Iranians Turning to Gold as a Currency Crisis Grips the Nation

With hyperinflation gripping Iran and sanctions strangling the economy, Iranians are beginning to turn to gold to make everyday transactions, most notably to pay their rent.

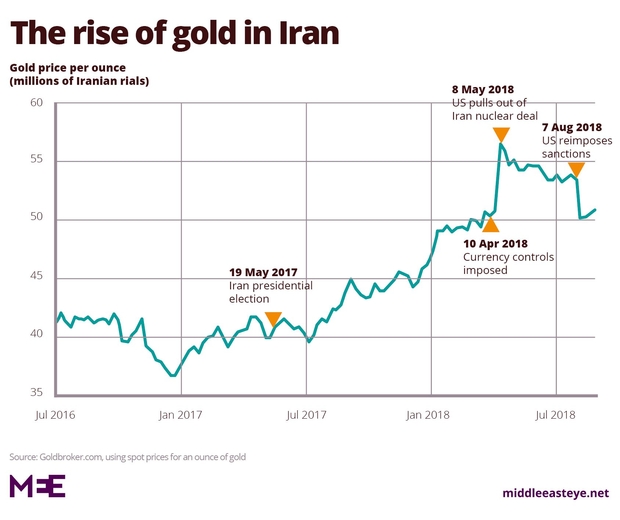

The Iranian rial has depreciated rapidly since the US announced its withdrawal from the 2015 nuclear deal and the reimposition of economic sanctions. After the US formally announced it was pulling out of the deal in May, the exchange rate peaked at around 45,000 rials to the dollar. But that official rate was only available to well-connected bankers, importers and businesses. Average Iranians were paying twice that. By July 29, money-exchangers in Tehran were charging around 100,000 rials for one dollar. Within 24 hours, it increased to 110,000 rials to the dollar.

With inflation rapidly spiraling out of control, Iranians have turned to gold. According to Bloomberg, bar and coin sales tripled to 15.2 tons in the second quarter of this year. That’s the highest demand for the yellow metal in four years. Novin Investment Bank analyst Massoud Gholampour said Iranians are preparing for an economic crisis.

Demand for physical gold is very high and has been as the currency’s been weakening. People want to invest in something that’s safe if they think that a crisis may be on the way.”

According to a report by the Middle East Eye, Iranians have traditionally saved gold coins for major purchases such as weddings, but they are increasingly turning to gold for more mundane transactions. Some landlords have started collecting rent in gold instead of rials. Rents have gone up as purchasing power has failed. As the Middle East Eye put it, “The downward spiral of the rial has led some landlords to try to safeguard their income by turning to gold.”

Esamil Jalali owns rental property in an affluent northern Tehran neighborhood. He now charges his tenants two gold coins per month for a 95-square meter apartment. With the rial depreciating so rapidly, he’s turned to gold to protect the value of his rental income.

I know that many may not be able to afford it, but when I see that the currency I may get from my tenants would have less value compared to the previous month, then that leaves me with no choice. If I continue to rent out my apartment in return for rials, then I would face financial loss.”

As the economic situation continues to deteriorate in Iran, the use of precious metals for barter will likely increase. Those who have invested in gold and silver will fare much better as the crisis deepens.

People often turn to barter, gold and silver in the midst of an economic crisis.

As the inflation rate approached 1 million percent, Venezuelans were forced to turn to barter just to survive. As a Reuters report put it, “The rise of barter exchange, amid hyperinflation and a dearth of cash, is a reflection of how the once-prosperous country is reverting to the most rudimentary of mechanisms of commercial exchange.”

Barter also spread through several European countries after irresponsible government spending led to a debt crisis and bailouts a few years ago. In 2012, Spain saw a noticeable increase in barter exchanges, as Spaniards sought alternative ways to do business with each other in an economy on the verge of a major debt crisis. Greeks also became fluent in barter and alternative means of trade when their financial system effectively collapsed in 2010. Greeks had their access to cash severely restricted during their country’s recent economic turmoil. It got so bad, a robust barter economy developed out of sheer necessity, as everyday Greeks had to find ways to cope with cash withdrawal limits and currency shortages.

More recently, Indians faced a major shortage of cash, with as many as 90% of ATMs in some regions of the country running completely out of currency. The cash crisis stemmed from a policy of demonetization the Indian government launched.

The key to weathering a currency crisis, hyperinflation and economic chaos is to be prepared. Once the meltdown happens, it will become much more difficult to buy precious metals. For more information on barter metals and preparing for an economic crisis, visit the SchiffGold barter metals page.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]