Taxpayers on the Hook for Nearly Half of Apartment Building Mortgages

This is not the ideal time to own an apartment building. Millions are struggling to pay rent and despite the extension of the federal eviction moratorium through Jan. 31 in the latest stimulus bill, a lot of people will likely face eviction in the coming months. According to data released in November, 17 million households are behind on rent or mortgage payments.

Of course, this has a trickle-down effect. If renters can’t pay their rent, that makes it difficult for apartment building owners to keep up with their mortgage payments. If they default, who’s on the hook?

Increasingly, the US taxpayer.

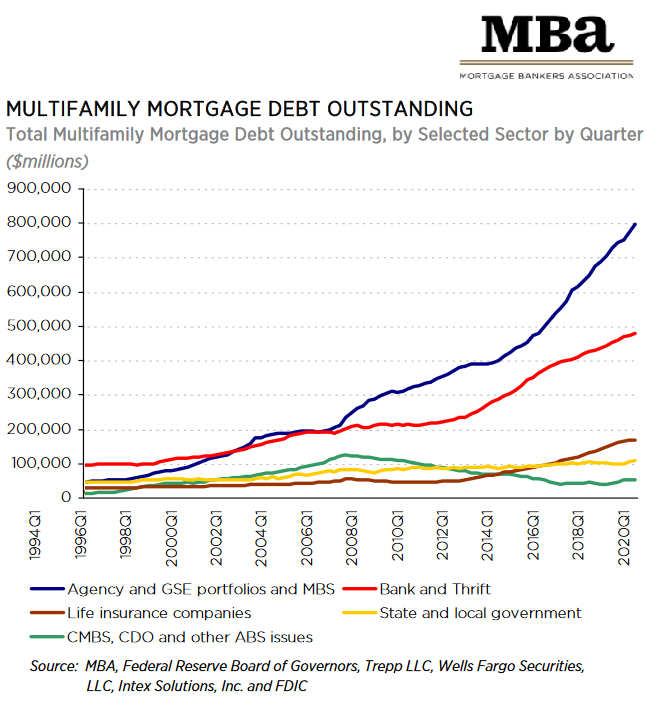

Total outstanding mortgages on multifamily housing property stood at $1.65 trillion in Q3. That was up by about $31 billion from Q2, according to data compiled by the Mortgage Bankers Association. Of that amount, the federal government backs $798 billion. That’s 48.4% of all mortgages on multifamily properties.

Uncle Sam backs these loans through Government Sponsored Enterprises (GSEs), such as Fannie Mae and Freddie Mac, along with government agencies such as Ginnie Mae. GSEs often securitize these loans into commercial mortgage-backed securities (CMBS) that are sold to investors. This practice with single-family home mortgages led to the housing crisis in 2008.

In simple terms, government-backed means that the US taxpayer is ultimately on the hook for any losses.

The US government got into multifamily real estate debt during the 2008 financial crisis. According to WolfStreet, up to that point, government-backed multifamily debt was about on par with the holdings of banks and thrifts. Since then, the government’s share (blue line in the chart below) has shot up to nearly 50%.

At this point, apartment building owners are holding on by the skin of their teeth, hoping the pandemic relents and the economy improves. If not, we could see a lot of mortgage defaults on the horizon. The situation is particularly dire in big cities where there is an exodus of people and plunging rents. As WolfStreet put it, “Landlords anywhere afflicted by renters not making rent payments, protected by eviction bans, are still trying to make mortgage payments on their rental properties, hoping that the surge in vacancies and non-payment of rents are short-term phenomena and that people will come back and fill those apartments and that tenants will catch up with the rent.”

If not, taxpayers will once again be left holding the bag.

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […] The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.

The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.