Gold and Silver Demand Have Surged in the Decade Since the 2008 Financial Crisis

The conventional wisdom is that demand for gold and silver has been somewhat tepid over the last couple of years. In fact, global gold demand grew by about 4% in 2018 and was in line with the five-year average. Much of that growth was due to a surged in demand through the fourth quarter as stock markets tanked, and concerns about debt and the global economy grew.

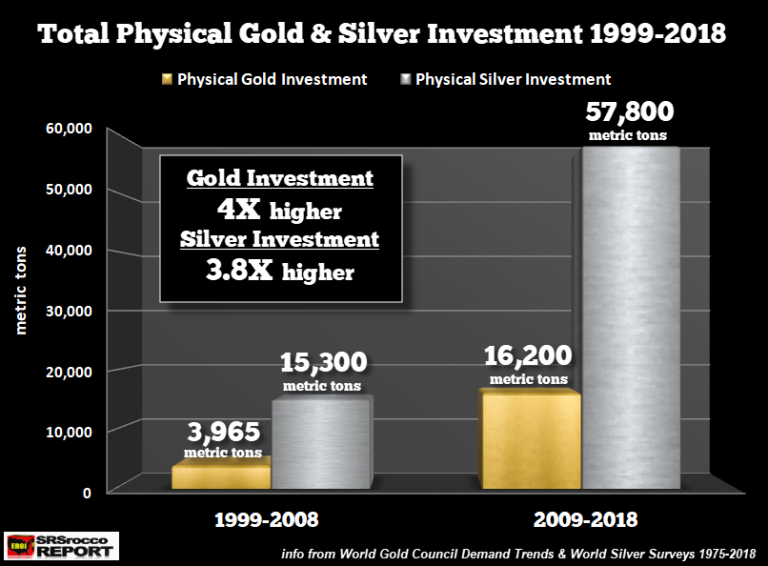

We tend to be pretty short-sighted when we look at market trends. Most investors focus on the day-to-day gyrations. As a result, we often completely miss significant long-term trends. For instance, investment demand for gold and silver has increased dramatically in the decade since the financial crisis.

According to data compiled by SRSrocco, investors purchased 16,200 tons of gold and 57,800 of silver from 2009-2018. That translates to 520 million ounces of gold and nearly 2 billion ounces of silver. This only includes physical coin and bar demand.

This compares with gold investment of 3,965 tons and 15,300 tons of silver investment between 1999 and 2008. In other words, investors bought nearly four times more gold and silver after the 2008 crash than they did in the decade before.

Last year, retail investment in gold bars and gold coins grew by 4%. Coin demand reached a five-year high of 236.4 tons, the second highest total on record. Demand for gold bars held steady at 781.6 tons, the fifth year in succession of holding in a firm 780 to 800-ton range. As SRSrocco noted, this is still pretty healthy demand, especially considering 99% of investors are busy in the “Grand Global Casino.”

That should say something about the strength of the precious physical metals demand with less than 1% of the market participating. What happens to gold and silver demand when the central banks are no longer able to prop up the financial and economic system? Please understand; it’s not a matter of ‘IF,’ it’s a matter of ‘WHEN.'”

Despite the high demand for investment gold and silver in the last decade, the price of both has underperformed – primarily due to dollar strength. As SRSrocco points out, stocks and real estate prices have soared while metals, peaked, declined and then stayed relatively flat. This has led to a lot of frustration for precious metals investors. But SRSrocco makes a good point.

That in itself should give anyone with a decent amount of intellectual know-how the ability to sniff out that… SOMETHING JUST AIN’T RIGHT. For some odd reason, all the negative aspects of the economy, the massive debt, derivatives, and leverage are all but forgotten when all we do is focus on the highly inflated stock, bond, and real estate asset values. Unfortunately, the inability to see how the debt, derivatives, and leverage have created the biggest Global Ponzi Scheme in history will create the largest financial collapse ever witnessed, causing most investors to go bankrupt. It’s only a matter of time, and time is running out.”

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]