Nearly 40% of S&P 500 Stocks Already in Bear Territory

Peter Schiff has mentioned before that about 25% of the stocks listed on the S&P 500 have already slipped into bear market status. A recent article published by ZeroHedge confirmed what Peter said, and further indicated that a big chunk of the stocks in the index appears to be in trouble.

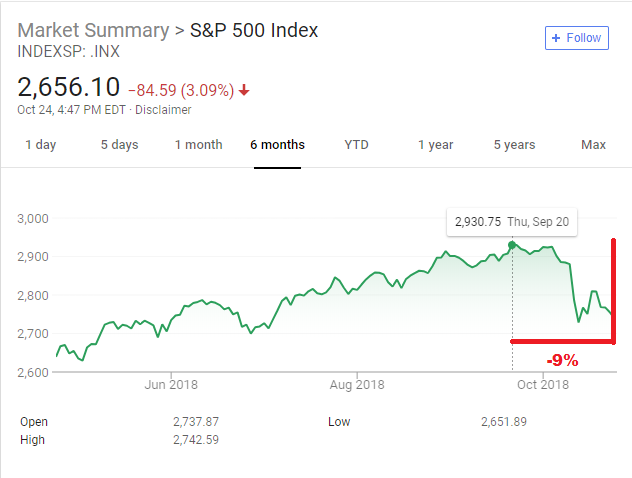

The S&P 500 dropped nearly 85 points on Wednesday, a 3.09% decline. The index has fallen over 9% from its September highs.

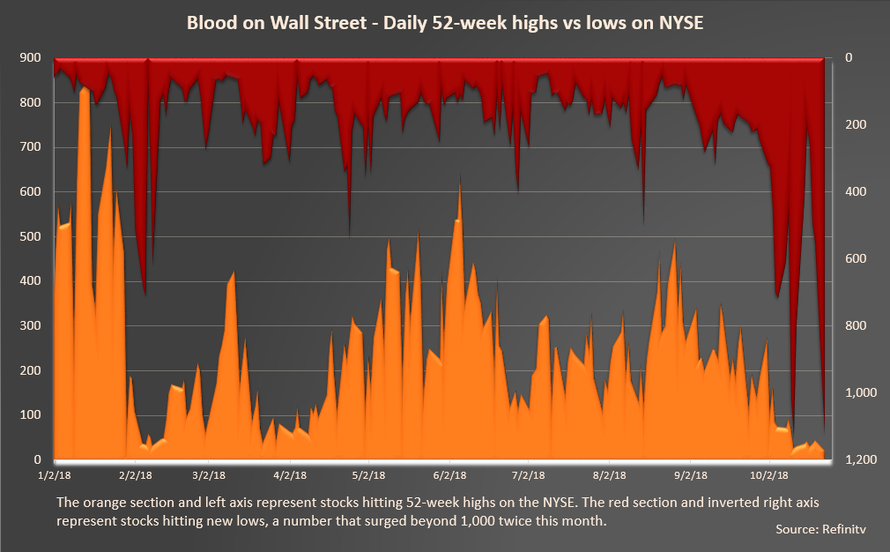

That’s pretty gloomy, but when you look at individual stocks within the broader marketplace, things look even worse. According to ZeroHedge, some 1,256 stocks on the New York Stock exchange hit 52-week lows with only 21 establishing new highs.

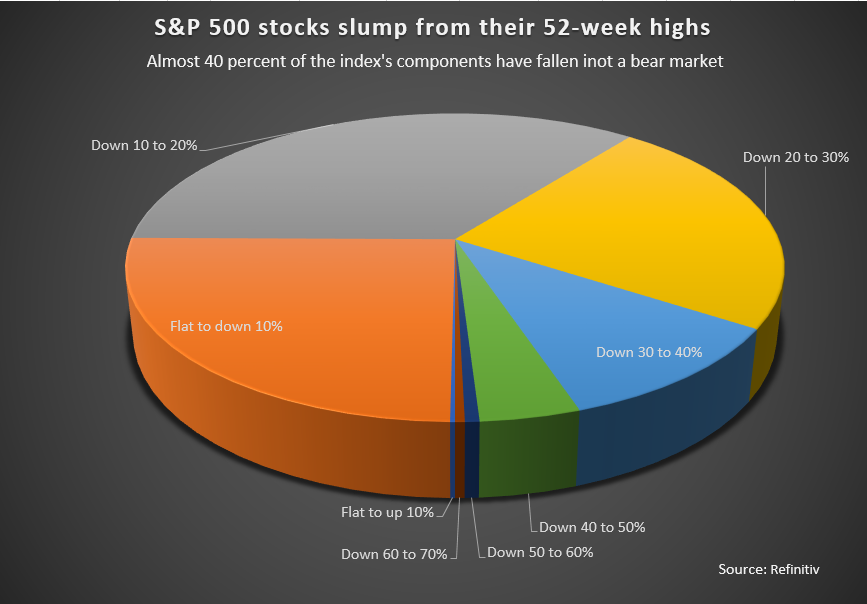

The S&P is teetering on the edge of correction territory (a 10% decline), but when you look at individual stocks in the index, more than 3/4 have already entered a correction, according to the ZeroHedge report.

More than three-quarters of all S&P stocks – or 353 – have already fallen more than 10% from their highs. Worse, of those, more than half 179 have already fallen by 20% or more from their highs, entering a bear market.”

With the most recent declines, things have deteriorated even further since Peter pointed out the number of S&P stocks already in a bear market earlier this month.

So, with all of these stocks already in correction territory, why hasn’t the S&P500 slipped below that threshold? In essence, a handful of stocks have buoyed the broader index.

Apple, whose $1 trillion market value makes it by far the most heavily weighted stock within the S&P 500, has fallen only 4.6% from its October 3 record high. That has helped the S&P 500 itself stay out of correction territory.”

Peter has said, “the recession is obviously coming.” But the mainstream still seems pretty ambivalent, despite the recent market selloff. In the midst of the first big drop in stocks earlier this month, a White House official said, “This is a bull market correction. It’s probably healthy. This will pass and the US economy remains strong.” Everybody is saying this is just a normal correction in a normal bull market. But as Peter said, this isn’t a “normal” market.

This bull market is already the longest bull market ever. So, based on duration, it ain’t normal. Also, based on all the stimulus that was required to create it — all the quantitative easing, the years of 0% interest rates — there is nothing normal about this bull market. If anything, it’s a bubble.”

And if it’s not a normal bull market, why would it have a normal correction? On the contrary, it seems more logical to think that a massive selloff in an abnormal bull market might be the beginning of a bear market.

Since it’s long overdue, why would you just assume that it’s a correction when we’re so overdue for a bear market?”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […] The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.

The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.