How Much Gold Is There?

How much gold is there in the world? Short answer: not much. That’s good news because gold’s value lies in its scarcity. After all, nobody picks up gravel off the ground and stores it in a safe. But if you find a gold nugget, you can take that to the bank – quite literally. Most people are vaguely aware that gold is scarce. But just how little there actually is might surprise you.

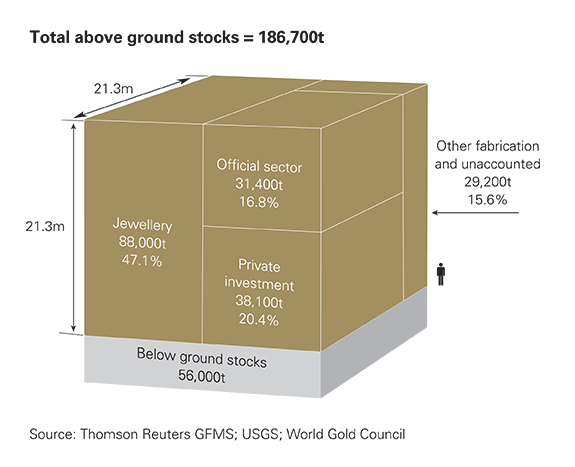

According to the World Gold Council, the best estimates suggest miners have pulled about 183,600 tons of gold out of the ground throughout history. That sounds like a lot. But if all of the gold ever mined was melted down into a giant cube, it would measure just 21.3 meters on each side, which translates to just under 70 feet. To put that into perspective, that’s about as tall as a seven-story building.

To look at it another way, if you formed all of the gold ever mined into 400-ounce bars and stacked them on top of one another, the stack wouldn’t even reach to the of the Statue of Liberty’s waist.

The scarcity of gold takes on more significance when placed in the context of declining production. In fact, some analysts believe the world hit “peak gold” production in 2015 or 2016. Peak gold means the amount of gold mined out of the earth will begin to shrink every year, rather than increase, as it has done pretty consistently since the 1970s.

Last March, ZeroHedge called peak gold “the biggest story not being reported.” Mine production plateaued at 3,100 tons in 2016, equal to 2015’s output. This after a steady increase in output since the Great Recession.

In April 2015, Goldman Sachs analysts predicted gold production would peak in 2015, claiming there are “only 20 years of known mineable reserves of gold and diamonds.” The report warned that mineable reserves of rare commodities like gold may dwindle to extreme scarcity within two decades, meaning easily mined gold will continue to get harder and harder to find.

In a nutshell, the gold industry may well be entering a long-term — and possibly irreversible — period of less available gold. As mining companies find it more difficult to pull gold out of the earth, it will mean less gold for refiners to produce for the consumer market. Remember, gold gets its value from its scarcity.

Get Peter Schiff’s latest gold market analysis click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]