Germany Ramped Up Gold Repatriation in 2014

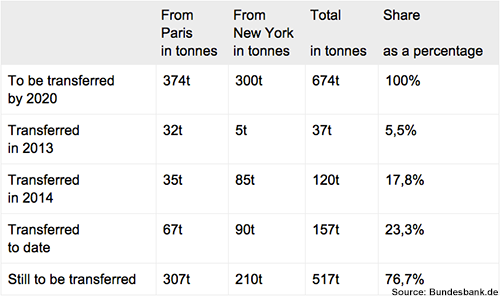

The German central bank (Bundesbank) repatriated 120 metric tons of gold in 2014. 85 of those tons came from the New York Federal Reserve, which held nearly half of Germany’s gold at the time. This is in sharp contrast to repatriating just 37 tons in 2013 – only 5 of which came from New York. It would appear that Germany is quite serious about getting its gold back after all.

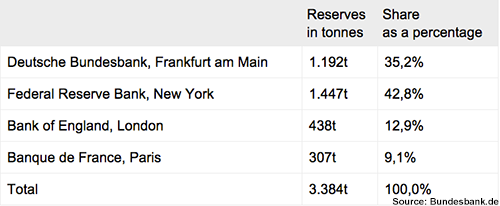

At the beginning of 2013, the Bundesbank announced that it would begin the process of repatriating massive amounts of its physical gold reserves back into Germany. The goal is to have half of its gold back in Germany by 2020. Currently, nearly 65% of its reserves are stored in the New York Federal Reserve, the Bank of England in London, and in the Banque de France in Paris. New York alone holds almost 43% of Germany’s gold:

To many physical gold investors this news suggested that one of the healthiest economies in Europe and the world was preparing for a currency crisis. Some analysts even thought that Germany distrusted the United States in particular. After all, the repatriation announcement came just months after the Fed denied Germany’s request to conduct their own physical inspection of the Fed’s gold reserves.

Whether or not Germany is getting its original gold back is still not clear. Some have suggested that the US has “rehypothecated” its holdings of foreign country’s reserves. This means that the US could have used Germany’s gold as collateral on debts to other countries. There is no hard evidence for this, but it is one concern of the German public, which has been pretty vocal about getting its gold back.

Whatever the case may be, Germany is clearly taking the repatriation effort seriously, even if it got off to a slow start in 2013. Here’s the current progress of the Bundesbank’s gold repatriation:

Germany is not the only European country taking a closer look at their foreign gold holdings. Read this. One thing is for sure – when central banks are publicly interested in acquiring more gold, private investors should take a serious look at their own safe haven strategy.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Of course this is alarming but if their goal is to have half the gold back by 2020, they may not see an imminent problem. Maybe they’re going suppress prices even further in order to acquire the gold they need to give back to Germany.

[…] Peter Schiff reports that Germany ramped up Gold repatriation in 2014. […]

Venezuela made gold repatriation from London since 2 years ago.

I suspect that Germany is taking what they can get. If my bank refused to let me view or review my assets, I’d pull them out as pronto “as possible”. There is no doubt that gold’s price has been intentionally suppressed, by commercial banks, brokers and countries as the precious metal becomes more popular with government currencies floating like pollen in the wind. Brokers and the Fed fear gold, as it threatens the own lucrative currency streams. No dividends, interest, fund fees or market speculative attractions, just back room jockeying and bogus forecasts. Gold is their kryptonite.

[…] York-stored gold and Germany has also accelerated their repatriation schedule. The country brought 120 tonnes of gold back home of which 85 tonnes were shipped from the vault of the NY Fed. And this results in another […]

[…] York-stored gold and Germany has also accelerated their repatriation schedule. The country brought 120 tonnes of gold back home of which 85 tonnes were shipped from the vault of the NY Fed. And this results in another […]

[…] York-stored gold and Germany has also accelerated their repatriation schedule. The country brought 120 tonnes of gold back home of which 85 tonnes were shipped from the vault of the NY Fed. And this results in another […]