Gold and Silver Sales Tax Being Challenged in Maine

State Senator from Maine Eric Brakey recently introduced Senate Bill 664, which attempts to provide sales tax exemption for precious metals purchases of “gold and silver coins and bullion.” Passing Brakey’s bill would align Maine with many other states that think taxing precious metals is bad business and discourages consumers from protecting their wealth.

The current attitudes towards taxing precious metals comes from whether they’re perceived as a regular consumer good like Starbucks coffee, or a type of investment or currency.

Exempting gold and silver from sales or consumption taxes is perfectly logical, given that precious metals aren’t typically “consumed” like other products. Instead, they’re used to move wealth from a volatile, government-backed fiat currency into real money.

Bill 664 also indirectly addresses another issue: free markets. Sales taxes on precious metals don’t discourage consumers from using such safe haven investments to protect from the inflationary effects imposed by central banking policies. Too often, consumers are forced to use the government’s devalued IOUs to conduct business when there are safer more dependable options available.

It’s like a carpenter being given a rubber hammer by their boss instead of the option to bring their own metal one from home. Why should US citizens be beholden to government issued currencies backed by nothing, when there are better alternatives?

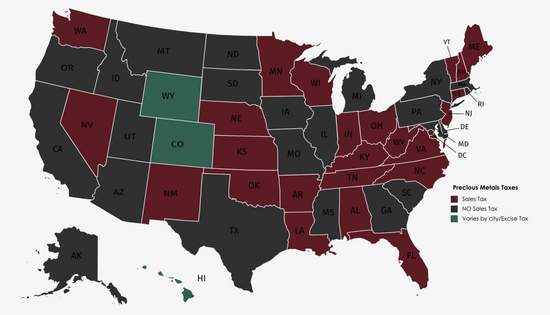

Whether or not a buyer pays sales tax on precious metals purchases depends on which state he or she lives in. While some states do charge a sales tax, others do not. Still, other states impose a tax only when the value exceeds a specific amount. Because tax codes and laws change all the time, it’s important for investors to check with a CPA about their state’s specific tax laws.

Below is a map of states that do collect sales taxes in red and those that don’t in gray:

If Brakey’s bill becomes law, it will bring Maine citizens one-step closer to being freed from the undue burden of over-taxation and regulation that continues to plague the country at large.

Start protecting your wealth today from the tyranny of central banking and the effects of low interest rates on a devalued fiat currency untether to real money. Purchase gold and silver coins and bullion.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]