Report: Increasing Global Risk Highlight’s Gold’s Relevance

On Oct. 10, the IMF released its Global Financial Stability report, highlighting increased levels of risk revealed by a number of global metrics. Just after the report was released, stocks in the US, Europe and Asia lost 4%, 3% and 4% respectively over three days.

As a recent investment update released by the World Gold Council points out, although stocks rebounded and regained some of those losses, the IMF report and subsequent market pullback “underline the relevance of holding gold in the near and long term.”

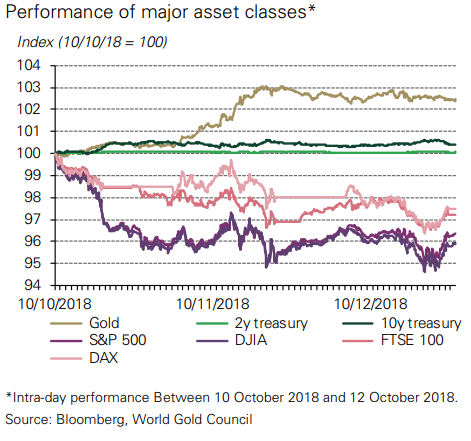

As the WGC update points out, gold broke higher as stocks retreated.

Gold acted as a key flight-to-safety asset in the market. Initially, as the US market retreated, gold held steady. But as the sell-off became more systemic globally, gold began to rally meaningfully.”

Peter Schiff has said a recession is obviously coming. The recent bounce in gold with the stock market drop indicates gold could have tremendous upside once the economy really starts to spiral downward.

The WGC report noted the recent bearishness on gold and the headwinds created by a stronger dollar. But the report said that sentiment may be tested in the near future. It pointed out that we’ve seen record short positioning in gold markets. According to the WGC, money managers’ net shorts are near record lows since data became available in 2006. And while the WGC says the headwinds have been warranted, the increasing instability in global markets is bullish for gold.

As the IMF signaled in its 2018 Global Financial Stability Report, an increase in commonly used metrics of risk highlight the relevance of including gold in a portfolio both for the near and long term – from a tactical and strategic perspective.”

The World Gold Council Report also highlights the problems in emerging markets.

Developed market (DM) countries have thrived while EM ones have struggled. In part, this has been driven by rising rates led by a Fed tightening stance with the potential to lead to inflation. Additionally, out of all the major economies, the Fed is hiking steadily … This has led to outflows from EMs and a stronger dollar. In addition, there have been specific concerns about some EM countries, such as weakness in China and broader market concerns in Turkey and Argentina. While some of this weakness has affected other EM countries, continued softness could spill over to DM countries, increasing the likelihood of global systemic risk.”

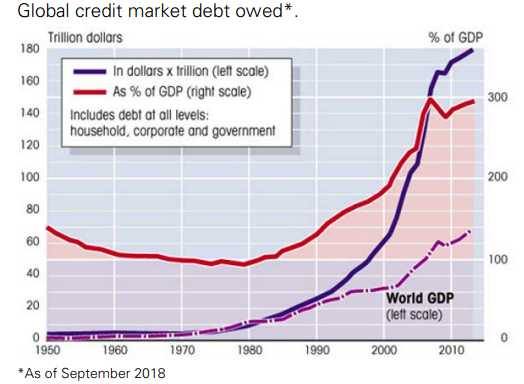

The WGC report also hit on a subject we’ve been hammering in recent months – global debt has exploded.

Debt has exploded over the past ten years with various forms of quantitative easing across the globe. Non-financial debt in jurisdictions with systemically important financial sectors has grown to over 200% of GDP and, with rates rising, could become more and more costly to repay, putting a strain on country health.”

On top of that, US stock valuations are at their highest level since the dot-com bubble burst and higher than they were on Black Monday.

Based on the report, this might be a good time to buy gold.

While there have been headwinds for gold over the past six months, there are clear reasons, based on the IMF’s most recent report, for gold to move upwards. The global economic recovery has been uneven, hurting EMs; complacency has crept into the market, questioning liquidity; market valuations are at extreme levels; debt has grown substantially globally, and increased tightening could hurt markets. All these factors, either individually or in combination, could be catalysts for a risk-off environment that could propel gold higher.”

As Peter said in a recent video, the sale we’ve been having in gold for years is about to come to an end.

If you’ve been thinking about buying more gold or more silver, stop thinking and start buying. If you don’t own any gold or silver, what are you waiting for? You’ve got to buy it because the prices are going to start to go up a lot faster. And once it really goes, it’s going to leave a lot of people behind.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]