Gold Was an Effective Hedge During Stock Selloff

The stock market plunge earlier this month reminds us why we should buy gold. As a report released by the World Gold Council shows, gold acted as a portfolio hedge during the brief downturn. The price of gold rose as stocks sold off; as stocks partially retraced their losses, gold trended lower.

But gold’s effectiveness improves when market corrections are wider or sustained for longer. In our view, the recent selloff is a good reminder that gold can deliver returns and reduce risk in portfolios.”

This is some food for thought especially in light of the fact we are ripe for a 1987-style market crash.

On Feb. 5, the Dow Jones suffered its largest-ever drop in terms of points. It was down 1,600 at one point and ultimately lost 1,175.21 points, a 4.6% drop that day.

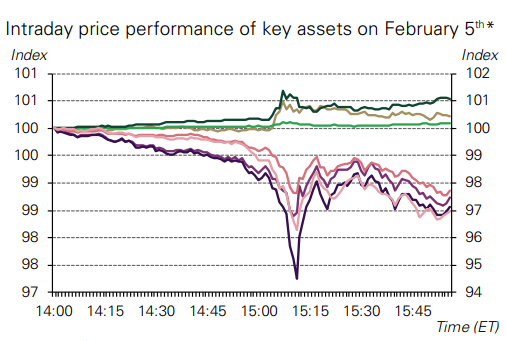

As stocks initially started trending lower, the price of gold didn’t move much. But as stocks tumbled, gold rallied strongly – even outperforming short-term Treasuries.

The WGC said some investors were disappointed in gold’s performance after the market dip because it didn’t sustain its rally. But gold actually performed consistent with its historical behavior. The stock market plunge was sharp, but short-lived. Asian stocks were already bouncing back in the early hours of Feb. 6. The market fell again on Feb. 8, reaching weekly lows on Friday, Feb. 9, but recovered from that point. By Monday, the Dow has retraced half of its maximum weekly loss and European stocks had regained about 30% of their value.

Gold dropped about 0.8% between Friday, Feb. 2 and Monday, Feb. 12. But as the WGC noted, “it still outperformed most assets on the week (other than Treasuries) and reduced portfolio losses, providing liquidity to investors as market volatility rose.”

World Gold Council analysis shows that gold protection during the selloff was even more pronounced for non-US investors. Gold rallied by 0.9% in euros and 1.8% in British pounds between Friday and Monday.

Gold’s performance during the selloff may have been something of a preview. The yellow metal’s effectiveness as a hedge becomes more pronounced during sustained selloff and as systemic risk increases.

As a safe-haven, gold typically benefits from flight-to-quality flows. This, in turn, makes stocks and gold inversely correlated in market downturns. The stronger the market pullback, the stronger gold’s rally. Consistent with its historical performance, gold’s correlation to stocks during the February 5th selloff turned more negative as stock prices fell … Gold has been more effective as a hedge when a market correction has been broader (i.e. affects more than one sector or region) or lasted longer.”

There’s a lot of debate about whether the stock market hiccup earlier this month was a healthy correction, or a prelude to the big crash. There is a lot of evidence that the bubble may burst for real in the near future. As Peter pointed out last month, twin deficits may soon doom the stock market boom.

If we have a return of the twin deficits as a problem in 2018 – I’m talking about the budget deficit and the trade deficit – twin deficits. You know the last time that was a big problem? It was in 1987. What happened in 1987? We got a stock market crash. I know that was just over 20 years ago, but what was happening then reminds me a lot of what’s happening now. We had the stock market roaring. Everybody was confident. But people were overlooking these gigantic problems until they couldn’t overlook them anymore and then it ended in a spectacular crash.”

As the WGC pointed out, it’s impossible to know when things are going to turn sour. But when they do, it can happen in a hurry and with little warning – just like it did earlier this month.

Many investors and market commentators grew worried over the past few months of frothy stock valuations and over-extended stock prices. Stocks trended higher for months, until they didn’t. Two weeks ago, after continuously reaching record highs, the DJIA had its biggest point-drop in history. This correction was seen by some as a healthy cool-down to an otherwise red-hot stock market. However, as interest rates continue to rise, and the environment of ultra-low interest rates comes to an end, other corrections may follow.”

You want to own gold before the crash happens. Now is the time to buy, not when stocks are falling through the floor and the price of gold is skyrocketing. You can’t create a strong hedge after-the-fact.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]