Global Mine Output Up Slightly in 2018; Shows Continued Signs of Slowing

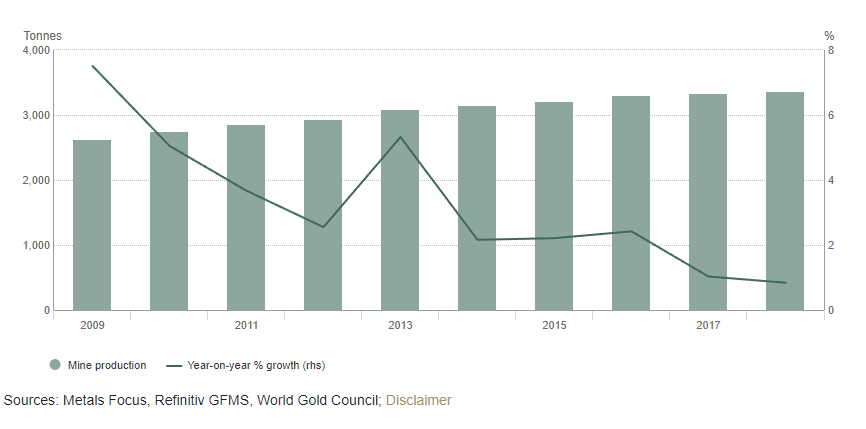

Global gold mine output marked its 10th year of annual growth but continued to show signs of slowing in 2018, according to the World Gold Council.

Gold production rose fractionally by about 1% totaling 3,346.9 tons. That compares with 3,318.92 tons mined in 2017 — a 28-ton increase year-on-year.

Meanwhile, global gold demand grew by 4%.

Gold mine production fell back in the fourth quarter of 2018 after a record third quarter. Output totaled 854.1 tons in Q4 That was 2% lower quarter-on-quarter and 1% lower year-on-year.

Chinese gold production fell for the second straight year. The country’s annual output declined by 9% year-on-year. China ranks as the number one gold producer. Analysts say stricter environmental regulations have squeezed Chinese miners.

South African gold mine output dropped 18% in 2018 according to the WGC report. South Africa once led the world in gold production. The precipitous drop in the country’s mine output over the last few years is expected to continue and could foreshadow a long-term trend of falling gold production globally.

Although South Africa still ranks eighth in the world in gold production, it continues to rapidly fall down the list of leading gold producers. In fact, South Africa may run out of gold within four decades, according to the Environmental Economic Accounts Compendium published by African Statistics Day. Analysts say that at current production levels, South Africa has only 39 years of accessible gold reserves remaining.

Output in Peru also dropped, falling 9% year-on-year. The WGC report said, “Declining production profiles at existing projects and a reduced production pipeline are evidence of miners’ reluctance to grow output in the country.”

Australia was a bright spot for gold production. Record local gold prices due to the Australian dollar weakness against the US dollar supported growth in mine production. Output grew by 4%. Meanwhile, Russian gold production rose 10% y-o-y. Supported by state incentives – such as royalty waivers, tax incentives and low-cost loans – local gold miners of all sizes boosted output in 2018.

The annual level of gold recycling barely changed in 2018 (+1%) at 1,172.6 tons

Overall, gold supply was up marginally by 1% in 2018, from 4,447.2 to 4,490.2 tons.

There are signs that global gold mine output is beginning to plateau. According to WGC numbers, production was up 77.72 tons between 2015 and 2016, 33.92 tons between 2016 and 2017, and 28 tons between 2017 and 2018.

Some analysts believe we may be at or near “peak gold” — the point where the amount of gold mined out of the earth will begin to shrink every year.

According to a report by S&P Global Market Intelligence, while gold production will increase marginally over the next three years, there are troubling signs on the horizon. In fact, some analysts project gold output in several key countries, could slump to “generational lows” in the midterm.

During the Denver Gold Forum in September 2017, World Gold Council chairman Randall Oliphant said he thinks the world may have already reached that point. Franco-Nevada chairman Pierre Lassonde also expects a significant dip in gold production in the coming years. During an interview with the German financial newspaper Finanz und Wirtschaft, Lassonde said we’re seeing a significant slowdown in the number of large deposits being discovered. And in 2016, Mining.com analyzed the data and concluded there are no more easy gold discoveries.

Billionaire Sam Zell said he recently bought gold for the first time. One of the reasons he invested in the yellow metal is because of shrinking mine production.

Go back to supply and demand. Supply is shrinking and that is going to have a positive impact on pricing.”

Despite continued modest growth in mine output, analysts say the gold industry may well be entering a long-term — and possibly irreversible — period of less available gold. As mining companies find it more difficult to pull gold out of the earth, it will mean less gold for refiners to produce for the consumer market. Remember, gold gets its value from its scarcity.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]