Inflation Is Eating Up Your Wage Growth

When the August jobs report came out earlier this month, much was made over the “solid” wage growth. Average hourly wages increased by 2.9% on an annualized basis.

Peter Schiff raised an important question when the report hit the news cycle. Is this wage growth indicative of a growing economy? Or is it simply a sign of inflation?

See, I think it’s the latter. I think it’s inflation that is the reason wages are going up. Remember, wages are prices. They’re the price that you pay to hire labor. So, the price of labor is wages … The price of goods and the price of labor are both affected by inflation. So, because we have all this inflation, prices are rising. They’re rising for goods and they’re rising for labor.”

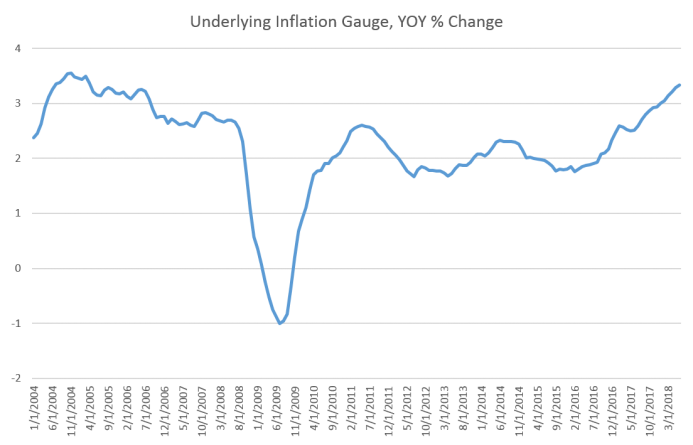

Well, we have pretty solid evidence that inflation is the real factor driving wage growth. As Ryan McMaken at the Mises Institute reported, according to the Federal Reserve, its underlying inflation gauge hit the highest rate in 158 months in June, coming in at 3.36%.

In other words, while wages are increasing, they aren’t even keeping pace with rising prices. In fact, according to Pew Research, your purchasing power is about the same as it was in 1978.

After adjusting for inflation, however, today’s average hourly wage has just about the same purchasing power it did in 1978, following a long slide in the 1980s and early 1990s and bumpy, inconsistent growth since then. In fact, in real terms average hourly earnings peaked more than 45 years ago: The $4.03-an-hour rate recorded in January 1973 had the same purchasing power that $23.68 would today.”

Economist Doug French raises an important question in a recent Mises Institute article: how is everyone, seemingly, buying all those new gadgets?

Answer: debt.

Consumer lending is at record levels. French quotes a Wall Street Journal article.

Lenders extended $81.9 billion in personal loans to US consumers in the first half of the year, up about 13% from a year prior, according to credit-reporting firm Experian PLC. That compares with a 9% rise in auto loans and leases and a 5% boost in spending limits issued on new general-purpose credit cards over the same period.”

As French points out, personal loans are unsecured and much riskier than lending on cars and homes. This is just one piece of the giant personal debt puzzle Americans have put together. Total household debt in the US hit a record $13 trillion in 2017, eclipsing levels seen on the eve of the Great Recession.

Debt is the rotten underbelly of the economy few people that most people are ignoring. It’s out of sight, out of mind. Consumers are spending. GDP is going up. That’s all the matters. But an economy built on debt is unsustainable.

As French put it, “US Consumers and their lenders are seeing the world through Trump’srose-coloredd glasses.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]