Goldman Sachs Suddenly Bullish on Gold

In his most recent podcast, Peter Schiff said gold could explode at any minute. Maybe the mainstream was listening because some big players, including Goldman Sachs, have suddenly turned bullish on gold.

Commodity analysts at Goldman say they expect gold to “outperform” in the coming months due to an uptick in inflation and “increased risk” of a stock market correction. According to a CNBC report, it’s the first time in more than five years Goldman’s commodity analysts have been bullish on the yellow metal.

Our commodities team believes that the dislocation between the gold prices and US rates is here to stay. Based on empirical data for the past six tightening cycles, gold has outperformed post rate hikes four times.”

Goldman Sachs admitted their bullishness on gold might seem “counter-intuitive” considering the investment bank has forecast four Fed interest rate hikes this year. But it seems Goldman analysts have finally acknowledged a trend we’ve been talking about for months. Contrary to conventional wisdom, rising interest rates are not bad for gold.

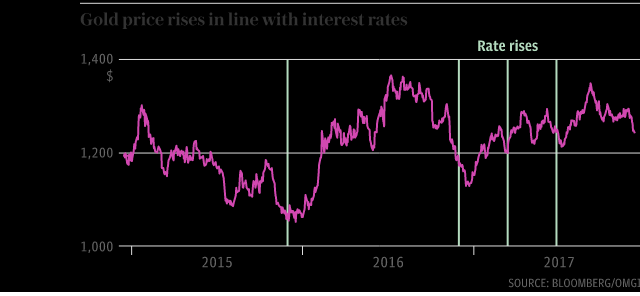

As we reported earlier this year, AJ Bell analyst Russ Mould called the conventional wisdom “a total fallacy,” noting that during the seven cycles of higher US interest rates the metal has on average gained 86% between the first increase and the last. Gold has followed that trend since the latest tightening cycle began. Between the first rate hike in December 2015 and the beginning of this year, gold had gained 23%, and it has swung upward after the announcement of every Fed interest rate increase. You can see this sell the rumor buy the fact phenomenon clearly in the following chart.

The trend continued after the most recent hike last week.

As Peter has explained, central banks generally hike rates when they see inflation on the horizon.

Rising interest rates are not negative for gold. I mean, the main reason that interest rates are rising around the world is because inflation is picking up around the world. Higher inflation is positive for gold. I mean, it is the most bullish thing for gold. And in fact, when inflation rates are rising, that means money is buying less, right? The purchasing power of money is going down. And that’s when you want to own gold.”

Goldman Sachs isn’t the only mainstream player to suddenly turn bullish on gold. TD Securities issued its Commodities Weekly Report on Monday, saying it expects gold to break out of its narrow trading range to the upside.

After being locked in a fairly tight range between $1,302-1,340/oz for many weeks, traders took the yellow metal higher into a position to challenge the high of $1,366/oz present in late-January. Gold broke through resistance into the upper bound of the range, after US sanction proposals prompted traders to question the sustainability of the current synchronized growth regime, while the Fed was not as hawkish as expected and the USD and yields eased lower.”

TD analysts said they expect increased investment in gold and silver as a hedge given the current level of geopolitical risk. And while they don’t expect a full-blown trade war, they do expect tensions between the US and China to remain high.

The mainstream investment world doesn’t usually pay a whole lot of attention to gold. That’s obvious when you consider Goldman’s hasn’t issued a bullish report like this in over five years, despite the fact gold has been pushing generally upward for two years. When the people who usually heap scorn on “gold bugs” suddenly turn into gold bugs, it might be time to sit up and take notice.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]