Puerto Rico Default Is Coming and It’s Just the Tip of the Iceberg

Good morning Puerto Rico. Default is coming.

Legislation moving in Congress would set up an oversight board to guide the US territory through what essentially amounts to bankruptcy. It would not expend federal funds to bail out Puerto Rico, but would allow the island’s government to pay back debtors at less than 100%.

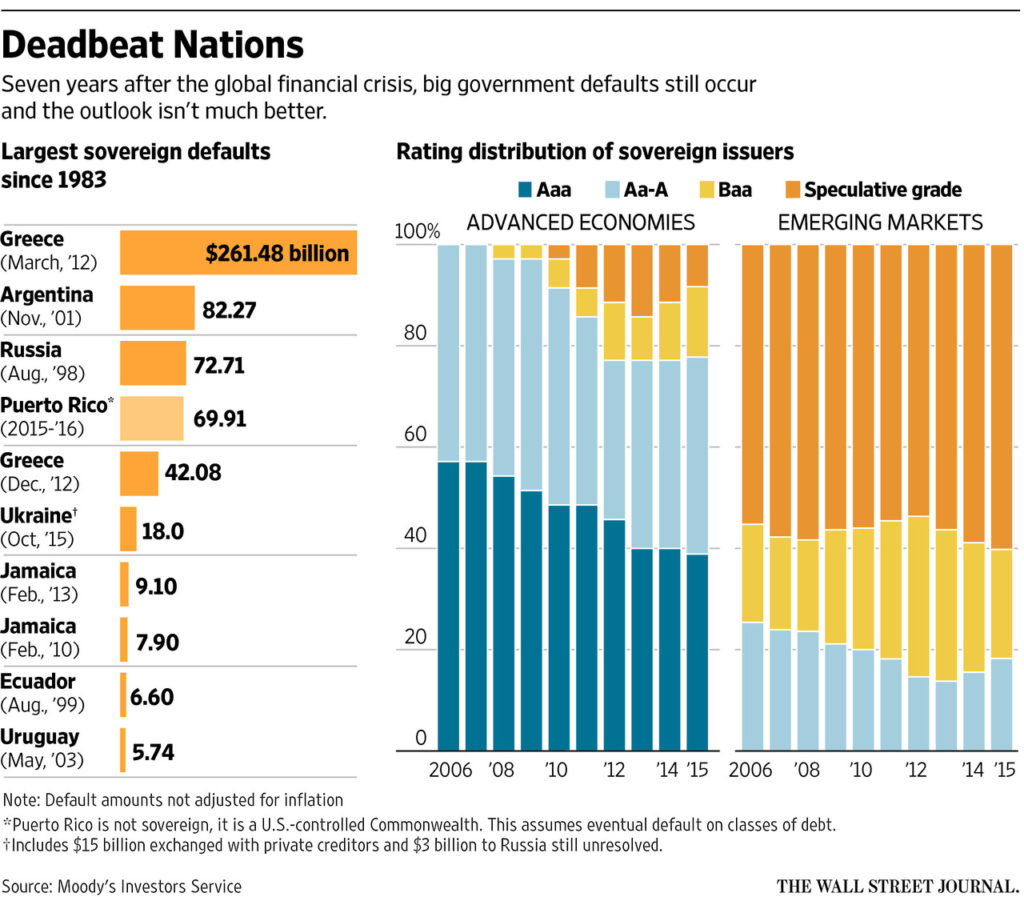

This is just a taste of things to come.

A default was unthinkable just a couple of years ago. The national obligation to repay what it owes was once considered almost sacrosanct. In 2013, Puerto Rico Gov. Alejandro García Padilla said paying back all of its debt was not only constitutional, but “a moral obligation.”

Times have changed, as the Wall Street Journal points out:

Though markets have met the event with a shrug, that shouldn’t diminish the significance of the moment. It underlines how much the stigma about government default has faded. Investors would be wise to build this risk into their calculations when lending to governments from now on, especially since arithmetic suggests more defaults are on the way. With less moralizing and more planning, both creditors and debtors will be better off.”

