Gold Outperformed S&P 500 in 2018

2018 ended up as the worst year for US stocks in a decade. And last month ranked as the worst December on Wall Street since 1938. But if you owned gold, things weren’t quite as painful for you as they were for investors without any of the yellow metal. While stocks sagged, gold rallied.

In fact, gold outperformed the S&P 500 in December, through the fourth quarter, and over the entire year.

Fears sparked by the trade war, ballooning debt, the end of accommodative central bank policy and concerns about the impact of the government shutdown unsettled investors. Stocks began dropping in October and continued a generally downward trend through the end of the year. Most pundits termed it a correction, but as Peter Schiff has been saying, it looks more like the market has entered a bear market. In fact, the Nasdaq officially dipped into bear territory last month.

Against this backdrop, the price of gold rallied late in 2018, reversing a trend of negative returns and weak investor demand that prevailed for most of the year.

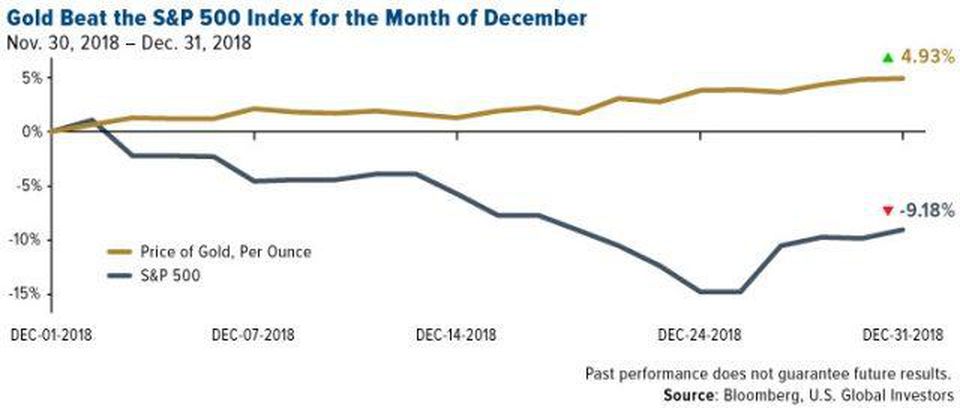

If you look at December, the S&P 500 dropped 9.18%. Gold went in the other direction, gaining 4.93%. And that was even with the headwinds of a Fed rate increase in December that conventional wisdom would tell you should have pushed the price of the yellow metal down. (This data was gathered by Forbes.)

If we back things out a bit, gold looks even better.

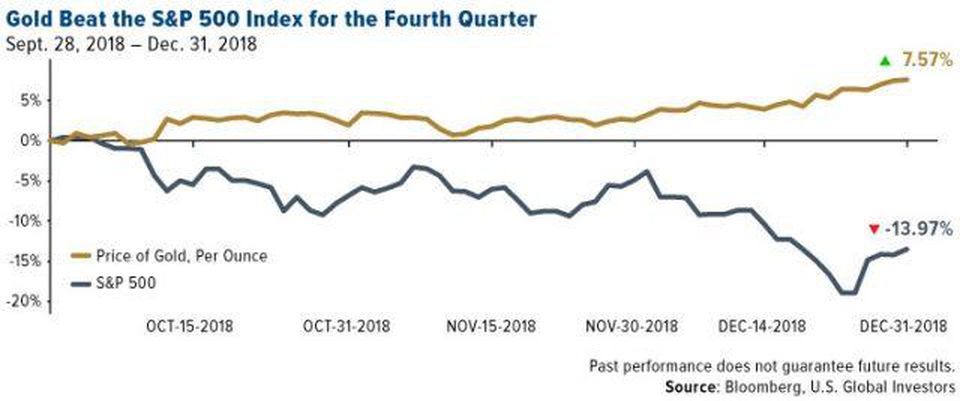

In the fourth quarter of 2018, the S&P 500 dropped 13.97%. On the flip side, gold was up a healthy 7.5%. Remember, the US stock markets started to tank back in October. So, if you have gold in your portfolio, you didn’t feel nearly as much pain as those who have spurned the yellow metal.

And in fact, a lot of people basically ignored gold and silver over the last year – especially here in the US. Demand has been stronger in Europe and Asia, but in the US, gold and silver bar and coin sales hit extreme lows. As just one example, according to the US Mint, demand for American Gold Eagles hit an 11-year low in 2018.

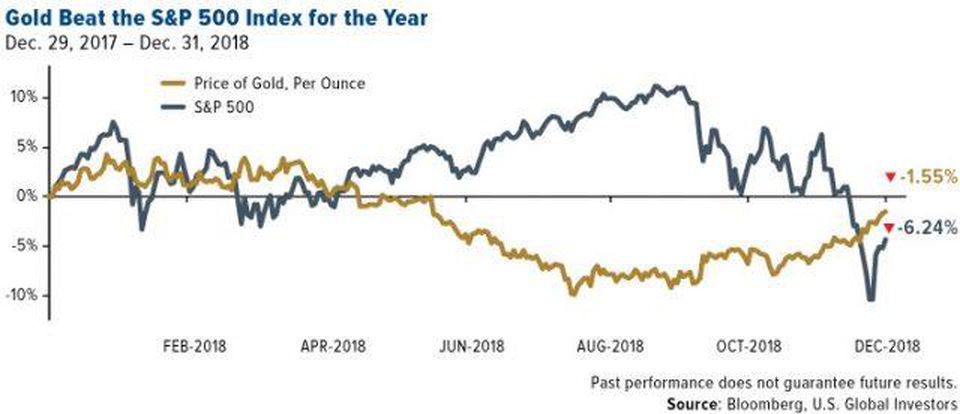

The fact that gold outperformed the S&P 500 in Q4 may not come as any shock. But it might surprise you to know that gold actually outperformed the stock index over the entire year. The price of gold dropped quite a bit in the spring, but overall, the yellow metal still ended 2018 ahead of the S&P500. Gold ended 2018 down 1.55% on the year while the market was off by 6.24%.

Believe it or not, we can extend this trend out even further. Despite what most people consider a stock market boom over the last couple of years, gold has outperformed the S&P 500 since the turn of the century. Gold is up 345.39% since Dec. 31, 1999, versus a 70.62% increase in the S&P 500.

Here’s the thing. This really shouldn’t surprise us. The gold has historically had a strong negative correlation with the stock market and it’s long been considered an important hedge in an investment portfolio. As the saying goes, the proof is in the pudding.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […] The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.

The VIX, often referred to as ‘Wall Street’s fear gauge,‘ is currently portraying a sense of calm among investors, registering well below the 20 level.