Gold Prices Will Rise with Peak Mining Exploration

Unlike re-printable fiat currency, gold is money because there is a finite amount of it. The Fed can’t produce more gold whenever it wants. For this reason, gold has functioned as a barter and wealth preservation system for thousands of years. But how much gold is left in the earth? What will happen to the price when exploration stops or is limited?

In a recent article, Frank Holmes, Chief Investment Officer of U.S. Global Investors, Inc., makes the case that world mine production is beginning to fall off and 2015 may have been the last peak production year.

Taking estimates from analysts like Goldman Sachs’ Eugene King, Holmes thinks we may be looking at only 20 more years worth of “known minable reserves.”

If King’s projection turns out to be accurate, and the last ‘known’ gold nugget is exhumed from the earth in 2035, that won’t necessarily spell the end of gold mining. Exploration will surely continue as it always has – though at a much higher cost.”

It’s this higher cost towards exploration and extraction that will help drive gold prices to unseen levels. “The gold price could spike dramatically to levels only imagined,” he states. “There’s really no way of knowing how high gold could go.”

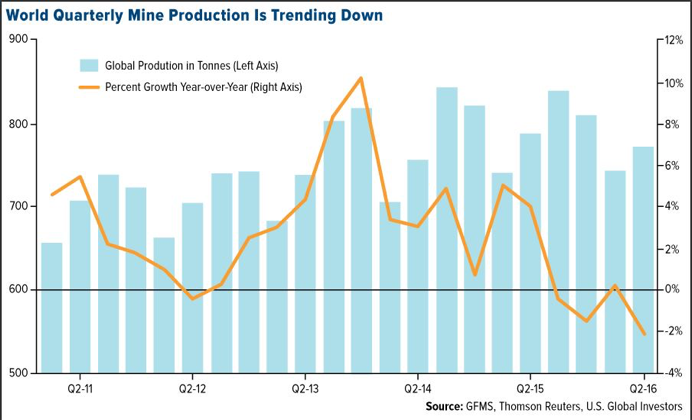

Peak production is also suggested by the slowdown in mining production overall.

This year, second-quarter mine supply was 2% less than the same period in 2015 … Some analysts now expect global production to fall 3% in 2016, after seven straight years of growth.”

Not only is mining slowing down, but the new mines coming online seem to be producing less yields than older ones.

Indeed, if we look at projects that opened in just the last two or three years, we see that they’re of lower grade, meaning they don’t produce nearly as much as older, easy-to-mine gold deposits.”

Making the issue even worse is the growing time between discovery of gold and then when it begins to yield due to regulations and an “increase in feasibility assessments, compliance, licenses, and more,” says Holmes.

With gold prices up 26% this year, it seems rational that gold mining companies would look to look to ramp up production. However, there’s a lot of cost savings and paying down of debts running throughout the industry.

With the gold availability limit looming and production slowing, it’s only a matter of time before gold prices begin moving north substantially. More and more investors will be looking to buy gold in the near future because of the current state of the mining industry.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]