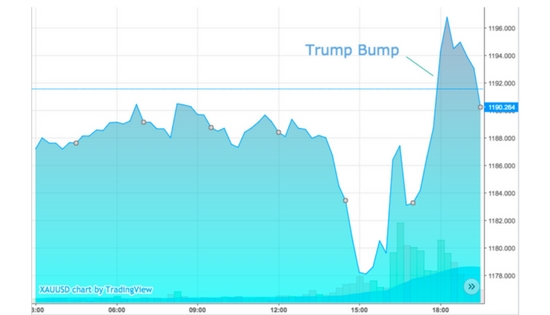

The ‘Trump Bump’ Rallies Gold to 7-Week High

Donald Trump’s press conference gave gold a rollercoaster ride on Wednesday as prices hit a 6-week low ahead of the president-elect’s speech, only to rally back to its highest point in 7 weeks. Spot gold moved from $1,176.94 to $1,198.40, the highest since late November.

Investors made a move into the yellow metal after the dollar took a tumble, according to Reuters. Stocks saw a negative move as well. Pharmaceutical stocks lead an overall decline in the market after Trump made comments about drug companies “getting away with murder” by price gouging their customers.

Wednesday’s gold session got a “Trump bump” at its lowest point after the future US president addressed Russia’s involvement in the election, claims he had been caught in a Russian sex sting, and his decision to transfer operations of his businesses to his two sons.

Nico Pantelis, head of research at Secular Investor believes the gains in the stock market and the dollar we’ve seen since the election are being replaced by a general anxiety that will be good for gold. “The fear of potential turmoil in the months and years ahead is creeping back into the market,” he told MarketWatch. “This had a positive impact on risk-off assets like gold,” he said.

Nico Pantelis, head of research at Secular Investor believes the gains in the stock market and the dollar we’ve seen since the election are being replaced by a general anxiety that will be good for gold. “The fear of potential turmoil in the months and years ahead is creeping back into the market,” he told MarketWatch. “This had a positive impact on risk-off assets like gold,” he said.

There are likely many more Trump Bumps coming soon. Now may be the time to think about diversifying your portfolio and protecting your wealth by buying gold and silver.

Get Peter Schiff’s latest gold market analysis ñ click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]