What Happens to the Federal Debt If the Bond Bubble Pops?

Earlier this month, Mint Capital strategist Bill Blain warned that the bond bubble is about to burst.

A crash in the bond market would likely take stocks down with it, but there is another impact that is less obvious. It could have a huge impact on the United States’ ability to finance its massive debt.

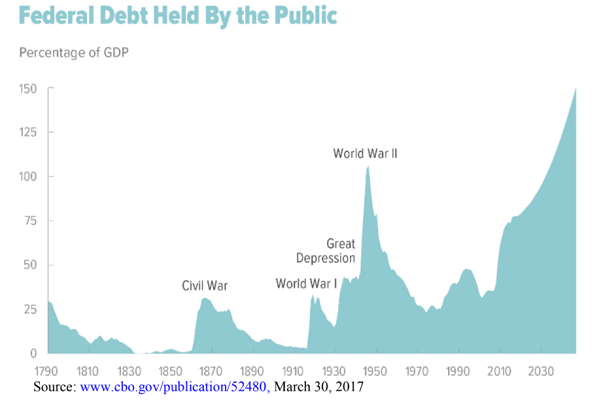

As Dan Kurz of DK Analytics points out, the federal government would have a difficult time even paying the interest on the debt in a “normalized” interest rate environment.

Neither US federal debt, nor virtually any OECD government debt, could be easily carried with ‘normalized’ interest rates, which would readily be 2 to 5 percentage points higher than current short-term (ZIRP-dominated) and long-term (based on 10-year OECD government bonds with no or very nominal yields) rates. For the US government, whose cost of funds is currently around 1.4% thanks to both massively lower, QE-enabled long-term rates and to a propensity to fund deficits and refinance debt with more shorter-term funding — which has been extremely cheap thanks to ZIRP or near ZIRP for nearly nine years — every one percentage point higher average cost of funding $20.5 trillion in debt would equate to a $205 billion higher annual interest expense.”

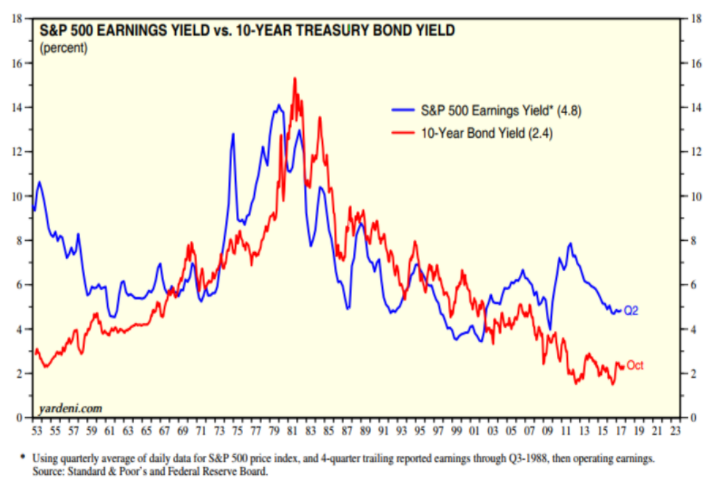

Government bond yields fluctuate wildly from the mean. In fact, they are typically at “non-mean” levels. Yields tend to spike during and after periods of marked debt expansion, wars, and/or higher inflation. When this reverses, yields tend to sink far below the mean. Falling bond yields typically take the S&P 500 earnings yield down with it, as the following chart shows.

According to Kurz, a bond bust would trigger massively higher interest rates/massively higher 10-year government bond yields, i.e., yields that would substantially exceed the 4%-5% nominal historical yields associated with “investment grade” government bonds.

Kurz provides some historical context.

For some fairly recent historical perspective, consider that 36 years ago America was still a $227 billion net creditor nation (vs. an $8.3 trillion net debtor recently), government debt-to-GDP was 31% (vs. 103% recently), one measure of ‘published’ inflation was 9.4% (vs. 1.3% recently), and Volcker’s ‘tough love’ monetary policy coupled with high inflation expectations had 10-year Treasury yields reaching 15.3%. (vs. 2.4% recently).”

He compares this to the environment today and reaches a disturbing conclusion.

Fast forward to today: given America’s hugely diminished manufacturing and financial stature juxtaposed against a) enormous external financing needs (about $500 billion per annum), b) overall foreign dollar holdings that have been estimated as high as $16 trillion, and c) a concerted effort by leading countries to conduct trade in non-USD terms, whether America can continue to indebt itself at nominal cost (low yields) isn’t an academic discussion. Specifically, Asian success at scaling up non-dollar and/or gold-backed payment systems to compete with — and eventually displace — the all-important ‘petrodollar’ standard used in the world’s biggest and most important trade (oil) would have increasingly superfluous overseas dollars come home. If a trickle became a gusher, this would place enormous pressure on the buck’s value, trigger much higher domestic inflation, and elevate the US government’s, and thus America’s, cost of capital substantially, as the latter is based on a premium to the ‘benchmark’ 10-year Treasury yield.

“Note that an increase in the overall cost of capital from, say, 2%-4% (from 10-year to Baa corporate bonds) currently to 6%-9%, respectively, would raise the federal government’s cost of funds by over $800 billion per annum and the US economy’s overall borrowing cost by about $3.2trn p.a. (assuming total US-based debt of $68 trillion), a huge sum or nearly 17% of the current $19.2 trillion US GDP. A heavily-indebted, interest rate-sensitive nation non-starter.

Globally, assuming $217trn in debt, an increase in the average cost of capital of roughly four percentage points would increase financing costs by $8.7t trillion equivalent to 11.5% of world GDP of $75.5 trillion. This is a heavily-indebted, interest rate-sensitive world non-starter!”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]