Is the Air Coming Out of Housing Bubble 2.0?

Peter Schiff put it pretty bluntly in a podcast last week. We don’t have a booming economy. We have bubbles. And it looks like the air is starting to come out of some of those bubbles. We see signs of trouble, particularly in interest rate-sensitive sectors such as real estate. As just one example, home sales in California have hit the lowest level in a decade. And it’s not just California. We’re seeing declines in many of the “most splendid housing bubbles” in America. Even more troubling is that we’re seeing these tremors and interest rates aren’t historically high.

Yet.

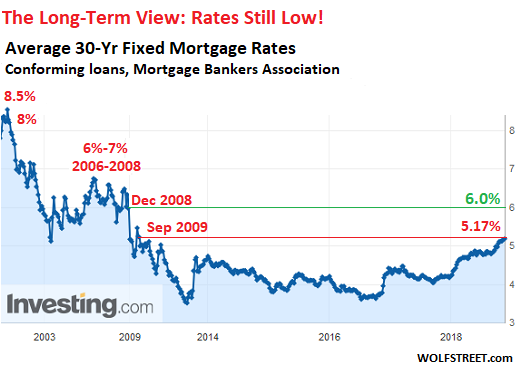

But they are rising quickly. According to an article in Wolf Street, they may soon hit 6% and that could be the real tipping point.

Mortgage rates have eclipsed the 5% level. According to the Mortgage Bankers Association, the average interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) and a 20% down-payment rose to 5.17% for the latest reporting week. That marks the highest rate since September 2009.

The next stop is 6%. As Wolf Street notes, that was the mortgage rate in December 2008.

Of course, rising rates are by design. The Federal Reserve has nudged the rate upward, and it is also shedding Treasuries and mortgage-backed securities. Here’s the impact we’ve seen since the beginning of the year, according to Wolf Street.

- The 30-year mortgage interest rate has risen 95 basis points, or nearly 1 percentage point (from 4.22% to 5.17%).

- The 10-year Treasury yield has risen 71 basis points (from 2.46% to 3.17%)

- The spread between the two has widened from 176 basis points on at the beginning of January to 200 basis points now.

In other words, mortgage rates are climbing faster than the 10-year Treasury yield, now that the Fed has begun the shed mortgage-backed securities. This is expected. It’s part of the QE unwind – it’s part of the Fed exiting the mortgage market and pulling its support out from under it.”

Keep in mind, 6% is still historically low.

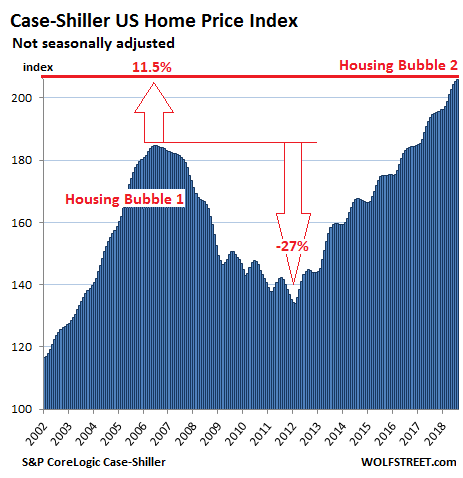

Here’s another disturbing piece of the puzzle. Home prices have risen precipitously and have eclipsed levels seen just prior to the housing bust. Average home prices nationwide have surged 11.5% above the crazy peak of housing bubble number one. In a nutshell, we’re looking at housing bubble 2.0.

As Wolf Street notes, even at relatively modest 5% mortgage rates, we’re seeing an impact on the housing market with significant pressure building on the margin, “with some potential buyers being locked out and others scared off as they’re finding today’s inflated home prices don’t mix well with even slighter higher mortgage rates: What was barely affordable for them, with a good amount of stretching, has become unaffordable.”

Wolf Street predicts the real pain will kick in as the mortgage rate approaches 6%. And that is likely less than a year away at the current rate.

Six percent will block enough potential buyers from buying at current prices to where sellers will have serious trouble selling their homes unless prices drop enough. The cure for this market will be lower prices – even if it means rising defaults and considerable problems among mortgage lenders, particularly the non-bank lenders (the “shadow banks”) that have very aggressively moved into the mortgage market over the last few years. Quicken Loans has now become the largest mortgage lender in the US, ahead of Wells Fargo. These shadow banks are less regulated and have taken more risks than the banks. The Fed is already worried about them but worrying is all it can do since it doesn’t regulate them.”

This is just one sector of the economy, but it’s indicative of what’s going on more broadly. While the mainstream touts the “economic boom,” there is underlying rot that rising rates are about to expose. As Peter said, the housing market is a leading indicator of the impact of rising interest rates.

If the US economy is really going to stay strong and if interest rates are going to keep rising, how is it possible that the economy can continue to stay strong with high interest rates when the economy, or the strength of the economy, is predicated on debt?”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]