Investors have long-considered sovereign debt a “safe” investment. But in a sense, they were ignoring reality. Loaning anybody money carries with it some level of risk. A guarantee to repay is only as good as economic realities surrounding it:

The idea that repayment of debt is a moral obligation irrespective of cost has deep cultural resonance. Yet it has never been a good guide to reality. Even without access to formal bankruptcy, every heavily indebted country weighs the cost of repaying debt against the loss of confidence and creditworthiness that default entails. Promises, even those embedded in laws and constitutions, are always subject to economic facts on the ground.”

Subscribe to Peter Schiff’s Gold Videocast

Of course, investors and hedge fund managers are crying foul. They want bailouts because they don’t want to be left holding the bag. But as Peter Schiff has pointed out, they took on that risk. They should pay – not innocent taxpayers:

The bailout wouldn’t help Puerto Rico. It would enrich all of the hedge fund speculators who bought up that Puerto Rican debt for pennies on the dollar. What’s the point of using taxpayer money and funneling it to hedge funds through Puerto Rico? All Puerto Rico needs to do is restructure… Why impose the losses on American taxpayers? Impose them on the people who were dumb enough to buy those bonds. Don’t allow them to use their political connections to rip off the American taxpayer.”

Peter’s comments hint at a deeper truth. A system guaranteeing repayment with absolute certainty creates perverse incentives. Governments always have access to “easy money.” And then they do what governments do – squander it based on political calculations. That’s exactly what happened in Puerto Rico. Flush with cash, the government went on a spending spree. It ran up its total debt to $118 billion, or 172% of gross national income. Now it’s time to pay the piper.

Ironically, the hedge fund investors knew what they were getting into according to the WSJ:

It’s hard to know what is less sincere: the original pledge or creditors’ claims to have trusted it. The prospectus accompanying the 2014 issue listed 14 pages of risk factors, including this one: ‘New legislation could…entitle the Commonwealth to seek the protection of a statute providing for the restructuring, moratorium and similar laws affecting creditors’ rights.’ The buyers, mainly hedge funds, knew they were getting an 8.7% yield, 5.5 percentage points more than top-rated Maryland offered, by assuming a high risk of default.”

They probably assumed Uncle Sam would ultimately bail them out. Looks like that’s not going to work out so good for them.

This isn’t just about Puerto Rico. The rest of the world is heading in the same direction. Just look at all the debt the US government has run up. It’s not sustainable. So, buyer beware.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

American taxpayers did not bail out the Big Housing Fraud Banks and Financial Corps, nor will they be on the “Hook” for any other”default.” Because the U.S. is the ad hoc issuer of its own non-convertible, fiat currency it can never, involuntarily, default. This is irrefutable.

The term “taxpayer funded” is wrong, irresponsible, misleading, cynical and meaningless in the context of the U.S. government needing to pay its bills/debts or other legal obligations such as pensions, health care, education, defense, transportation, research, etc.

One need only go back to 1946 for supporting evidence from the then Chairman of the New York Federal Reserve Bank, Mr. Beardsley Ruml. Ruml wrote a seminal paper on tax policy, “Taxes for Revenue are Obsolete”, published in a periodical named American Affairs.

http://goo.gl/a5zMg6

While Ruml was writing about the merits of corporate taxes, it is his discussion about how the function of taxes changed after the nation exited the gold standard that make this a must read. As Ruml’s stated, with an “…inconvertible currency, a sovereign national government is finally free of money worries and need no longer levy taxes for the purpose of providing itself with revenue… It follows that our Federal Government has final freedom from the money market in meeting its financial requirements…

All federal taxes must meet the test of public policy and practical effect. The public purpose which is served should never be obscured in a tax program under the mask of raising revenue.”

He goes on to explain how, with Federal spending not revenue constrained, the first function of taxation is to regulate the value of the dollar, which we know as regulating inflation. The notion of the Federal government ‘running out of money’ and ‘dependence on foreign borrowing’ as well as ‘sustainability’ is categorically inapplicable.

Do away with the Jones act, and other old

laws that are hurting the island.One time

helping hand.

One day dollar will loose reserve currency status and then what? Big Bang.

You can’t live forever for free .

Your argument despite its depth is fraught with falicy. American taxpayers are always on the hook, as the government is funded through taxing the populous.