US Gold Market Saw a Deficit in 2017

The US gold market went into a deficit last year despite sluggish American demand, according to analysis by SRSrocco.

Demand for gold fell in the US from 212 tons in 2016 to an estimated 150 tons in 2017. A 56% decrease in demand for gold bars and gold coins through the first three quarters of last year was a primary factor pushing overall US demand for the yellow metal lower. Peter Schiff talked about sagging US investment in gold last summer during an interview at International Metal Writers Conference noting that a lot of the investors who typically buy gold in America voted for Trump, and they’re no longer worried about the economy. As a result, they’re not buying gold. They’re buying stocks instead.

So what accounts for this deficit in the US gold market?

Americans are exporting large amounts of gold.

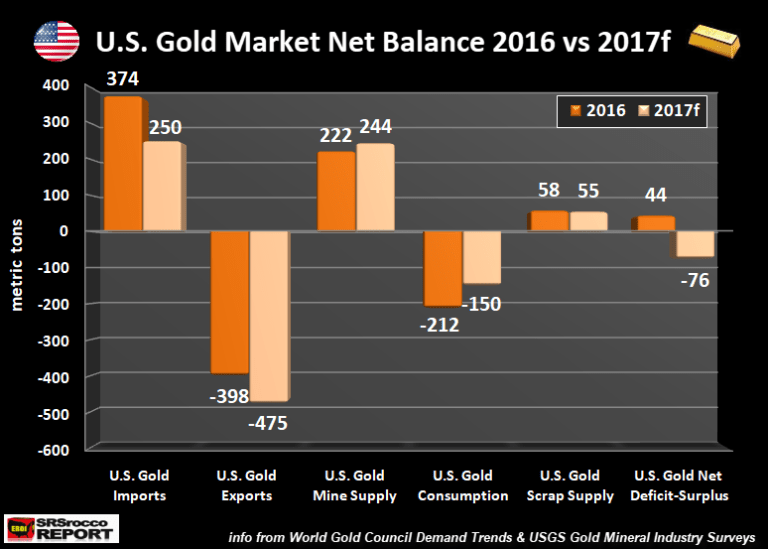

In 2016, the United States imported 374 of gold and exported 398 tons for a relatively small 24-ton deficit. But analysts estimate US gold imports fell to around 250 tons in 2017, while exports increased to an estimated 475 tons. That equates to a 225-ton net export deficit for last year. When you factor US mine production and scrap supply into the equation, the US gold market ended up with a 76-ton net total deficit last year.

Gold appears to be flowing from west to east. Demand for the yellow metal surged in India during 2017. Demand was strong in China throughout most of last year as well. The Germans also have a budding love affair with gold where demand increased by a healthy 45% in Q3 2017. German demand helped spur healthy inflows of gold into European based ETFs. European funds took in 75% of global inflows last year, adding 148.6 tons of gold.

SRSrocco said the gold deficit could have serious ramifications in the near future and raises an important question: What happens when the bubbles burst, markets crack and Americans suddenly decide they want to buy gold?

This happened in the first quarter of 2016 when the Dow Jones Index only fell 2,000 points in a few months. Gold ETF inflows surged to the second highest quarterly amount ever at 350 tons. The all-time record of quarterly gold ETF inflows took place during the first quarter of 2009 when the Dow Jones was crashing towards 6,600. During the Q1 2009, gold ETF flows were a staggering 465 tons. While precious metals sentiment is currently depressed due to the surging stock and cryptocurrencies, at some point, we are going to see a crash in these two markets. The amount of leverage in both markets is off the charts. I believe the next market crash will cause more investor fear than ever. We could see gold ETF inflows surge above 500 mt while physical bar and coin demand beats all records.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]