The Gold Market Is Strong With the Potential for Growth

Gold is the third-most consistently bought investment globally.

This was just one of many findings in the World Gold Council’s recently released consumer research report that revealed a strong global gold market with the potential for future growth.

Globally, there are clear perceptions of gold as a safe, durable, traditional store of value. As an investment, it plays to these strengths – retail investors buy it to protect wealth and create long term returns. Jewelry buyers treasure it for sentimental reasons and as a reward for success.”

The WGC surveyed 18,000 people in countries around the world, including China, India, North America, Germany and Russia, to gain insights on their attitudes and perceptions of gold, how and why they buy gold and their reasons for not buying the yellow metal.

World Gold Council CEO David Tait said the gold market is strong and had the potential to get even stronger.

The retail gold market is healthy, with gold being considered a mainstream choice. But what really excites me is the untapped part of the market: those people who have never bought gold but are warm to the idea of doing so in the future.”

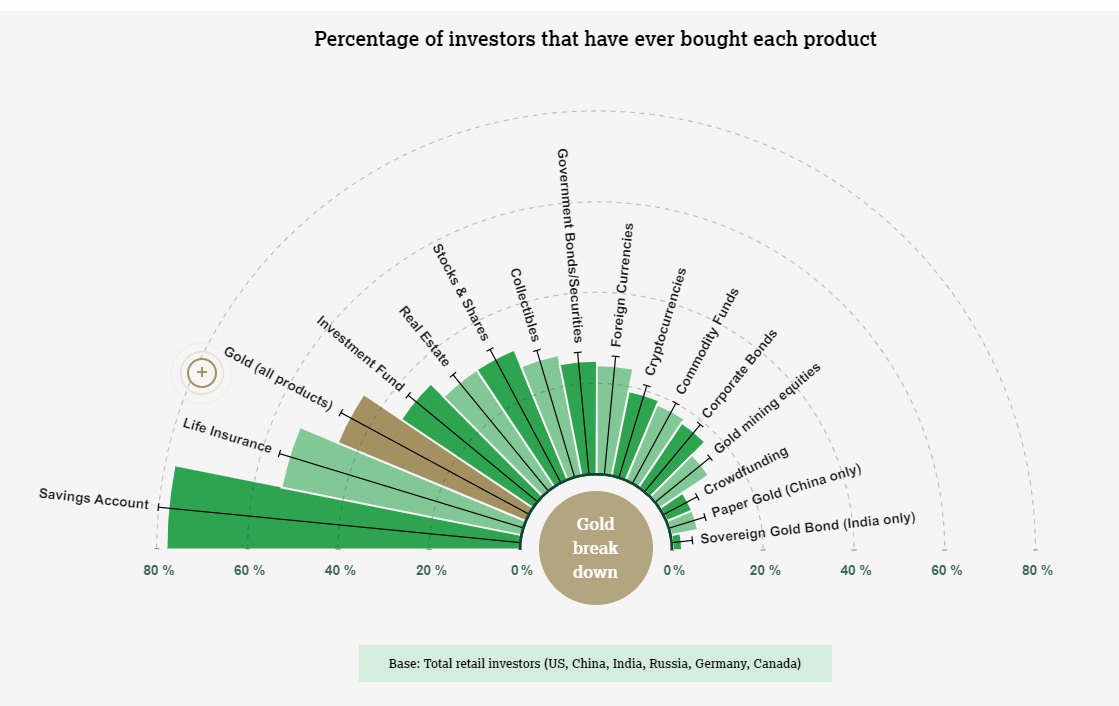

According to WGC research, 46% of global retail investors include gold products as part of their portfolios. This ranks only behind savings accounts (78%) and life insurance (54%).

The gold jewelry market is also strong with 56% of consumers having bought fine gold jewelry. That compares to 34% who have bought platinum jewelry.

There is also the potential for growth in both markets. Thirty-eight percent of retail investors and fashion enthusiasts have never bought gold in the past but are warm to the idea.

This shows a huge potential for the gold market to grow if untapped sources of demand can be converted.”

“Two issues need to be addressed to engage with these potential gold buyers: trust and awareness,” Tait said. “This market can flourish if we can build trust across the broad spectrum of gold products being sold and raise awareness around the positive role gold can play in protecting people’s wealth.”

The research revealed five key themes.

- People have confidence in and are loyal to gold. More than two-thirds (67%) of all retail investors believe that gold is a good safeguard against both inflation and currency fluctuations, and 61% trust gold more than fiat currencies.

- There are pockets of mistrust among those who have not bought gold, but who are open to future purchases. This primarily revolves around the worries about counterfeit gold, product purity and the trustworthiness of some retailers.

- Gold resonates among young consumers. Millennials’ attitudes about gold are very similar to those of older generations.

- Technological innovation can expand the gold market. Improvements in areas including digital distribution, marketing and communications can attract new buyers. Globally, only about 9% of gold coins are bought online. About 6% of jewelry purchases happen in the digital realm. That compares to about 25% of gold ETFs.

- There are knowledge gaps to be filled. The survey found that (66%) of potential gold consumers globally say they lack the necessary knowledge to buy gold. The gold industry needs to make better use of TV, print and social media to educate consumers about the yellow metal.

Overall, the research paints a positive picture of the state of the global gold market and reveals the potential for future growth.

Gold creates a feeling of safety and security. The majority of retail investors and fashion and lifestyle consumers trust gold more than the currencies of countries.”

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]