Gold and Silver Behaving A Lot Like They Did in 2008

The prices of gold and silver are behaving very much like they did in 2008. You remember what was happening in 2008, right?

After the dot.com bubble burst, the Federal Reserve swooped in and dropped interest rates to an artificially low level. In the mid-2000s, the economy boomed and the housing bubble inflated driven by the sudden influx of cheap credit. In 2007, it all began to unravel and the air started leaking out of the subprime mortgage bubble. Of course, everybody said, “Hey, nothing to worry about. Everything is great!”

And they were spectacularly wrong.

As John Rubino put it in an article published by DollarCollapse.com, the periphery subprime mortgage crisis spread to the core.

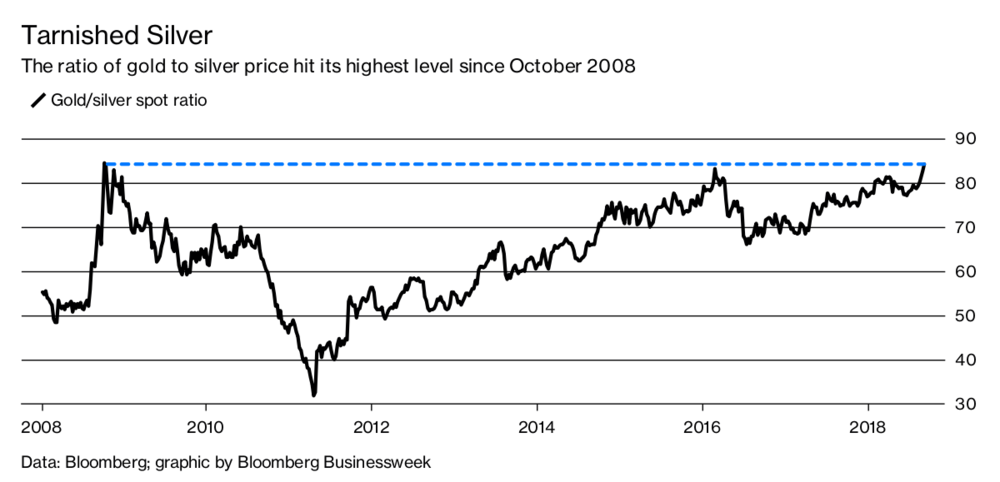

The markets panicked, with even gold and silver (normally hedges against exactly this kind of financial crisis) plunging along with everything else. Gold lost about 20% of its market value in a single month. Gold mining stocks – always more volatile than the underlying metal – lost about half their value. Silver also fell harder than gold, taking the gold/silver ratio from around 50 to above 80 – meaning that it took 80 ounces of silver to buy an ounce of gold.”

Of course, that dip in gold and silver prices was short-lived. When the Fed once again flooded the world with cheap money, the price of gold and silver soared.

Fast forward to today.

In the midst of the Great Recession, the Fed doubled down on its interventionist monetary policy. It not only pushed interest rates to zero, it launched successive waves of quantitative easing – in effect, money printing. That sparked a long, although somewhat tepid recovery. And once again, easy credit blew up a bunch of bubbles – most notably a massive global debt bubble.

Rubino focused on one specific group of debtors – emerging market economies.

The global economy is booming because of artificially low interest rates and massive lending to all kinds of subprime borrowers. One group of them – the emerging market countries – made the mistake of borrowing trillions of US dollars in the hope that the greenback would keep falling versus their national currencies, thus giving them a profitable carry trade. Instead, the dollar is rising, threatening to bankrupt a growing list of these countries – which, crucially, owe their now unmanageable debts to US and European banks. The peripheral crisis, once again, is moving to the core.“

And like 2008, we see the price of gold and silver getting whacked. Silver has been hit especially hard in recent months. In fact, the silver-gold ratio hit its highest level since 2008 this week.

So, are we seeing a repeat performance of ’08?

Rubino thinks it’s possible.

Some of the big western banks would probably fail if several major emerging markets default on their debts. And historically – at least since the 1990s – the major central banks have responded to this kind of threat with lower rates, loan guarantees and, more recently, massive and coordinated financial asset purchases. So watch the Fed. If the EM crisis leads to talk of suspending the rate increase program and possibly restarting QE, then we’re off to the races. Just like 2008.”

Peter Schiff has been saying he sees signs that the Fed is turning more dovish, and he thinks the central bank may well back off rate increases.

During its August meeting, the FOMC mentioned concern about emerging markets. Some analysts fear the currency crisis in Turkey could spread to other emerging economies. The expectation that the dollar will continue to strengthen is the real problem for emerging markets. Peter summed it up.

And the main reason that everybody believes the US dollar is going to continue to strengthen is because they believe the Fed is going to keep raising rates and shrinking its balance sheet. So, the longer the Fed is going to keep up the pretense that it’s going to raise rates and shrink its balance sheet, then it continues to put pressure on emerging markets and it continues to put pressure on the housing markets. So, ultimately, the Federal Reserve is going to have to give, and what the markets are going to have to start anticipating is the end of the cycle. Because even though the Fed is still talking about removing the monetary accomidation, there’s not much left that they can remove without the whole thing coming toppling down. In fact, the evidence is already there that the economy is weak, despite the refusal of the markets to acknowledge that. And clearly, Donald Trump wants to continue to pretend that the economy is strong.”

If we are seeing a repeat of 2008, this would be a good time to buy gold and silver – while they are essentially on sale.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]