Pension Systems Pushing Some States Toward Bankruptcy: Where Does Your State Rank?

Recently, we reported on the rapid collapse of pension systems, both public and private, across the United States. This is not only jeopardizing Americans’ retirement. Failing government pension systems are pulling several states down into a black hole with them.

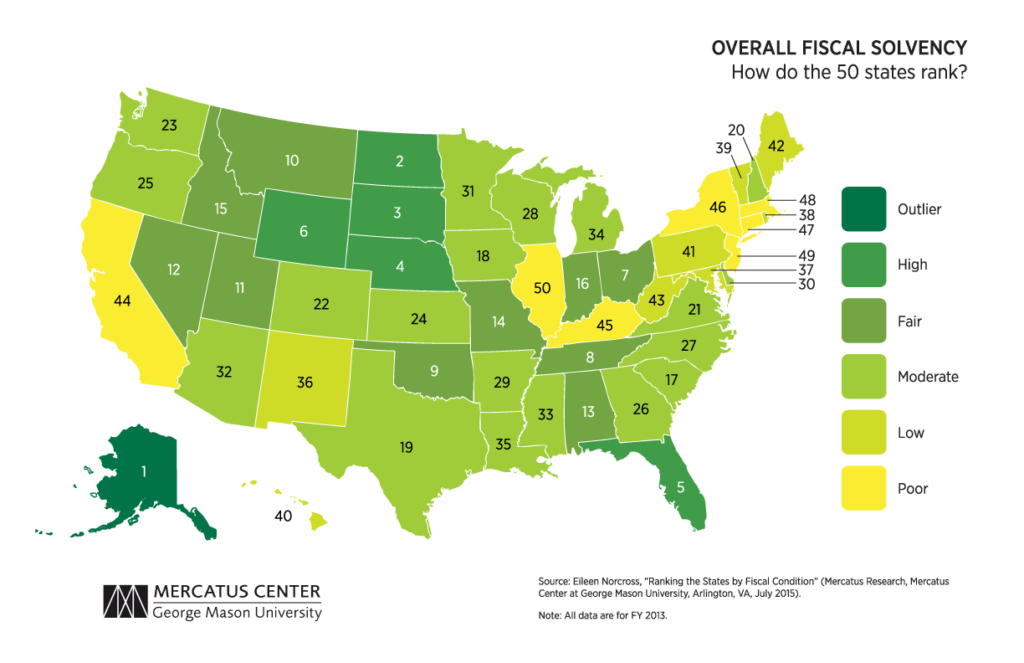

When we talk about government debt, we tend to focus on the US national debt. But a lot of states are deep in the red as well. A George Mason University study highlighting the most bankrupt states reveals an interesting commonality – a pension crisis. Topping the list: California, Kentucky, New York, Connecticut, Massachusetts, New Jersey, and Illinois.

Download Free: SchiffGold’s Guide To Tax-Free Gold & Silver Buying

The study ranked the states based on how well they can pay their short-term bills, their budgets, their ability to meet future commitments, their ability to accommodate an increased demand for services, and their debt levels. In all, 30% of US states received low or poor grades. These states have little cash on hand to cover short-term bills, struggle to balance their budgets, and are burdened by unsustainable long-term expenses.

The states in the worst financial shape also share the problem of underfunded pensions. Illinois, Connecticut, and Kentucky actually have less than half of their pension obligations funded. According to a Pew Research report released last year, state pension systems overall are short $968 billion. When you included debts from local programs, the number eclipses $1 trillion. The impending collapse of the country’s pension systems is not only turning many Americans’ retirement dreams into nightmares, it is also jeopardizing the country’s economic stability.

In fact, the extreme debt load in America today is one of those underlying economic fundamentals that simply can’t be ignored. These nearly bankrupt states serve as a vivid reminder of the impact of debt – personal, corporate, and national. It is the giant elephant in the room that is eventually going to rampage.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 FREE and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Being from Long Island, seeing New York ranked #46 is surprising since our local pols always say the NY pension system is well funded. I’m sure its those six-figure police and school pensions that are dragging it down.

This is simple math confounded by simpleton minds (politicians and government employees). The right thing to do is adjust benefits (down) and increase the retirement age now. Yes, this will upset a lot of people but it’s either that or go down with the ship. It’s better to live and fight another day. The problem is….swallowing the bitter pill won’t happen because a) politicians don’t have huevos, b) we haven’t taxed citizens and corporations at 110% yet….c) it’s all about “me” which means all of the “retirees” (people, like me, in their early 50’s) will revolt (see point a), and d) the states will look to the Fed and related politicians (see point a again) to print the dough. We’re hosed.