Focus on Fundamentals: Revival in the Chinese Jewelry Market

The Chinese gold jewelry market reversed three years of declines in 2017, marking its first gain since a 2013 boom. According to a report released by the World Gold Council, the modest increase in gold jewelry demand last year could mark a return to sustained growth thanks to continued efforts to reinvigorate the industry through innovation, along with growing Chinese incomes.

The Chinese jewelry market is an important component in the overall global demand for gold. Jewelry accounts for more than half the yearly gold demand, and the Chinese make up about 30% of the gold jewelry market.

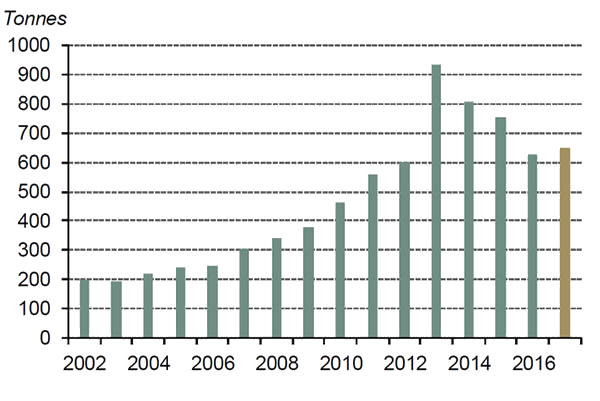

According to the World Gold Council, demand for gold jewelry in China more than tripled over the past 15 years as the economy expanded and individual wealth grew. The boom peaked in 2013 when low gold prices sparked a buying frenzy. But rapid success led to problems in the industry, including a record number of stores, excess capacity and fierce price wars.

After three years of declining demand, the industry appears to have turned the corner. After a solid performance in 2017, demand for gold jewelry in the world’s top gold market was up 7% in Q1 2018, coming in at 187.7 tons, according to the WGC. That marked a three-year high. Demand was buoyed by jewelry themed around the Year of the Dog, which appealed to consumers buying during the Lunar New Year holiday. The start of the week-long holiday coincided with Valentine’s Day, which further boosted what is often called the love trade.

According to the WGC, a “painful period of reinvention” has helped turn around the gold jewelry industry in China.

Rather than relying on traditional consumers buying jewelry purely for its gold content, goldsmiths now undertake extensive jewelry market research to get to know their customers better. They increasingly try to meet the needs of modern consumers by offering a more diverse product mix, designing more appealing jewelry and optimizing sales channels. Greater focus has been placed upon increasing the adornment value of jewelry and fulfilling the desires of China’s gold market consumers who wish to express their identity, gain social recognition and embrace change.”

The World Gold Council has projected that rising incomes in China, as well as India – the world’s leading consumers of gold – will have a major impact on gold demand in the coming years. China’s income growth is expected to come in at around 6.4% in 2018. And India’s economy is expected to be one of the fastest-growing in the world next year, expanding at an even faster rate than it did between 2012-2014. Consumers in both of these countries buy a lot of gold, so this bodes well for the broader market for the yellow metal.

It’s easy to get caught up in the latest headlines on the financial networks and expectations about what the central banks will do next, but it’s important to always remember the fundamentals. Increasing demand for gold, along with shrinking gold production, are important factors to consider when analyzing the gold market.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]