Most US States Drowning in Red Ink

The federal government isn’t alone drowning in debt. Most US states don’t have enough money to pay their bills either.

That was the conclusion of the Truth in Accounting annual State of the States 2018 report. According to the report, American states have racked up $1.5 trillion dollars in unfunded state debt. Much of the red ink is related to pension plans and retiree benefits

States, in general, do not have enough money to pay all of their bills. Based on our latest analysis, the total unfunded debt among the 50 states increased by $53.4 billion to more than $1.5 trillion in FY 2017. Most of this debt comes from unfunded retiree benefit promises, such as pension and retiree healthcare debt. This year, pension debt accounts for $837.5 billion, and other post-employment benefits—mainly retiree healthcare liabilities— totaled $663.1 billion.”

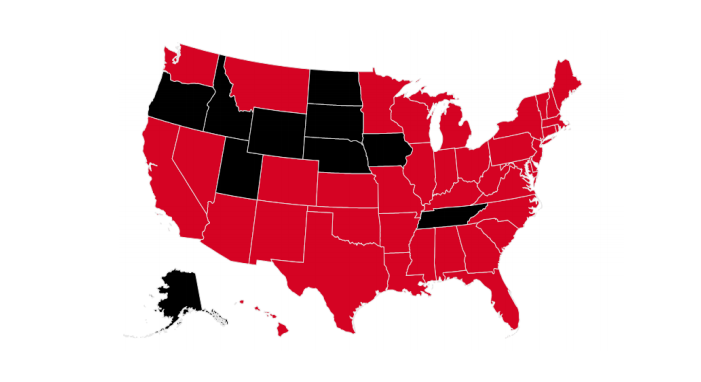

Forty of the 50 states do not have enough money to pay their bills. The report ranks the states based on their taxpayer burden. New Jersey earns the dubious distinction as the top “sinkhole state.” Each taxpayer in the Garden State is on the hook for $61,400. Connecticut ranks second with a debt burden of $53,400 per taxpayer. Illinois, Kentucky and Massachusetts round out the top five debtor states.

A few states (10) run surpluses. Alaska ranks as the state in the best fiscal condition, with an annual budget surplus of $56,500 per taxpayer. North Dakota, Wyoming, Utah and South Dakota round out the top five “sunshine states.”

Looking at percentages, 56% of US states earn a grade of D or F based on their fiscal condition according to the report. A ‘D; represents a taxpayer burden of between $5,000 and $20,000 (18 states). States with a burden of over $20,000 earn an ‘F.’ (10 states)

Ironically, every state except Vermont has a balanced budget requirement. But as the report put it, “in the world of government accounting, things are often not as they appear.” Here are some of the tricks states used as they managed to run up $1.5 trillion in debt while simultaneously “balancing” their budgets.

- Inflating revenue assumptions

- Counting borrowed money as income

- Understating the true costs of government

- Delaying the payment of current bills until the start of the next fiscal year so they aren’t included in the calculations

Underfunded pension plans by far account for the vast majority of state unfunded liabilities.

The most common accounting trick states use is hiding a large portion of employee compensation from the balance sheet and budget. Employee compensation packages include benefits such as healthcare, life insurance, and pensions. States become obligated to pay these benefits as employees earn them. Although these retirement benefits will not be paid until the employees retire, they still represent current compensation costs because they were earned and incurred throughout the employees’ tenure. Furthermore, that money needs to be put into the pension fund in order to accumulate investment earnings. If states didn’t offer pensions and other benefits, they would have to compensate their employees with higher salaries from which they would fund their own retirement.”

The bottom line is that if you’re depending on a fat government pension to fund your retirement dreams, your golden years could turn into a nightmare. As we reported about a year ago, you should probably shouldn’t assume any government pension will ever be paid.

This report highlights yet another aspect of America’s massive debt bubble that includes not only government red ink, but also corporate and household debt. extreme debt load in America today is among the underlying economic fundamentals that simply can’t be ignored. The looming pension crisis serves as a vivid reminder of the impact of debt – personal, corporate, state and national. Debt is a powder keg and it is eventually going to blow up. Are you ready for the explosion?

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]