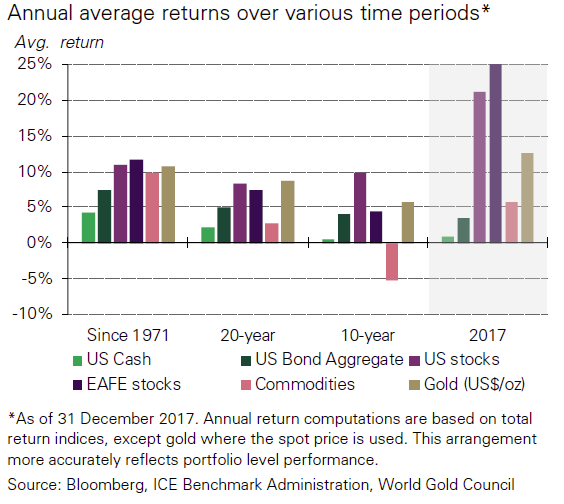

This is not an anomaly. Gold has provided competitive returns over the long run, growing by 10% on average since 1971 – following the collapse of Bretton Woods and the end of the Gold Standard. It has also performed well compared to major stock indices over the past two decades.

As we move into 2018, WGC analysts have pinpointed four key themes they believe will drive global financial markets and influence gold in the coming year.

1. A year of synchronized global economic growth.

Global economic growth increased in 2017 and the WGC expects the trend to continue in 2018. The report specifically focuses on economic growth in India and China, the world’s leading consumers of gold.

Our research shows that continued economic growth underpins gold demand. As incomes rise, demand for gold jewelry and gold-containing technology, such as smartphones and tablets, rises. Income growth also spurs savings, helping increase demand for gold bars and coins.”

Of course, robust economic growth assumes no major crashes or crises in 2018, and that certainly isn’t a given considering we are deep into the business cycle and due for a recession.

2. Shrinking balance sheets, rising interest rates

The Federal Reserve, along with other central banks, have launched efforts to shrink their balance sheets and normalize interest rates after years of loose monetary policy. Even so, the WGC expects rates to remain low by historical standards. Even with rising rates, the council doesn’t follow the conventional wisdom assuming rising rates are necessarily bad for gold, saying the potential headwinds may not be as strong as some think

The actions that central banks took over the past decade have had substantial implications for the performance of financial markets. As they pumped trillions of dollars, pounds, euros and yen into the global economy and slashed interest rates to – and in some cases below – zero, asset values hit record highs, market volatility reached record lows and prices became increasingly correlated. It is reasonable to presume that as central banks rein in their expansionary policies, these trends will reverse. Government bonds – the chief beneficiaries of quantitative easing – may come under pressure and their multi-decade high returns decrease. Financial market volatility may pick up and idiosyncratic risk may re-emerge.”

3. Frothy asset prices

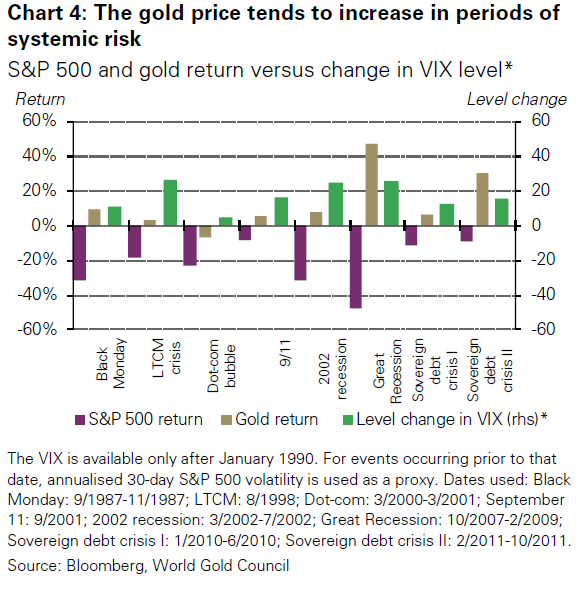

In other words, there are a lot of bubbles in the economy and a high level of systemic risk.

Should global financial markets correct, investors could benefit from having an exposure to gold as it has historically reduced losses during periods of financial distress.”

4. Market transparency, efficiency, and access

According to the WGC, the world gold market has made great strides in transparency. Theoretically, that means more people will be willing to access the market and invest in gold. There are also some regulatory changes on the horizon in several countries that could make it easier for people to own gold. For instance, a draft amendment to the tax code proposing an exemption for gold has been submitted for consideration by the Russian government. If approved, it may herald the development of a new gold investment market in the country.

With these trends in mind, the WGC offers four reasons to own gold.

• It has been a source of return for investors’ portfolios

• Its correlation to major asset classes has been low in both expansionary and recessionary periods

• It is a mainstream asset that is as liquid as other financial securities

• It has historically improved portfolio risk-adjusted returns.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]