Venezuelan President Raises Minimum Wage and Unemployment

In his weekly radio address to his citizens, Venezuela’s post-Hugo Chavez leader, President Nicolas Maduro, announced he would raise the minimum wage for the fifth time over the last year. The bump puts the minimum salary at 40,683 bolivars or $60 per month, according to Reuters.

The new minimum wage represents a 322% cumulative increase since February 2016 and is an attempt to protect citizens’ wages from “mafia attacks,” according to Maduro. The President attributed his country’s woes to anti-socialist political opponents and capitalists who have created an “economic war” to foment disorder and unrest.

Maduro’s comments are an attempt to appeal to anti-private business sentiments within Venezuela’s citizenry. Essentially, they’re a red herring designed to distract from the state-created hyperinflation that has left Venezuelans awash with cash, but little to buy. The enormous amount of cash floating around is a consequence of an effort to devalue the country’s currency with the intention of shrinking trade deficits by making exports more competitive.

Manipulating Venezuelan wages is an approach to correcting misguided socialist policies, one that will ultimately push prices higher when costs are passed on to workers. However, the real economic harm of minimum wages is they’re destructive to labor markets by eliminating lower paying jobs. Venezuelan businesses that are forced to pay more for a worker who’s worth less than the minimum wage will look to automation or simply leave the position unfilled.

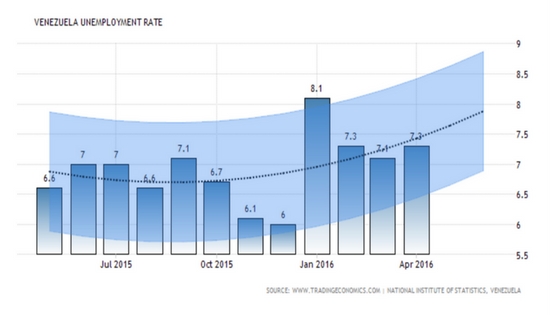

Venezuela’s unemployment rate reflects the effects of minimum wages over the last 12 months. Although the country’s leadership is known for being less-than-forthcoming with the release of economic indicators like GDP and unemployment, reports show unemployment at 7.3% in April 2016. Forecasts expect 9% by the end of Q2 and 11% by the end of 2017.

Until leaders like Maduro scale back regulations and market manipulations, market forces that function to balance prices and unemployment rates will continue to be ineffective to solving Venezuela’s problems.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]