US Government Runs Third-Biggest Deficit of 2021 in July

After a briefly shrinking for two months thanks to IRS tax collections, the US government budget deficit ballooned again in July, hitting the third-highest number of fiscal 2021.

The July budget shortfall was $302.05 billion. The only months with bigger deficits in fiscal 2021 were February ($310 billion) and March ($600 billion).

With two months left in the fiscal year, the 2021 deficit stands at $2.54 trillion, according to the July Monthly Treasury Statement.

Money flowing into the US Treasury dropped sharply in July as tax season came to an end. Government receipts totaled $262.0 billion last month compared to $449.20 billion in June.

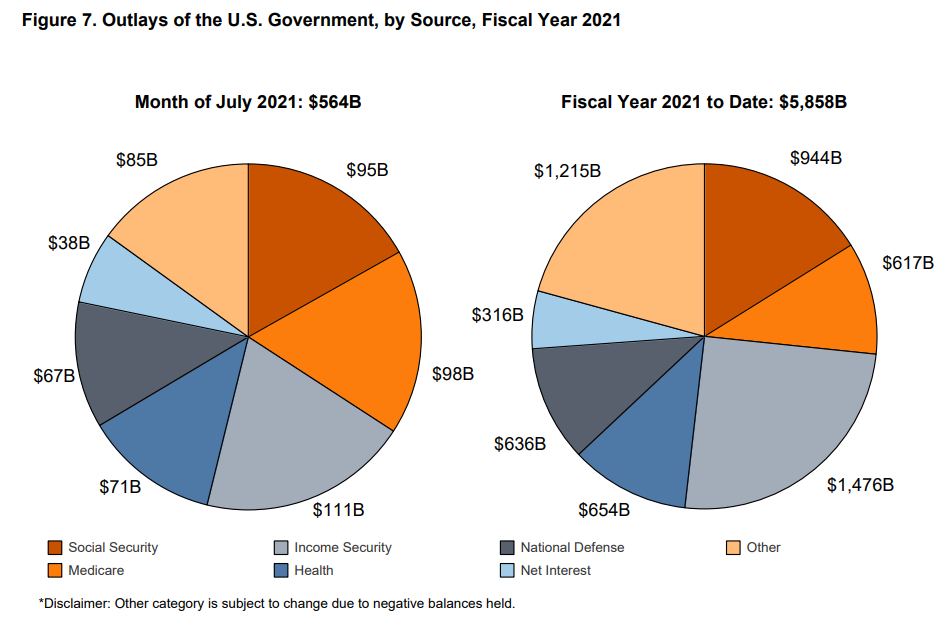

But Uncle Sam continues to spend money at a torrid pace. July government outlays totaled $564.05 billion. The US government has spent over half a trillion dollars in every month of the fiscal year but two (November and December). Total spending for 2021 currently stands at $5.86 trillion. On a trailing 12-month basis, outlays are 55% above where they were in the period ending in July 2019.

Even without additional stimulus in the coming year, spending doesn’t appear set to slow much. Congress is on its way to passing a $1.2 trillion infrastructure bill, and Biden’s 2022 budget tops out at over $3.5 trillion in spending. The Biden budget would take the US to its highest sustained spending levels since World War II.

As with any budget proposal, the reality will likely prove worse than the projections. The government will almost certainly spend more than planned and tax receipts will come in under projections. That means even bigger deficits piled onto an ever-growing national debt.

As of July 12, the national debt stood at $28.43 trillion. The debt is currently frozen at that level with the 2-year debt ceiling suspension ending on July 31. Congress is set for another debt-ceiling fight that will ultimately raise the federal borrowing limit again. The government can limp along with the ceiling in place temporarily using “extraordinary measures.” Congressional Budget Office projects Uncle Sam will run out of money this fall, likely in October or November.

According to the National Debt Clock, the debt to GDP ratio is 125.61%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt to GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

Currently, every American citizen would have to write a check for $85,973 to pay off the national debt. It would cost every taxpayer $227,474.

It’s easy to write off the soaring deficits as a product of pandemic spending, but as already mentioned, there is no sign that spending is about to slow down. This throws a wrench in any Federal Reserve plans to tighten monetary policy to fight inflationary pressures. As Peter Schiff pointed out in a recent podcast, with all of the federal spending coming down the pike, the economy will need monetary stimulus more than ever.

How else is this fiscal stimulus going to be paid for? Where is the Treasury going to get the money for the $1.2 trillion infrastructure package? Where’s it going to get the even greater amount of money for the $3.5 trillion spending bill that’s supposed to follow? The answer is from the Fed. So, while everybody is selling gold because they expect the Fed to taper its asset purchases, the real threat is that the Fed expands its asset purchases.”

It seems almost certain the massive budget deficits will continue into the foreseeable future. That means the government will need to continue borrowing and it will need the central bank to keep its thumb on the bond market through Treasury purchases to make that possible. That means no tightening. Even if the Fed tapers a bit first, ultimately, asset purchases will more likely go way up. It’s the only way to fund these massive deficits. The bottom line is larger deficits mean even higher inflation.

Furthermore, given all of the debt the US economy can’t handle the high interest rate environment necessary to tame rising prices. The Federal Reserve boosted interest rates modestly to 2.5% in 2018 and all hell broke loose. The stock market crashed, and the Fed was forced back to loose monetary policy even before the coronavirus pandemic.

You can take a deeper look at the July deficit numbers HERE.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]