Student Loan Bubble Just Keeps Getting Bigger

Based on the latest data, the student debt crisis in America isn’t about to end any time soon.

US household debt climbed to a record $13.54 trillion in the fourth quarter of 2018. Student loan debt makes up a sizeable chunk of that total. In fact, student loan debt now ranks as the second-largest consumer debt category, trailing only mortgages.

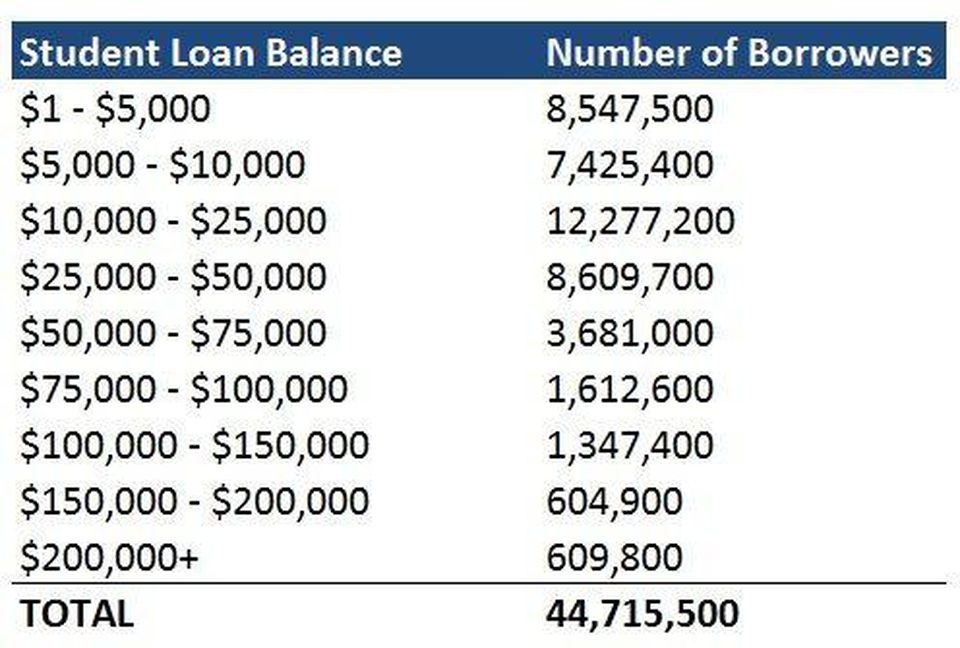

More than 44 million American student loan borrowers owe nearly $1.5 trillion, according to statistics compiled by Zack Friedman for an article published by Forbes. Students who graduated from college in 2017 left school with an average debt of $28,650, according to the Institute for College Access and Success.

The vast majority of student loan borrowers owe less than $100,000, but 2.5 million Americans owe more than $100K, and 610,000 borrowers have run up more than $200,000 in student loan debt.

Crushing student loan burdens mean millions of Americans launch into adulthood already trying to dig themselves out of a financial hole. Defaults are on the rise and student loan debt is one of the biggest factors driving a growing trend of millennials struggling to transition into adulthood. Consider that the average student loan borrower pays $351 per month to service those loans.

This creates a tremendous drag on the economy. Every dollar spent paying off loans is a dollar not available to buy houses, cars or put into savings. Parents are even beginning to feel the squeeze.

And a lot of these borrowers struggle to pay their bills. A whopping 11.4% of aggregate student debt was 90+ days delinquent or in default in 2018 Q4. Over $101 billion in student loans held by 5.1 million borrowers are in default (360-days delinquent). Another 2.6 million borrowers are not paying on their loans because they have been granted temporary forbearance.

Keep in mind, American taxpayers ultimately hang on the hook for the vast majority of these loans. In a speech late last year, Education Secretary Betsy DeVos revealed just how significant the level of student debt has become, noting that it comes with “significant risk.”

At 1.5 trillion dollars, FSA’s loan portfolio is now one-third of the Federal government’s balance sheet. Last year, uncollateralized student loans—which are all of them, by the way—accounted for over 30 percent of all federal assets. One-third of the balance sheet. Only through government accounting is this student loan portfolio counted as anything but an asset embedded with significant risk. In the commercial world, no bank regulator would allow this portfolio to be valued at full, face value. Federal Student Aid has a consumer loan portfolio larger than any private bank. Behemoths like Bank of America or J.P. Morgan pale in comparison. FSA also is the largest direct loan portfolio in the whole Federal government—by far—surpassing all other federal direct loans combined by 1.1 trillion dollars.”

DeVos admitted that the spiraling level of student debt has “very real implications for our economy and our future.”

The student loan program is not only burying students in debt, it is also burying taxpayers and it’s stealing from future generations.”

The student loan mess is yet another bubble created by government.

And like all bubbles, it will eventually pop.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]