The Outlook for Gold in 2020 Remains Bullish

Gold had a strong year in 2019 and a World Gold Council report says the outlook for 2020 remains bullish.

We expect that many of the global dynamics seeded over the past few years will remain generally supportive for gold in 2020.”

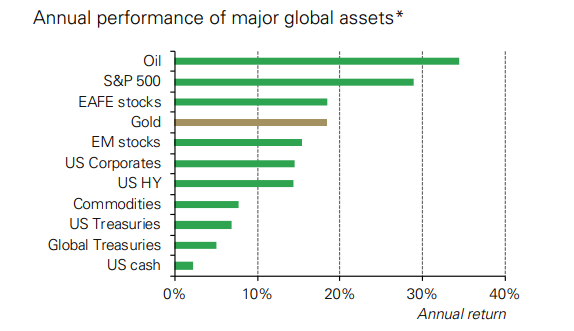

Gold charted its best year since 2010 last year. The price increased by 18.4% in dollar terms. The yellow metal also reached record highs in every G10 currency except the dollar and the Swiss franc. There were record inflows of metal into gold-backed ETFs and central banks continued to gobble up gold.

Overall, gold ranked as one of the best investments in 2019, outperforming both bonds and emerging market stocks.

The World Gold Council Outlook 2020 report highlights several reasons why gold should have another good year.

- Financial and geopolitical uncertainty combined with low interest rates will likely bolster gold investment demand

- Net gold purchases by central banks will likely remain robust even if they are lower than the record highs seen in recent quarters

- Momentum and speculative positioning may keep gold price volatility elevated

- And that gold price volatility, as well as expectations of weaker economic growth, may result in softer consumer demand near term but structural economic reforms in India and China will support demand in the long term.

Overall, the WGC says this is currently a “supportive environment for gold investment.”

Looking ahead, we believe investors – including central banks – will face an increasing set of geopolitical concerns, while many pre-existing ones will likely be pushed back rather than being resolved. In addition, the very low level of interest rates worldwide will likely keep stock prices high and valuations at extreme levels. And although investors may not step away from risk assets, anecdotal evidence suggests they are increasing exposure to safehaven assets like gold as a means to hedge their portfolios.”

The report pointed out that 90% of developed market sovereign debt is trading at negative real interest rates. Central bank policy is geared toward holding interest rates down and there is no indication that this is going to change any time soon. As Peter Schiff said during a recent appearance on Fox Business, bad monetary policy is good for gold.

I said the next move would be a cut and that then they would return to quantitative easing. Both of those predictions have come true. That’s what’s been powering stocks. But bad monetary policy, bad fiscal policy is much better for gold than it is for stocks.”

Globally, central banks have pivoted toward easing. In fact, the highest number of banks since the financial crisis are cutting rates and expanding or initiating quantitative easing.

According to the WGC, historically, gold’s average monthly returns have been twice as high as the long-term average when real rates have been negative.

The Outlook 2020 report also includes a detailed breakdown of economic growth scenarios and their potential impact on gold’s performance.

The results of the analysis suggest that, in general, gold may see a positive performance in 2020. Some of the scenarios – with the exception of an economic upturn in emerging markets – could result in lower consumer demand. But the dampening effect of consumer demand on price performance will likely be offset by potentially robust investment demand on the back of deteriorating credit conditions and stable to lower interest rates.”

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]