Silver Mine Output Drops for Second Straight Year; Industrial Demand Up

Global silver mine supply dropped for the second straight year as industrial demand rose for the first time since 2013, according to the World Silver Survey 2018 produced by the GFMS team at Thompson-Reuters and released by the Silver Institute this week.

Industrial demand for silver rose 4% to 599 million ounces last year. Solar panel fabrication primarily drove the growth. Photovoltaic demand climbed 19% as solar panel installations worldwide rose 24%. Brazing alloy and solder silver fabrication also increased, rising about 4%.

The surge in electronics, most notably in semiconductor fabrication demand, led to the electrical and electronics segments delivering the first annual increase in offtake in this category since 2010, with 242.9 Moz consumed last year. Silver demand for the production of ethylene oxide retreated by a third from 2016 volumes to 6.9 Moz, mostly due to a decline in new installations. GFMS estimates that silver’s use in photography, which fell by 3 percent last year to 44.0 Moz, appears to have stabilized, with renewed interest in various photographic applications utilizing silver, only falling marginally over the last few years.”

Even with the healthy increase in industrial consumption, overall demand for silver fell slightly in 2017 due to weakness in the investment sector. Total demand came in at 1017.6 million ounces, a 2.3% decrease from 2016.

Silver bar and coin demand plummeted to 151.1 million ounces from 205.0 million ounces the year before. Identifiable investment, consisting of net-physical bar investment, the purchase of coins and medals, and net-changes to exchange-traded product (ETP) holdings, reached 153.5 million ounces last year, a 40% decline from the previous year. This was primarily driven by a 35% drop in coin and medal fabrication, led by lower demand in the United States, Canada and China.

Physical bar demand slipped by 16% in 2017.

Silver jewelry demand increased 2% last year, pushed upward by strong North American buying. The US posted a 12% rise to an all-time high. Silver jewelry sales in India also posted a 7% gain over 2016 volumes.

Shrinking Supply

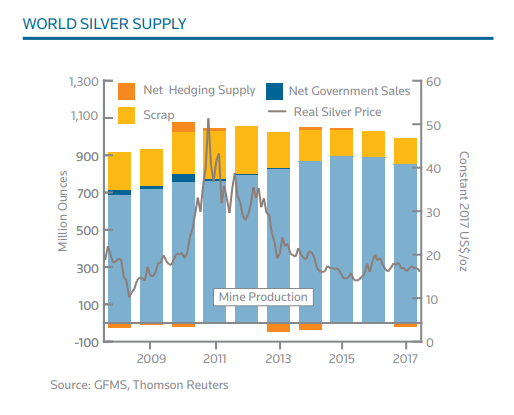

Global silver mine production fell by 4.1 percent in 2017. It was the second straight year of declining mine output.

Of the key producing countries, Peru and China registered subtle dips, followed by more acute losses in Australia and Argentina. Offsetting those losses was higher output from Mexico, which was once again the world’s top silver producing country, trailed by Peru, China, Russia and Chile.”

Supply from primary silver mines decreased by 9% last year, contributing 28% of total mine supply. The lead/zinc sector contributed 36% of by-product output, followed by copper at 23% and gold at 12%.

Silver scrap supply also dropped, falling to 138 million ounces. It was the sixth straight year of declining silver scrap supply.

Overall, the silver market saw a net physical surplus deficit of -35.2 million ounces.

Many analysts think silver is set for a breakout. The silver-gold ratio remains historically high. This means silver is undervalued compared to gold. Currently, the silver-gold ratio stands over 80 to 1. This means you can buy 80 ounces of silver with one ounce of gold. Compare that with the historic average ratio which hovers around 16:1. The modern average over the last century is around 40:1. As Peter Schiff said in a video last year, “This is silver on sale.”

The Silver Institute World Silver Survey indicates the fundamentals look good in the silver market. Earlier this year, analysts at the Silver Institute said they expect strong demand in 2018 in an environment of tightening supply.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]