Starting With a Bang: US Government Kicks Off Fiscal 2022 With Another Massive Deficit

The US government started fiscal 2022 the same way it ended fiscal 2021 — spending itself into a massive budget shortfall.

The budget deficit for October came in at $165.1 billion, according to the most recent monthly Treasury statement.

This comes on the heels of the second-largest annual budget deficit in history. Uncle Sam spent $2.77 trillion more than he took in during fiscal 2021.

Of course, the spending isn’t slowing down.

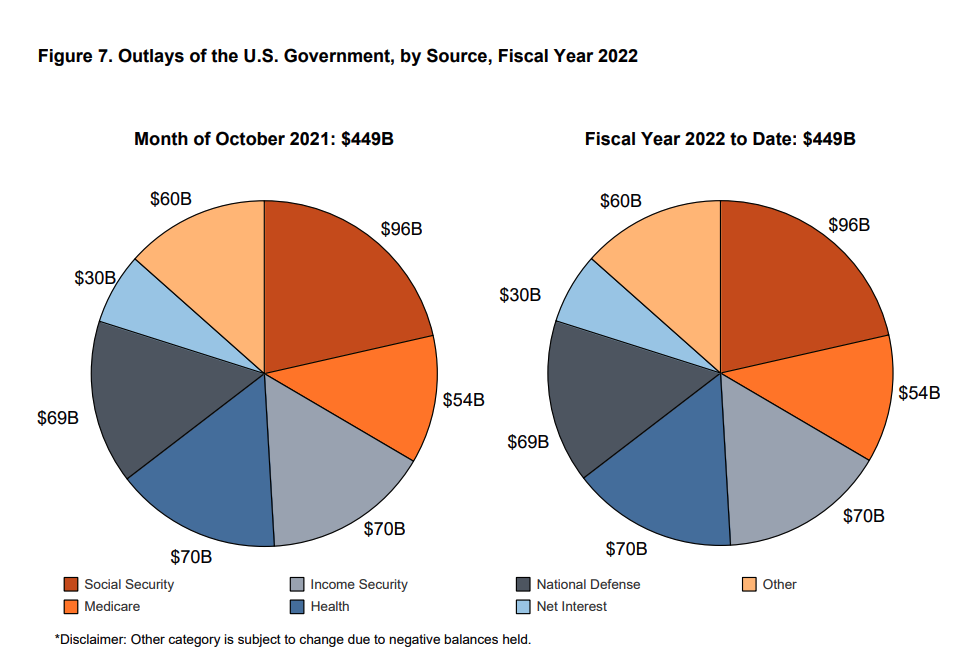

The Biden administration blew through nearly half a trillion in October. Spending came in at $449 billion. That represented 36.8% of total expenditures for the month.

Government receipts totaled $284 billion in October.

As of Nov. 10, the national debt hovered just shy of $29 trillion at $28.91 trillion.

The US government added $480 billion to the debt in October after Congress passed a bill increasing the federal debt ceiling by that amount. The federal government has already run up against the new borrowing limit. It can limp along with the current ceiling in place temporarily using “extraordinary measures.” Uncle Sam will reportedly run out of money in early December.

Congress will almost certainly run the debt ceiling saga to the brink, but it will undoubtedly raise the spending limit. When it does, the Treasury Department will go on another massive borrowing binge.

And there is no end in sight to the spending. Congress has already passed a massive infrastructure bill and it continues to haggle over the “Build Back Better” bill. Supporters of these big spending plans promise tax increases and government savings will “pay for” the spending. But it’s almost certain tax receipts will fall short of projections and spending will be even higher than budgeted. That’s hove government always works.

This raises an important question: how will the Treasury Department continue to borrow at this pace with the Fed tapering its bond purchases? In an interview on RT Boom Bust, Peter said it can’t. The Fed will “back the truck up” and do even more quantitative easing.

The Fed is going to have to expand its asset purchase program to buy up all these bonds that are going to be sold to finance all this spending.”

This doesn’t bode well with inflation already sizzling hot.

According to the National Debt Clock, the debt to GDP ratio is 125.94%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt to GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

Every American citizen would have to write a check for $86,985 in order to pay off the national debt. That’s $164 more than last month.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]