More of the Same: Feds Run Another Big Budget Deficit in March

The federal government ran a $192.68 billion deficit in March, according to the latest Treasury statement. Somehow, this is supposed to be good news.

Bloomberg looked at this latest Treasury statement and came up with this headline: US Budget Gap Shrinks by More Than Half So Far in Fiscal Year.

Sounds good, right? Until you realize that through the first five months of fiscal 2022, the US government has already run up a $668.27 billion deficit.

Talk about putting lipstick on a pig.

Uncle Sam is on pace to run a budget shortfall of well over $1 trillion. This is with pandemic stimulus in the rearview mirror and the economy supposedly “strong.”

Prior to the pandemic, the US government had only run deficits over $1 trillion four times — all in the aftermath of the 2008 financial crisis. Trump almost hit the $1 trillion mark in 2019 and was on pace to run a trillion-dollar deficit prior to the pandemic. The economic catastrophe caused by the government’s response to COVID-19 gave policymakers an excuse to spend with no questions asked. Now it appears the government is settling back into the status-quo – running ’08 financial crisis-like deficits every year.

The bottom line is the US government still has a big spending problem.

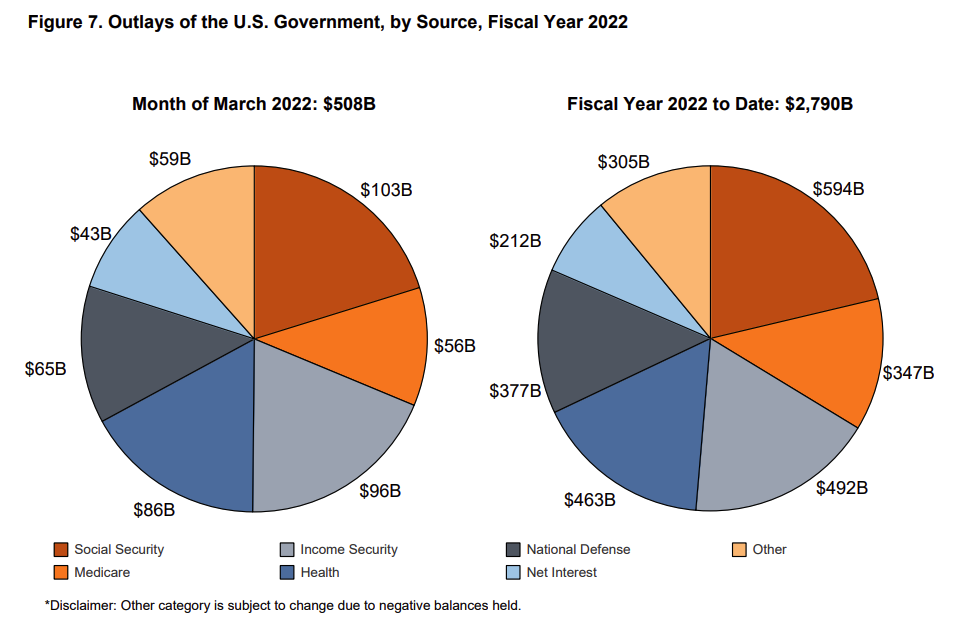

The federal government spent $507.9 billion in March alone. That brings total spending for fiscal 2022 to $2.79 trillion.

Tax receipts are up as well. The Treasury took in $315.17 billion in March, bringing total fiscal 2022 receipts to $2.12 trillion. This is helping dent the deficits, but these tax receipts will dry up quickly when there is a recession.

During the pandemic, mainstream pundits and government officials said it was the wrong time to address surging deficits. We were told you can’t worry about spending during a crisis. With the pandemic seemingly fading into history and the economy supposedly strong, you would think now would be a good time to get a handle on borrowing, spending, and debt.

You would be mistaken.

President Joe Biden wants to keep spending, and he wants to spend more. His budget raises spending on everything from domestic programs to the Pentagon.

The deficits are a big problem for the Federal Reserve as it tries to raise rates to fight inflation. This also raises Uncle Sam’s borrowing costs. The annualized interest on the US debt rose by $16.4 billion in just six months.

This raises a key question: how will the Fed shrink its balance sheet – increasing the supply of Treasuries on the market even as the US Treasury tries to sell more bonds to finance these deficits?

This quick answer is: it won’t.

The national debt currently stands at $30.37 trillion.

According to the National Debt Clock, the debt to GDP ratio is 125.58%. Despite the lack of concern in the mainstream, debt has consequences. More government debt means less economic growth. Studies have shown that a debt to GDP ratio of over 90% retards economic growth by about 30%. This throws cold water on the conventional “spend now, worry about the debt later” mantra, along with the frequent claim that “we can grow ourselves out of the debt” now popular on both sides of the aisle in DC.

To put the debt into perspective, every American citizen would have to write a check for $91,282 in order to pay off the national debt.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]