The Economy Is Great? American Consumers Aren’t Buying It

Every time the folks at the Federal Reserve talk about the “Powell Pause,” they assure us that the US economy is still strong. The president assures us that the US economy is still strong. The pundits on the financial news networks assure us that the US economy is still strong. But the US consumer doesn’t seem to be buying it.

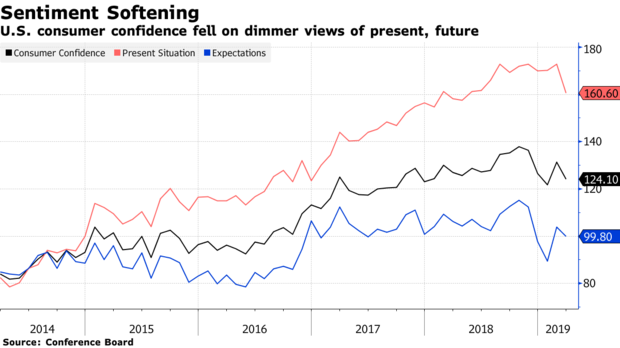

US consumer confidence declined for the fourth month out of five in February, surprising economists who expected an increase in optimism.

The Conference Board’s consumer confidence index fell from 131.4 to 124.1. This missed every economist’s estimate in a Bloomberg survey. They were expecting a rise to 132.5. Meanwhile, consumers’ views on the present situation fell to the lowest level in almost a year, and the expectations index weakened as well.

The consumer confidence numbers come even as a major recession warning sign is flashing. Last week, the yield curve inverted. The yield on 10-year Treasurys fell below the yield on 3-year bonds for the first time since 2007 – the cusp of the Great Recession.

Peter Schiff has been saying a recession is a done deal for quite some time. Economist Marc Faber says we’re probably already in a recession. Perhaps American consumers are figuring it out. As Bloomberg put it “dimmer assessments of present conditions suggest that weak first-quarter growth and slower job gains in February are weighing on attitudes and potentially spending.”

According to Bloomberg, the weak February jobs report likely shook consumer confidence. The economy added just 20,000 jobs last month. There are also concerns about rising gasoline prices “leaving Americans with less power to spend on other goods and services.”

There are other gloomy numbers out there that we’ve reported, including rising wholesale inventories, high levels of consumer debt, and skyrocketing federal budget deficits.

Interestingly, the economists Bloomberg quoted tried to slap some lipstick on the pig, saying that consumers are overreacting.

“While economic conditions are likely to moderate this year –- meaning we’ve passed peak confidence for the cycle — this month’s slump is too severe when measured against underlying conditions.”

This underscores a point Peter made in his podcast earlier this week. The markets and the pundits still haven’t caught on to what’s going on. The Fed is giving us every signal we need. It has done a complete 180 on monetary policy. But it’s not telling the truth about why. It’s making excuses. It’s talking about a global slowdown and muted inflation. The truth is given the enormity of these deficits and the ever-upward spiraling debt, the Fed has no choice but to call off the tightening. You can’t raise interest rates in an economy built on piles of debt. But the Fed can’t tell the markets that, and at this point, the markets haven’t figured it out. Peter said they don’t really want to.

They don’t want to admit I was right from the beginning – that the Fed checked us into a monetary roach motel and there’s no way to ever check out. But I do believe the markets are going to figure this out, whether the Fed admits it or not – during the next recession.”

The recent drop in consumer confidence indicates the American public might just be a step ahead of the markets.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]